European Energy Prices Soar as a Deep Freeze Arrives

(Bloomberg) -- Europe is bracing for energy shortages as freezing weather sets in, boosting demand and sending prices surging with no relief in sight.

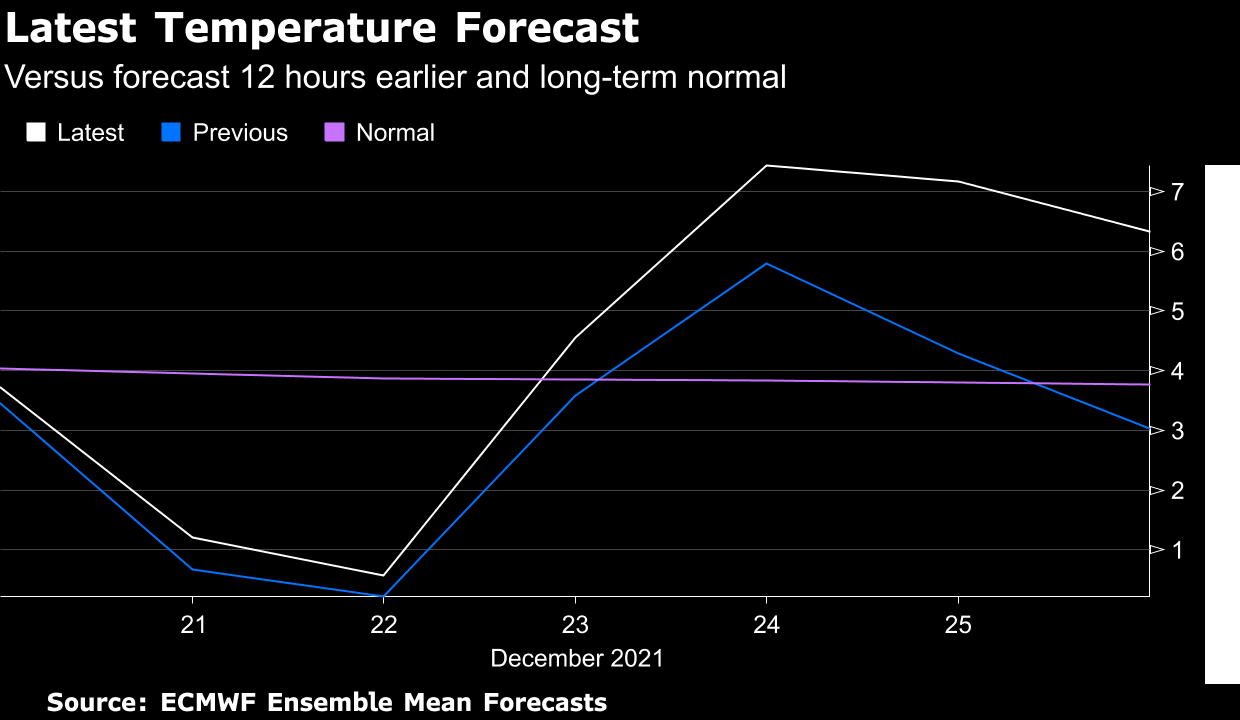

Temperatures are forecast to fall below zero degrees Celsius in several European capitals this week, straining electricity grids already coping with low wind speeds and severe nuclear outages in France. To make matters worse, Russia is limiting natural gas flows through a major transit route to Germany. The route is set to be only partially used in January.

Energy prices have spiraled this year, with European gas surging more than 600%. The region’s benchmark gas contract climbed as much as 8.8% Monday and closed record-high, while German year-ahead power, a benchmark in Europe, rose as much as 5.7% to a record 256.25 euros ($289) a megawatt-hour. The French contract jumped 9% to an all-time high.

Short-term electricity also jumped, along with the cost of using dirtier energy sources in Europe. In France, day-ahead power rallied to the highest since 2009 in an auction Monday, while the German contract soared to the highest on record. Carbon-emission permits jumped 8.3% to 79.38 euros a ton.

Rising prices have fueled inflation, a headache for policy makers already contending with the spread of the omicron virus variant just before the holiday season. Geopolitical tensions between Russia and Ukraine could also make things worse, with a potential invasion likely to send prices even higher.

Jeremy Weir, chief executive officer of commodities trader Trafigura Group, last month warned that Europe could experience rolling blackouts in case of a cold winter. That was before Electricite de France SA said it was halting reactors accounting for 10% of the nation’s nuclear capacity, leaving the region at the mercy of the weather at the height of winter in January and February.

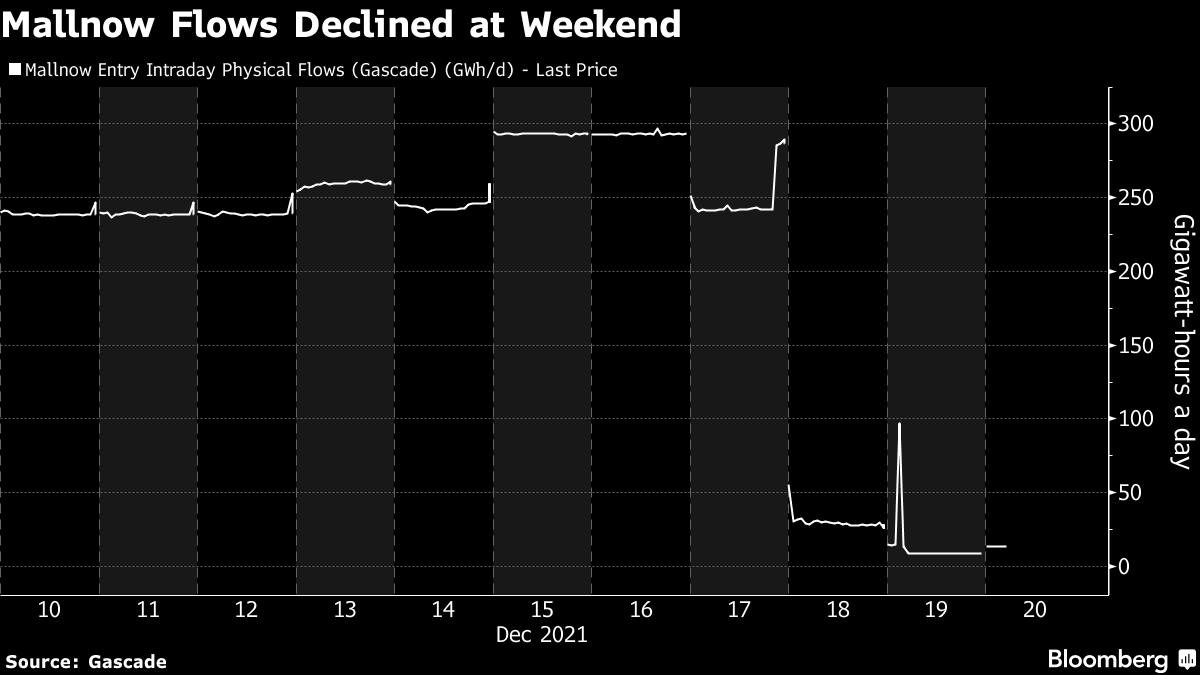

Benchmark Dutch gas prices settled at 146.93 euros a megawatt-hour, its highest closing level. Gazprom PJSC booked about 21% of the Yamal-Europe pipeline to Germany for January at a month-ahead capacity auction Monday. Though limited, it’s a change from the less predictable daily auctions the exporter opted to use for December.

The auction results “will not ease the risk of very tight supplies -- given limited bookings for now,” said Ole Hansen, head of commodity strategy at Saxo Bank A/S. “But with a market clutching straws every little helps.”

But less certain is supply for the rest of December. Gazprom opted against reserving the route in day-ahead auctions for Tuesday, a move that means shipments hinge on within-day bookings.

With nuclear outages biting, electricity producers will have to use more gas to keep the lights on. Russia plans for gas flows into Germany via the key Yamal-Europe pipeline to remain capped, potentially forcing Europe to rely on its already weak inventories. Storage sites are only 60% filled, a record-low for this time of year.

There’s no relief to market tightness in sight as temperatures are expected to remain below normal levels in the U.K., Denmark and northern Germany next week. While traders expect liquefied natural gas may help to some extent, due to lower demand in Asia, cargo diversions will take time and increased arrivals at European ports are unlikely to come before January.

EUROPE GAS OUTAGES: Cuts at U.K.’s Elgin-Franklin, Cygnus Fields

Meanwhile, wind power is expected to stay low in Germany until Dec. 23. In France and Britain, generation is forecast to dip on Tuesday, causing further supply issues.

More stories like this are available on bloomberg.com

©2021 Bloomberg L.P.