Octopus Australia to Spend Over $10 Billion on Green Energy Over Five Years

(Bloomberg) -- The Australian arm of Octopus Group plans to spend as much as A$20 billion ($14.2 billion) on renewable projects over the next five years, one of the largest investment plans in the country’s green sector.

Octopus Australia will invest at least A$15 billion developing assets in New South Wales, Victoria and Queensland, Chief Executive Officer Sam Reynolds said in an interview. About 60% of that will be spent on wind projects, with the remainder divided between standalone batteries and combined solar and batteries.

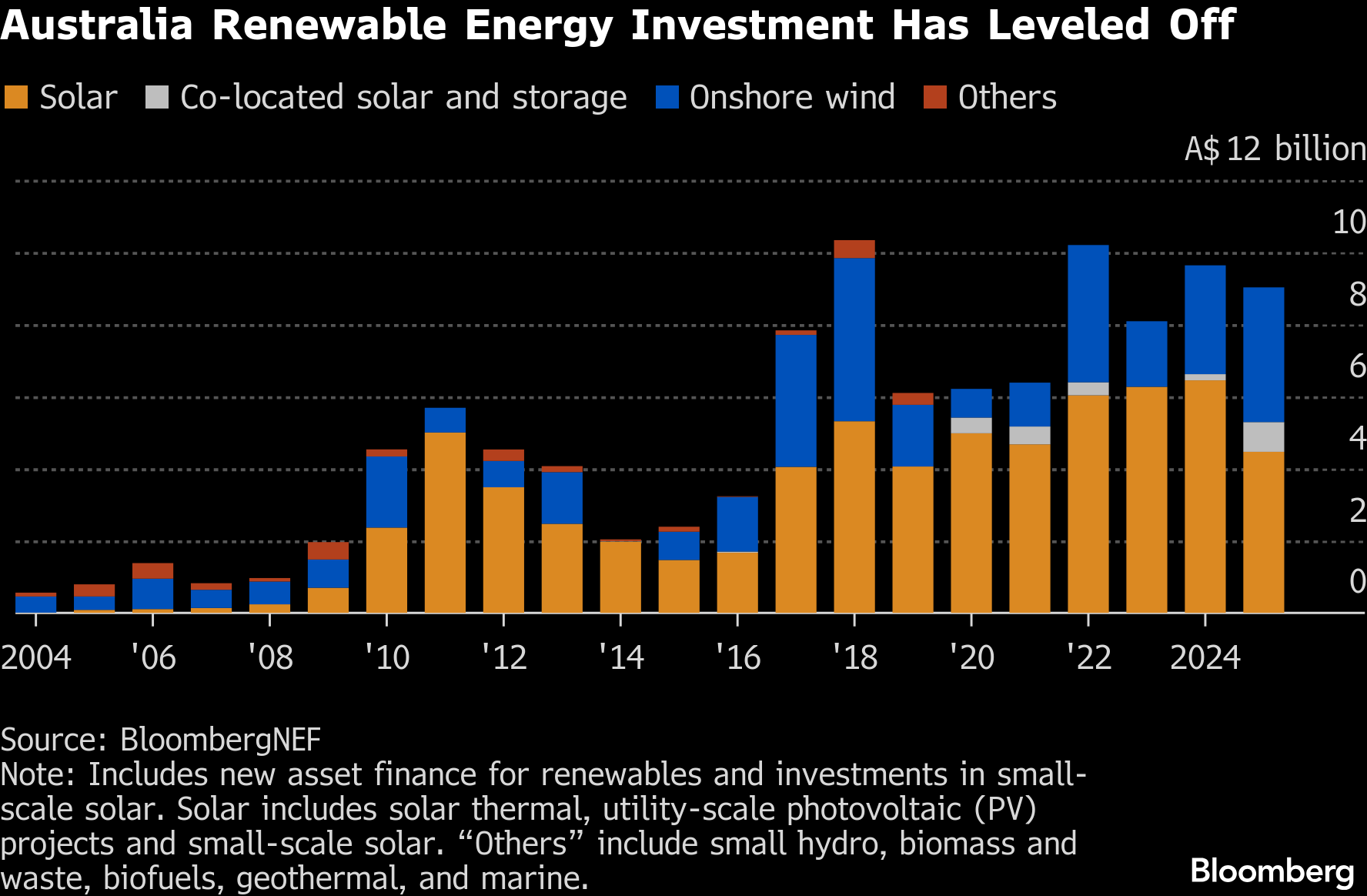

Octopus’s big bet on Australian renewables, and especially wind, would be a boost to a sector that has plateaued in recent years, threatening an ambitious government goal to more than double green energy generation to 82% of the total by 2030. Octopus has form in disrupting markets — becoming the UK’s biggest energy retailer just nine years after starting, partly by tapping outside capital, something it also intends to do in Australia.

Octopus Australia has won the backing of Dutch pension fund APG Asset Management NV and the Australian government’s Clean Energy Finance Corp., among others. It bought two battery projects worth more than A$3 billion earlier this month.

“We still need to find big investors to come in, so we’ll continue to fundraise,” Reynolds said, adding that he would look to international markets including Singapore, Japan, Korea, Canada and Europe.

Octopus Group owns 60% of Octopus Australia, APG holds 25% and the company’s employees the remainder.

©2026 Bloomberg L.P.