Trump’s Project Vault Gives US Critical Mineral Startups a Boost

(Bloomberg) -- US startups and venture investors are eager to reap the benefits of the Trump administration’s planned $12 billion initiative to stockpile critical minerals, which provides another national security-driven lifeline to green tech.

The new initiative “signals a clear move” to support domestic supplies, and venture capitalists will likely follow suit by investing more in the sector, said Duncan Turner, a partner at SOSV whose firm has bankrolled several startups in the critical minerals sector. That will help cultivate and scale up next-generation approaches to mining, processing and refining minerals — areas in which the US is heavily reliant on China.

The venture, dubbed Project Vault, is set to marry $1.67 billion in private capital with a $10 billion loan from the US Export-Import Bank to procure and store the minerals that industries from automotives to renewable energy rely on. The investments will also help shield those sectors from supply shocks.

A government initiative could help quell wild price swings, which has been a “real concern” for startups and their backers, Turner said.

Investors have been increasingly bullish on critical minerals, even before the new initiative was announced. Pitchbook data shows that venture capitalists invested more than $628 million in US startups working on rare earth minerals in 2025, accounting for 90% of all funding globally. That represents a nearly 3,000% jump compared to 2024.

“We expect every investor to be reaching out to understand what sales contracts we will have with the stockpile,” said Nick Myers, chief executive officer of Phoenix Tailings, a startup that recycles mining byproducts into rare earth minerals.

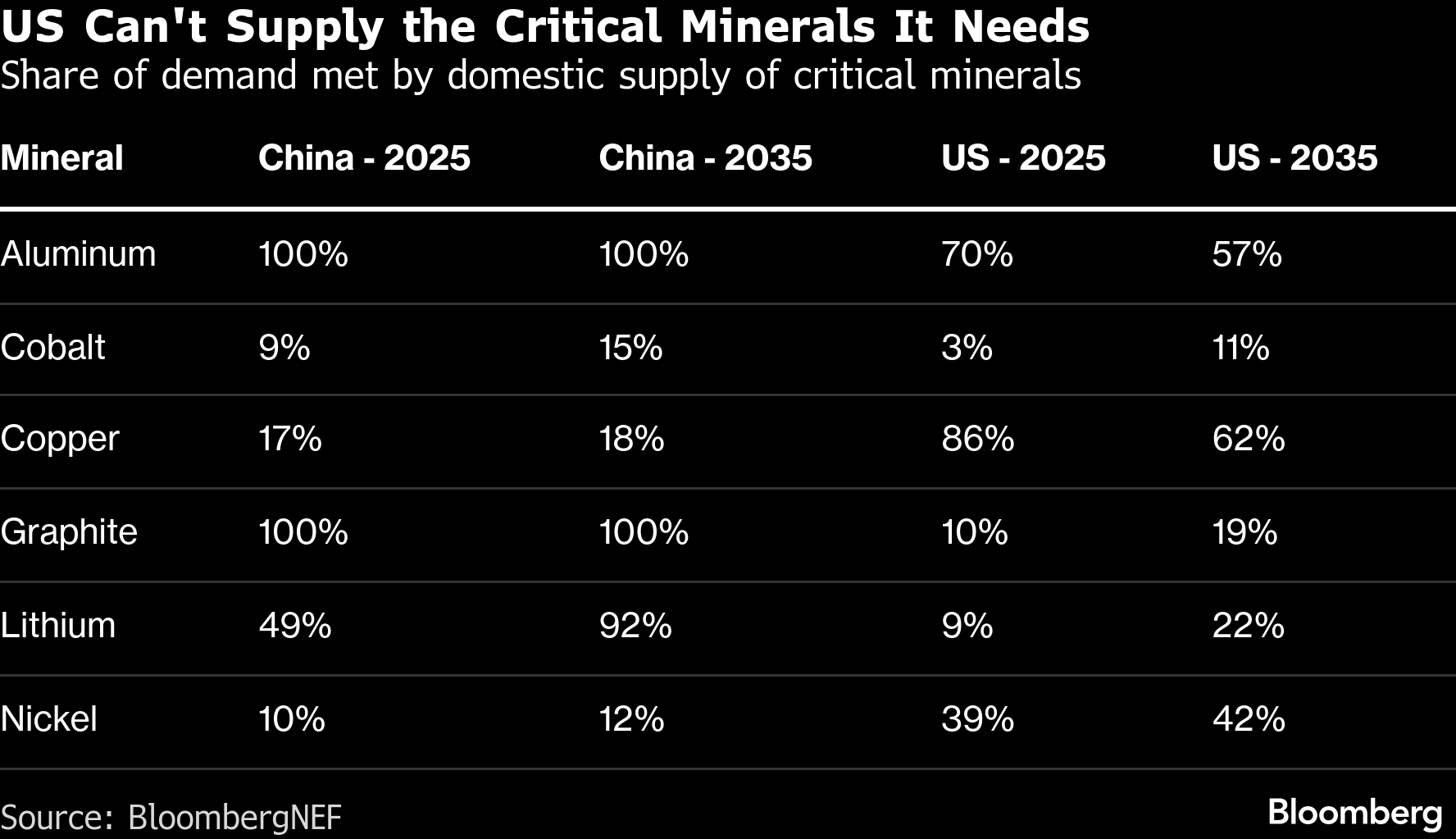

Critical minerals is a label that covers dozens of elements and compounds, including lithium, cobalt and graphite, that are essential for goods ranging from electric vehicles and solar panels to fighter jets and iPhones. Graphite, for example, is needed to make batteries — which are increasingly required to stablize electricity grids and protect against outages. Yet, US domestic suppliers provided only 10% of the graphite the country needed in 2025, according to a December report by BloombergNEF.

They also include what are known as rare earths, a subset of 17 metallic elements. The US imported nearly 13,000 metric tons of rare earth metals and chemical compounds in the first 11 months of last year, surpassing all of 2024, according to the latest data available from BNEF. Much of that came from China, which controls roughly 60% of the world’s rare earth mining output and more than 90% of the global refining capacity.

That, combined with China’s dominance in other critical minerals, poses supply chain risks to US companies at a time when geopolitical tensions are on the rise. The Chinese government has used the elements as a weapon in its trade war with the US: Last April, Beijing added seven rare earths and permanent magnets to its export control list.

President Donald Trump referenced China’s threats to choke off access while announcing Project Vault. “We don’t want to ever go through what we went through a year ago,” Trump said.

But “reducing dependence on China requires more than financial support” to build a stockpile, Turner said, adding that it also requires investments across the whole value chain from supply to refining. As an example, he pointed to copper, a critical mineral vital for electric car charging and grid infrastructure.

Of the 1.1 million tons of copper the US mined in 2024, the country could only process around 80% of it, according to the US Geological Survey. But the US requires much more processed copper than it can refine, so it imports around 45% of its total consumption.

Even without support for the full value chain, though, companies working on upping the domestic supply of critical minerals likely stand to benefit from Project Vault, said Sierra Peterson, cofounder and partner at Voyager Ventures. “Sovereign initiatives like this can derisk market demand,” she said.

©2026 Bloomberg L.P.