China Ramps Up Energy Boom Flagged by Musk as Key to AI Race

(Bloomberg) -- New data on China’s relentless energy installations underscore warnings from Elon Musk and Jensen Huang that the nation’s world-beating power network will deliver a major advantage over the US in the race to dominate artificial intelligence.

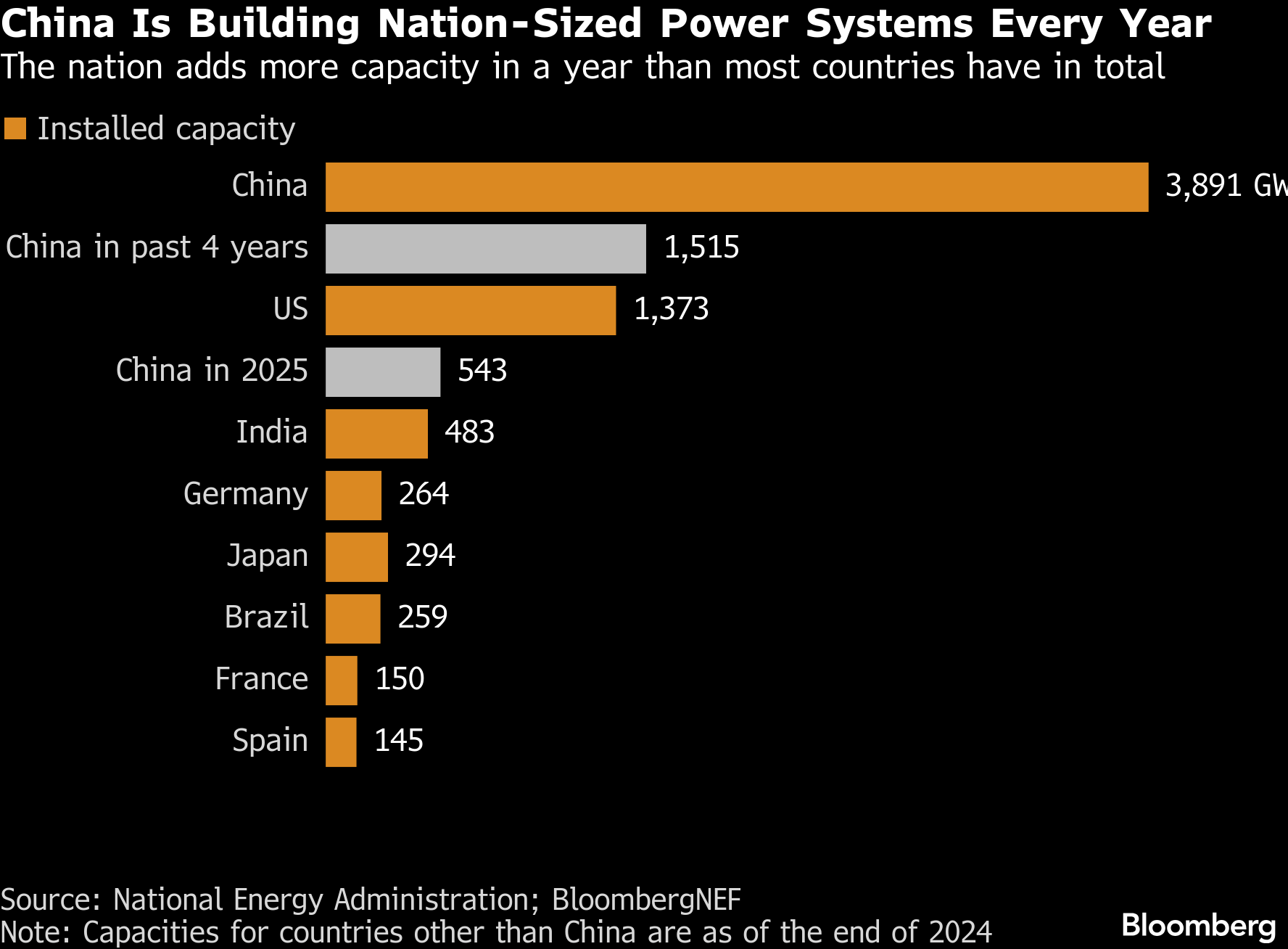

Since 2021, China has added more power capacity across all energy technologies than the US has in its history, including 543 gigawatts last year, according to figures released late last month by the country’s National Energy Administration.

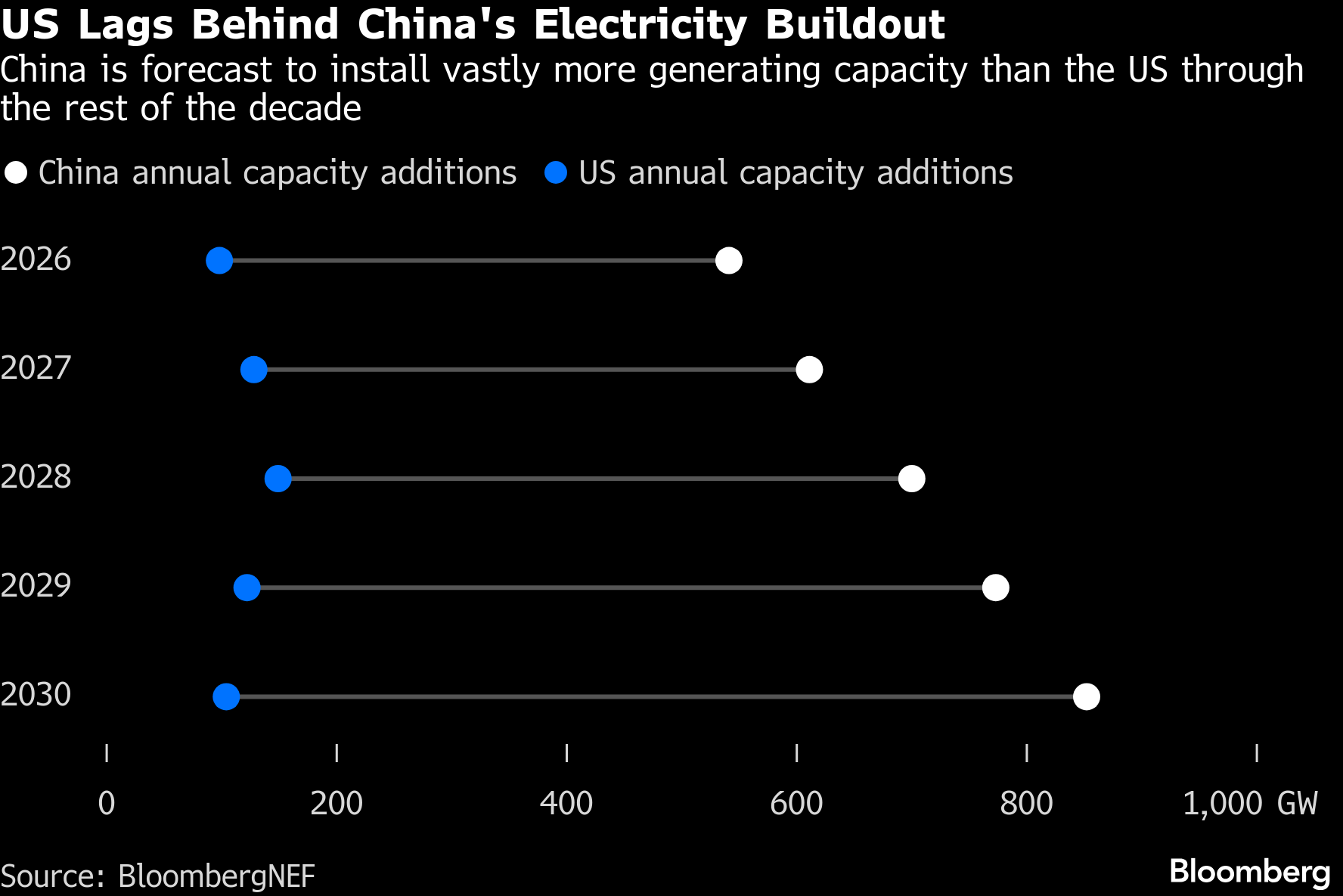

China will add more than 3.4 terawatts of electricity generation capacity over the next five years, almost six times as much as the US, BloombergNEF projects under its base-case Economic Transition Scenario. That influx would give the No. 2 economy greater ability to accommodate rising power demand from data centers.

“The limiting factor for AI deployment is fundamentally electrical power,” Musk told BlackRock Inc. Chief Executive Officer Larry Fink in an interview at the World Economic Forum on Jan. 22. “Very soon, maybe even later this year we’ll be producing more chips than we can turn on — except for China,” said Tesla Inc. CEO Musk, whose xAI is building US data centers. “China’s growth in electricity is tremendous.”

Musk’s comments echo similar sentiments from Nvidia Corp.’s CEO Huang, who has also identified access to electricity as a potential differentiator between the US and China. AI competitiveness can be thought of as a cake composed of five layers: energy, chips, infrastructure, models and applications, Huang told a December event hosted by the Center for Strategic and International Studies. “At the lowest level — energy — China has twice the amount of energy we have as a nation,” he said.

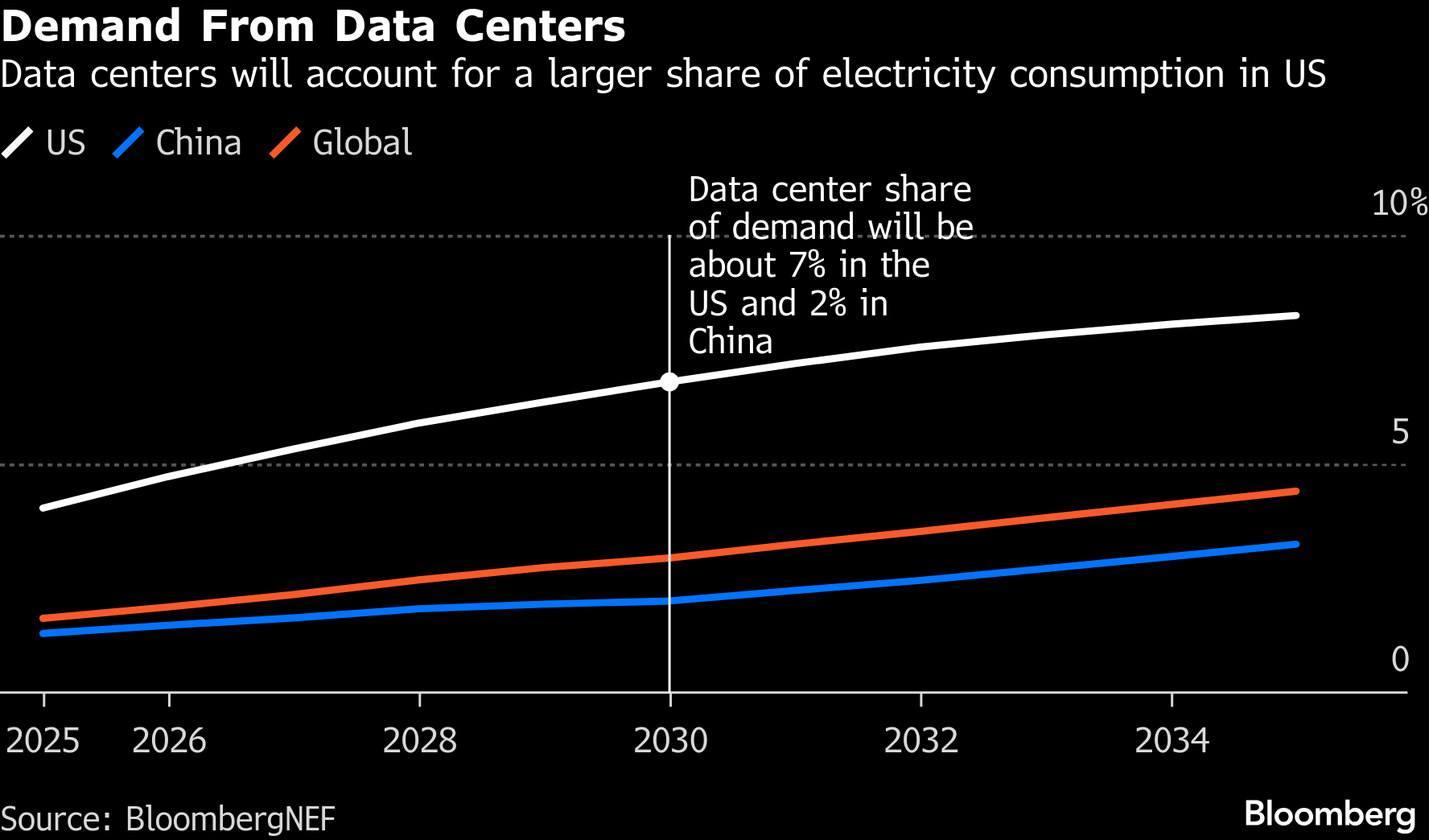

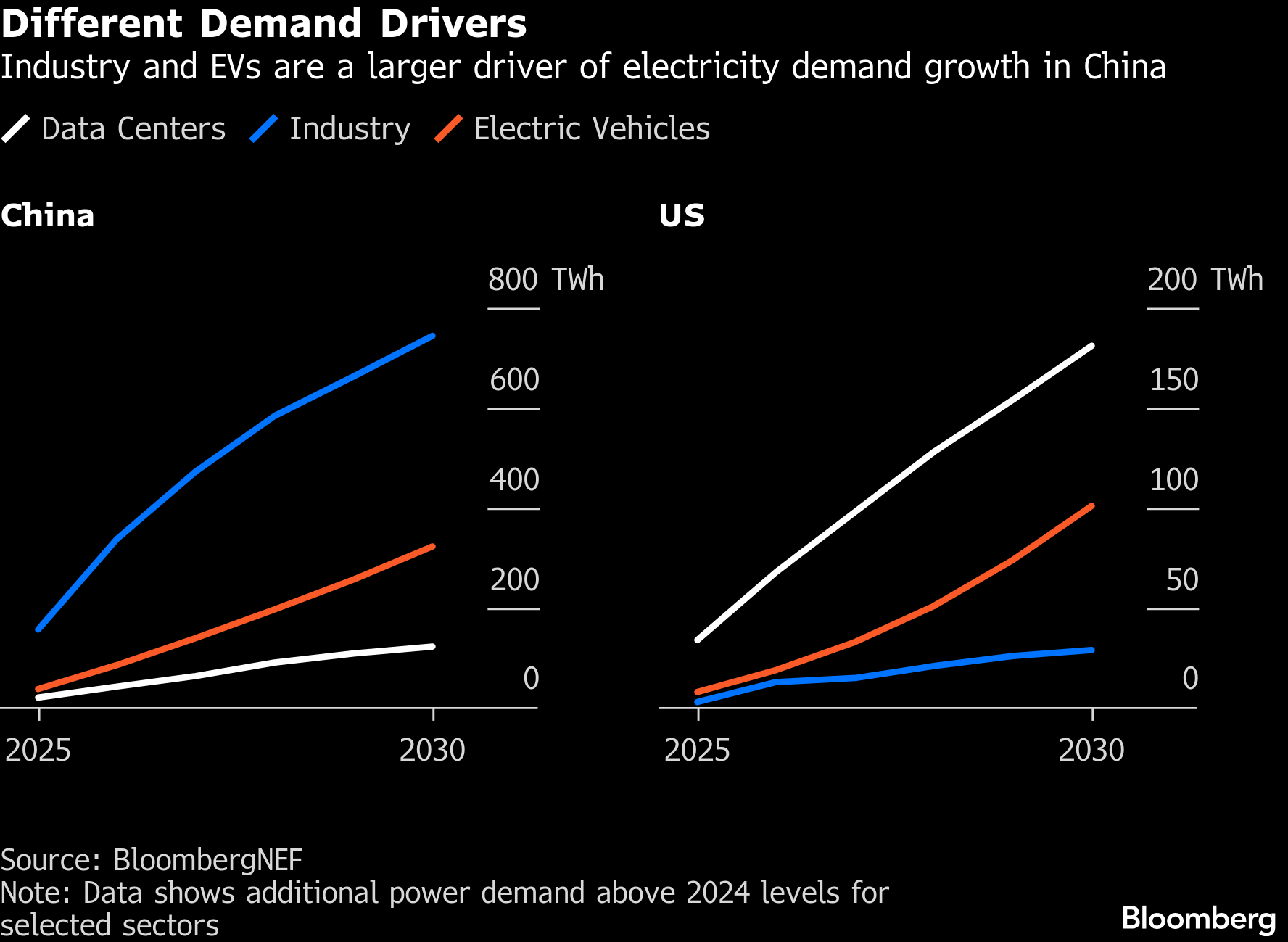

In the US, data centers will account for 38% of the growth in electricity demand between 2024 and 2030, though just 6% in China, according to BNEF projections. Data centers will command almost 7% of total US power demand by 2030, compared to 2% in China.

China, where electricity consumption hit a record last year, is continuing to rapidly add new power capacity with huge deployments of renewable sources like solar and wind alongside more coal, nuclear and gas facilities. Solar generating capacity is on track to surpass coal in China for the first time this year, though newly added renewables have lower utilization rates than fossil fuel assets.

Growth in generation capacity is proving slower in the US, where electricity demand has recently begun surging after roughly two decades of flat growth through the early 2020s. The anticipated requirements from AI have triggered a rush of development of new gas-fired capacity, though US power plants can take years to come online as a result of more onerous regulation and supply chain bottlenecks. President Donald Trump’s opposition to renewables also means clean energy projects have been subject to cancellation or delays.

“The federal government is essentially shooting ourselves in the foot by not allowing a more straightforward and robust uptake of” renewables to meet data center demand, said Michael Davidson, an associate professor at UC San Diego who focuses on US and Chinese energy policy.

Already, snarls across the US power grid are becoming a drag on the AI industry. Some US utilities are telling data centers it will take years for them to connect, while northern Virginia — a major global hub for the sector — has experienced instances of disconnections as a result of grid faults. The mismatch of AI power demand and slower growth in capacity additions could trigger effective electricity shortfalls in some US markets by 2030, BNEF said in a December report.

In contrast, connecting to the grid is “a non-issue in China” for new data centers, according to David Fishman, a Shanghai-based principal at consultancy The Lantau Group.

China is likely to have spare power capacity equal to more than three times the world’s entire data center demand by 2030, according to Goldman Sachs Group Inc. analysts. A lack of similar capacity “could act as a bottleneck for further data center developments in the US,” analysts including Hongcen Wei wrote in the November note.

Concerns about power availability mean it’s “extremely common” that energy is now the factor that is dictating AI developers’ growth in the US, said Samantha Gross, director of the energy security and climate initiative at the Brookings Institution.

“The AI industry talks about time to power because that’s what’s rate-determining for them,” she said. “It’s not chip availability, it’s availability of power.”

AI will account for a smaller share of total power demand in China than the US in part because of the impact of the Asian nation’s other energy-hungry sectors, including industry and electric vehicles — both of which will add electricity consumption at a faster rate through 2030.

Still, energy access isn’t the only factor that’s likely to determine success in the AI sector, and the US retains its own advantages. China’s AI companies haven’t yet been able to innovate beyond the current cutting edge of technology and remain about six months behind the frontier AI of the most innovative Western firms, according to Google DeepMind CEO Demis Hassabis.

“China has an abundance of energy,” said Gartner Inc. analyst Chirag Dekate. “I think the US has an innovation edge in the chip layer and in the model layer.”

©2026 Bloomberg L.P.