EU Carbon Prices Plunge as Merz Signals Openness to Soften Rules

(Bloomberg) -- European Union carbon prices slumped the most since 2022 after German Chancellor Friedrich Merz said the bloc should be open to revising or delaying its carbon market.

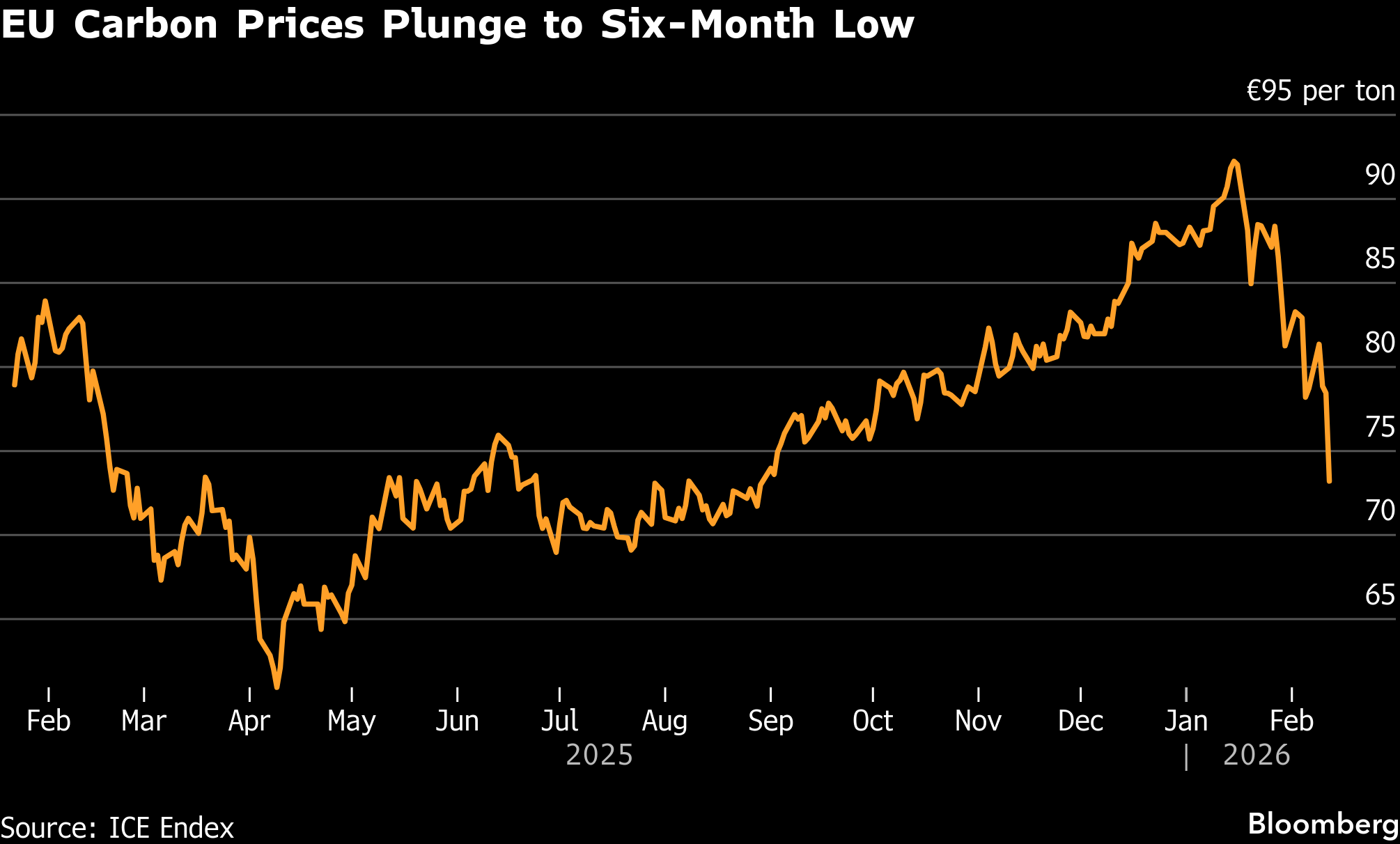

Benchmark carbon allowances fell as much as 8% — the biggest drop since May 2022 — to €72.18 per ton as of 12:11 a.m. CET on ICE Endex. Merz said on Wednesday the EU carbon market was meant to cut emissions while helping companies transition to clean production.

“So if this is not achievable and if this is not the right instrument, we should be very open to revise it, or at least to postpone it,” he said at a heavy industry summit in Antwerp. He didn’t comment further ahead of a meeting of European Union leaders Thursday.

The remarks reflect growing pressure from Europe’s largest economy to soften or revise the plan, highlighting the debate over how to reconcile climate policy with industrial competitiveness.

The commission, the EU’s regulatory arm, is set to unveil its proposal to reform the carbon market in the third quarter of this year. Under the bloc’s revised climate law, the overhaul should give companies in the system more time to decarbonize and slow down the phaseout of free permits to pollute, a demand supported by countries including Germany, Poland and Austria.

“For our industry, this is an enormously important issue,” Austrian Federal Chancellor Christian Stocker told reporters ahead of Thursday’s gathering in Belgium.

While most of allowances in the Emissions Trading System are sold at governments auctions, some companies still get part of their permits for free as protection against carbon leakage, or relocation to regions with laxer climate rules.

Merz’s comments are “the straw that broke the camel’s back,” building on other recent criticism of the EU’s ETS, said Yan Qin, principal analyst at ClearBlue Markets. “Market participants are now weighing the possibilities of political intervention to loosen allowance supply in the next couple of years to avoid EUA price spike and reduce costs on the industry.”

The EU already agreed last year to delay a new carbon market for buildings and road transport amid concerns over rising energy costs and voter backlash. The future of the carbon market is expected to be one of key issues to be raised at the informal meeting of EU leaders in Belgium on Thursday.

Ahead of that meeting, Czech Prime Minister Andrej Babis said that the price to emit one metric ton of CO2 should be no more than €30 — less than half of current levels. With 80% of allowances subject to “fervent” market speculation, profits from those trades are being made in the US and the UK, not the EU, he added.

Lowering permit prices is the only way “we can save our industry immediately,” Babis said.

Still, Merz’s comment have surprised some market watchers.

“It seems all but impossible to enact an immediate ‘delay’ or ‘suspension’ of ETS,” said Anders Nordeng, carbon market analyst at Veyt. “Has he misunderstood how ETS works or, more generally, how quickly EU policy instruments can be changed/scrapped? Or is it political posturing rather than actually trying to bring about a change?”

The sharp fall in carbon prices spilled over into German power markets, where wholesale prices for next month dropped as much as 2.4% before paring some losses. The country relies on fossil fuels during periods of low renewable output, making power prices more sensitive to CO2 costs as utilities must buy emissions certificates whenever such plants are running.

©2026 Bloomberg L.P.