Trump Pushes for Emergency Power Auction to Support AI Boom

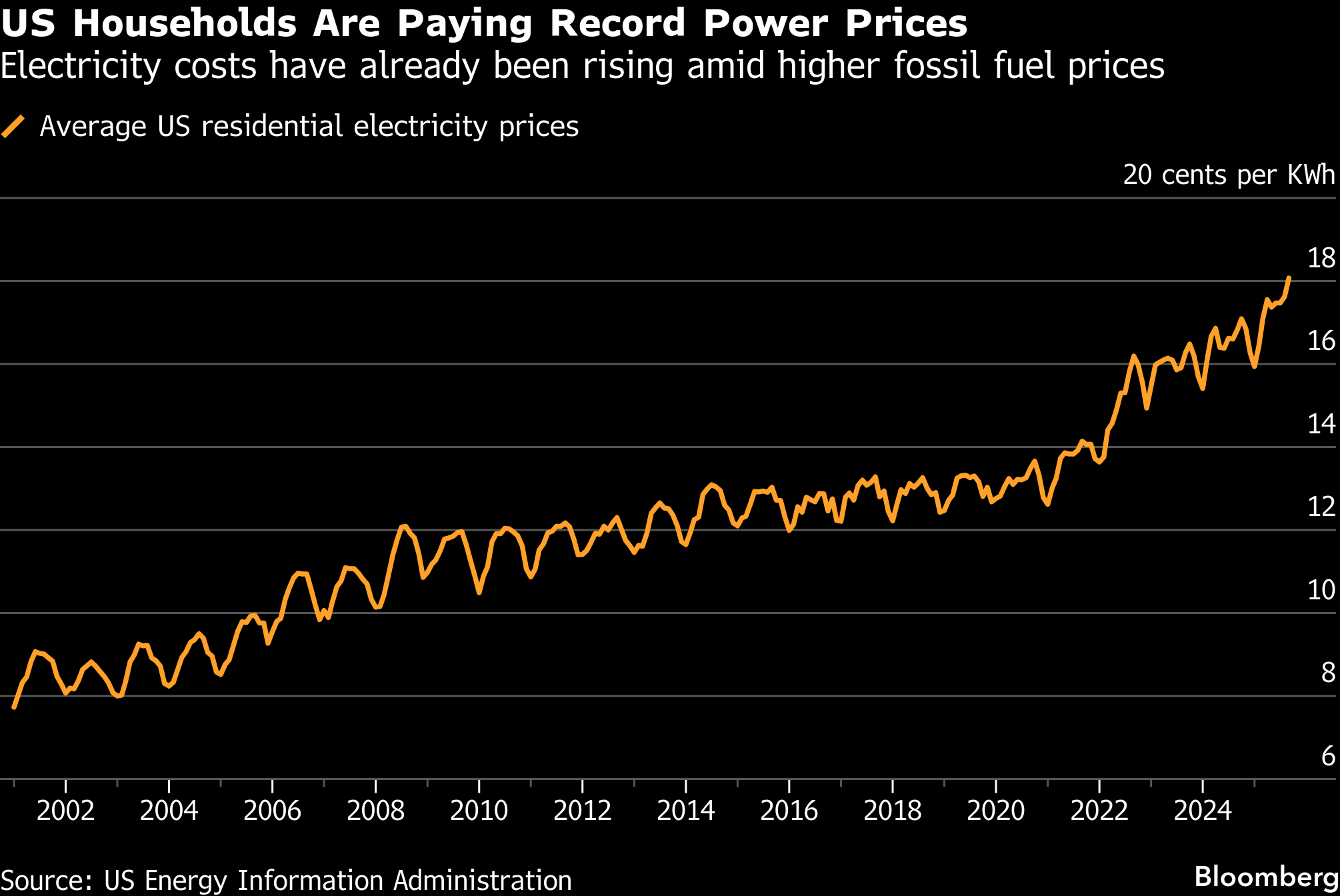

(Bloomberg) -- The Trump administration is pushing a sweeping plan to compel technology companies to effectively fund construction of new power plants in an ambitious bid to speed the country’s AI build-out and tame surging consumer utility bills.

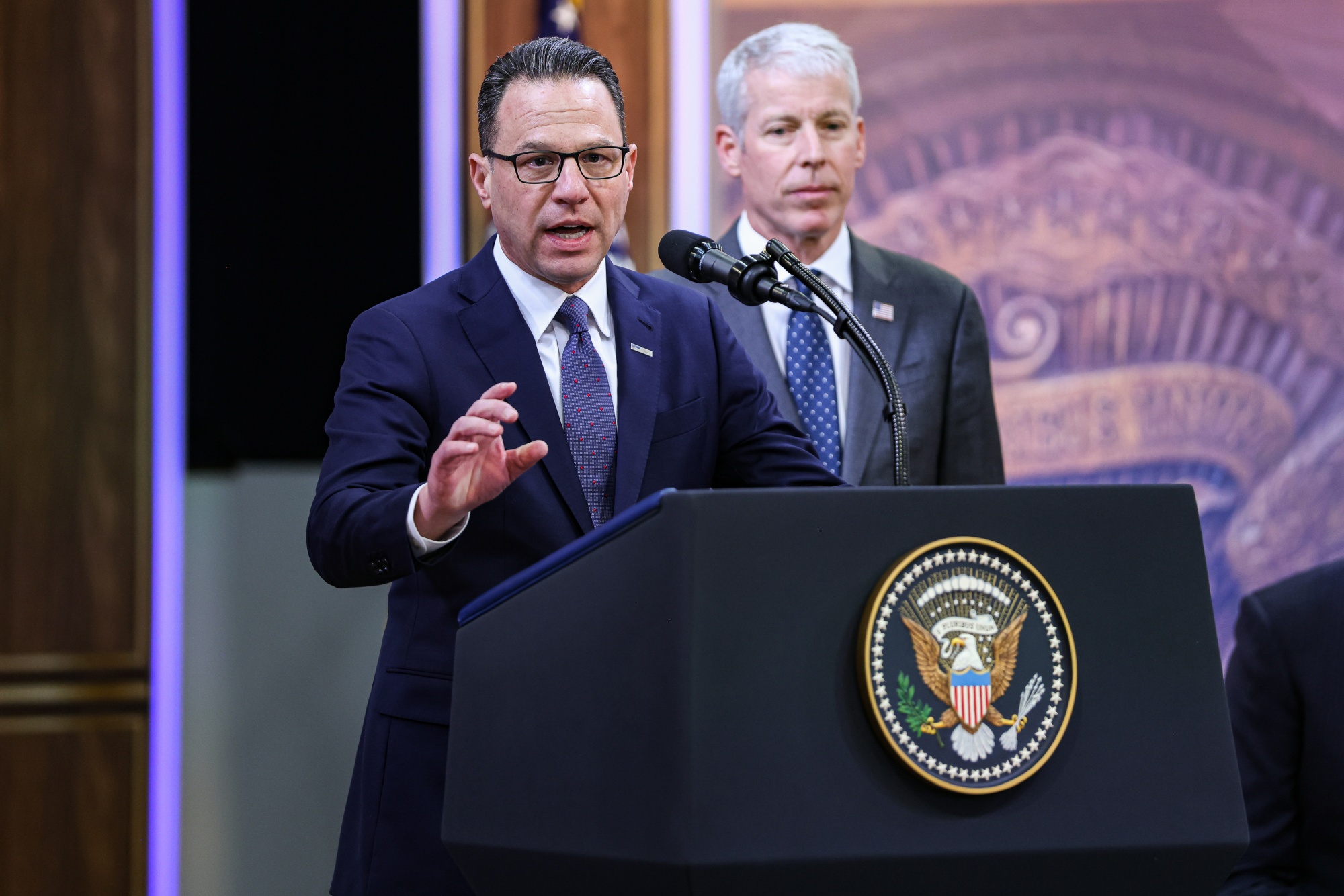

US Energy Secretary Chris Wright and Interior Secretary Doug Burgum joined 13 governors Friday in outlining a non-binding plan urging the nation’s biggest grid operator, PJM Interconnection LLC, to hold an emergency auction for tech companies to bid for long-term electricity contracts. The governors represent every state served by the grid operator — including Pennsylvania’s Josh Shapiro, who’s threatened to pull out if costs aren’t controlled.

The Trump administration and America’s governors are grappling with two sometimes conflicting goals: add data centers vital to winning a global artificial intelligence race while easing spiking power bills that loom large ahead of the nation’s November elections.

The Trump administration’s plan is “essentially guidance” to help PJM “come up with a policy that’s going to enable our goals of affordability for consumers, but also the power we need to keep our economy going — in particular to power the data centers we need to drive the AI arms race,” Burgum said.

The emergency auction would allow tech companies to bid on 15-year contracts for new electricity generation capacity, helping to secure supplies and curb price volatility.

The auction could support construction of roughly $15 billion of new power plants, which would add as much as 7.5 gigawatts of capacity, according to a report from Jefferies. A gigawatt is roughly the output of one large nuclear reactor.

The coalition’s blueprint also presses PJM to extend an existing price cap, limiting the amount that existing power plants charge — a key ask from Shapiro.

PJM serves more than 67 million people from the Mid-Atlantic to the Midwest. The grid operator is already home to the world’s biggest concentration of data centers, in northern Virginia, and it has said it expects peak demand across its system to jump 17% by 2030 from this year’s high.

At the event Friday, Republican and Democratic governors blamed the grid operator for moving too slowly to add new power generation. PJM officials weren’t invited to the event.

Hours later, PJM released a 14-page plan to bring data centers online faster. Its board proposed an “immediate initiation” of backstop measures to secure more power supplies after its auction in December failed to meet standards aimed at preventing blackouts.

Trump administration officials and governors expressed confidence PJM would take their suggestions. “I would be surprised if we don’t see something along these lines,” Wright said.

Shapiro, who’s used the threat of a Pennsylvania retreat from PJM as leverage to push price caps previously, said it would be in the operator’s “best interest” to adopt the changes.

“I’ve been very clear if PJM doesn’t clean up its act, Pennsylvania is the second largest energy exporter in the country — we’ll be forced to go on its own,” Shapiro said.

Many power companies can’t shoulder the cost of building new generation without long-term commitments from buyers to purchase electricity. Meanwhile, PJM holds regular power auctions for electricity supplies in 12-month periods.

The Trump administration’s plan for a 15-year auction would secure revenue for more than a decade in a market notorious for price volatility and generator bankruptcies. In turn, tech companies would be able to lock in the electricity they need — and simultaneously, developers would likely have more confidence in the long-term outlook to take on the big investment of building more plants.

Even with an emergency auction held by the end of September, it would be challenging to quickly ease surging consumer utility bills. There would still be a lengthy process before new power plants are built and more supplies enter the market.

Cost-of-living concerns are already weighing heavily on Republicans’ bid to maintain control of the House and Senate in this November’s congressional elections. While Trump has stressed the plummeting cost of oil and gasoline since he took office last January, electricity prices have climbed due to rising demand — and there’s a building backlash against data centers that are fueling the surge.

Meanwhile, a long-term auction would likely mean that Trump is handing tech companies what they’ve been desperately seeking: a massive supply of new electricity they can depend on to energize hundreds of billions of dollars in mega-data centers now under construction. Amazon.com Inc., Microsoft Corp., Alphabet Inc., Meta Platforms Inc. and OpenAI have already collectively invested in the development of several gigawatts of new power — with a single gigawatt typically enough to power roughly 750,000 homes.

The emergency auction plan comes one month after three Democratic senators opened a probe into how data centers drive up monthly customer bills, citing a Bloomberg News investigation that found electricity now costs as much as 267% more in areas near significant data center activity.

“We have a simple problem of a market disconnect: We can put up a data center in 18 months and it takes five years to build a power plant,” said Teri Viswanath, lead economist for power, energy and water at CoBank ACB. “This is a very difficult challenge with no easy solutions.”

(Updates with PJM’s plan in 10th paragraph.)

©2026 Bloomberg L.P.