Volvo’s Boss Says Some Western Brands Won’t Survive the EV Shift

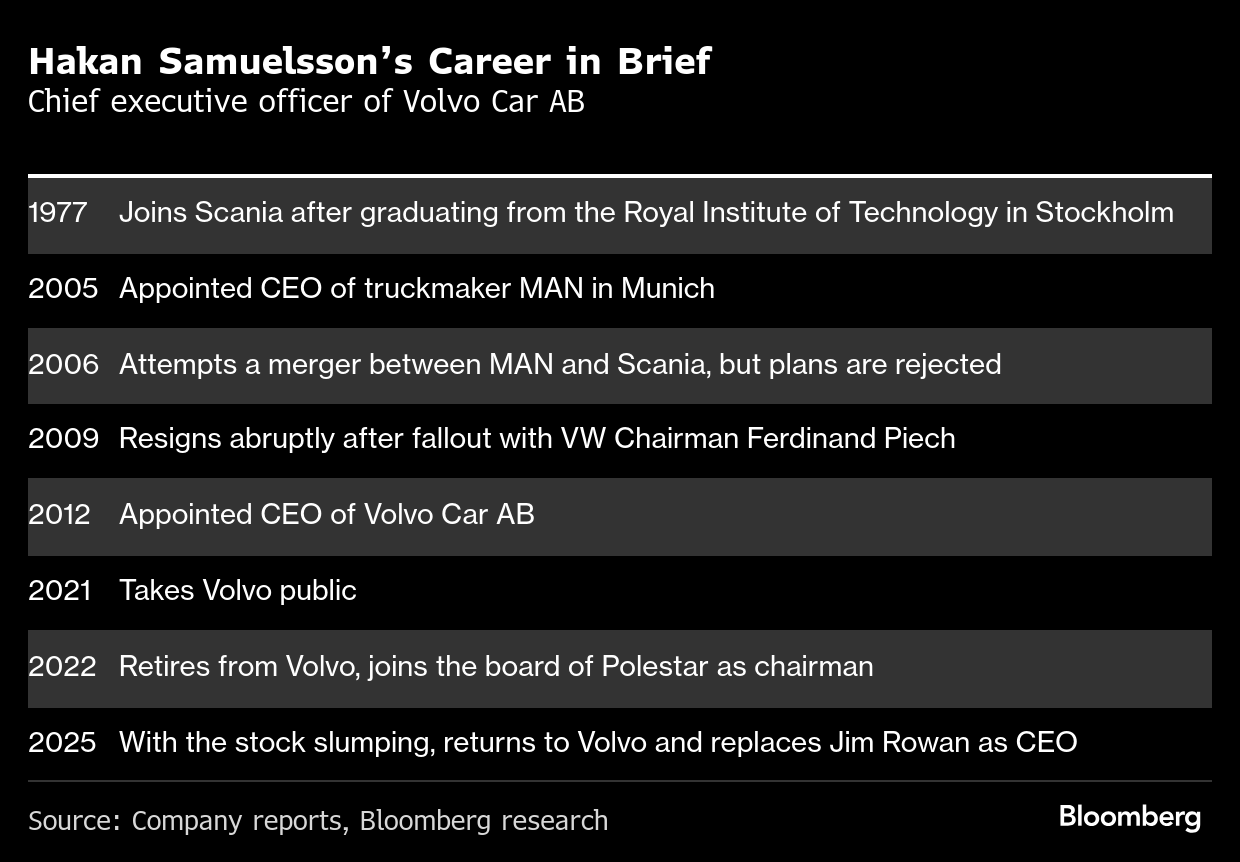

(Bloomberg) -- Hakan Samuelsson was brought out of retirement to guide Volvo Car AB through one of its most challenging periods.

Grappling with disappointing sales, software glitches, delays in key new models and even the threat of a sales ban in the US, Li Shufu — the billionaire behind China’s Geely Automotive Holdings Ltd., Volvo’s majority owner — turned to the 74-year-old Swede, who had previously led Volvo for nearly a decade and steered it through its 2021 public listing.

Back in charge since April, Samuelsson spoke with Bloomberg about the task of reviving the Swedish brand’s fortunes, the risks and benefits of having a Chinese owner and how not all Western brands will survive the transition to electric cars. The transcript has been edited for length and clarity.

Bloomberg: You left Volvo on a high note after the IPO in 2021, but now the carmaker is struggling. Why come back?

Samuelsson: To really revitalize what we said to investors then. The message was basically that electrification is a big opportunity and Volvo would come out as a more profitable, bigger electric company. That was our promise and what they invested into. My ambition is to revitalize that story. With some modifications, it is still the way forward.

When I got the question, ‘Can you come back and help put the company back on track?’ I didn’t need too long to say yes.

Q: Volvo recently booked a hefty charge related to the delayed launch of the EX90 electric model, and this week there were stories on Polestar writedown. Is more bad news coming?

A: The write-offs are concrete and both related to a car that was delayed. Two and a half years of revenue is lost and will not be recuperated. Those customers have bought other cars. That is the simple explanation.

Of course, the industry is in a challenging situation. It’s a race and that will get tougher and tougher, especially for the Europeans. It’s a hard time, so you just roll up your sleeves and work hard.

I must admit I didn’t analyze exactly what was in our books and how tough this job would be before I came back, and when you add everything up with Trump’s tariffs and all other things, it’s probably got a bit worse than I thought.

Q: What are the top priorities you’ve set for the turnaround?

A: First it’s costs. That creates time for us. Next is sales — improving marketing, improving the energy we put in the system, more performance-oriented leadership.

And then, when that works, comes the third phase. That is revitalizing the long-term strategy. How fast do we electrify? Can we come back into autonomous drive? We need to regain our position in tech development. We need some lighthouse projects where we are in leadership. We have lost that.

Q: You’re back on a two-year contract. Would you consider extending your stay?

A: No. My ambition is to find somebody who can take this on. It has to be somebody who has been part of making this story. There are several internal candidates who, within two years, could absolutely be capable of doing this job. Of course, the board will also consider external solutions, but bringing in someone from outside is always a bit of a gamble.

Q: Electric car sales fell in August at a time when Volvo’s future is supposed to be electric. How worried are you about this trend?

A: It is very disturbing, but really no big surprise for me. Last year, we imported EX30s in large volumes from China. Then came the 28% tariffs, and that was impossible to continue. We relocated the car to Ghent (Belgium). Now we’re ramping that up.

The losses on that car really explain the negative figure. We have a solid plan to bring back that car into much higher volumes, with product improvements but also of course with the cost level of making it in Ghent. So that’s why I’m quite confident we can go back to growth.

Q: If we look five years ahead, what’s your vision for Volvo’s place in the global auto market?

A: One area which is very difficult, very challenging, but where I am optimistic, is to achieve a global architecture for future cars — all-electric and electric with backup engines. To do that in one global architecture, with a better cost position, and at the same time allow regional models. That is something very few, or none, of our competitors have achieved. But I think we can, together with Geely.

Q: Does Volvo’s electrification strategy still make sense with some governments softening targets?

A: Volvo will be stronger if we electrify fast. But we need new plug-in hybrids — electric cars with a backup engine — as a bridge until charging is everywhere. Strategically, the direction has not changed.

Realistically that may take some more years beyond 2030, depending on charging infrastructure and customer demand.

Q: Chinese EV makers like BYD, Xiaomi and Zeekr are expanding globally. How much of a threat are they?

A: Chinese brands are already more than half the market in China, and they are entering Europe. That puts pressure on Europeans and Americans, who are competing in a shrinking part of the market.

China, whether we like it or not, will be a very big player in the car industry in the future, not just in China. The stronger the Chinese car industry becomes, the more valuable our connection with Geely is.

Q: Would you consider going as far as setting up a joint venture with Geely in China?

A: No, that is not something we are looking at now. We did that some years ago, but in today’s regionalized world — which also includes restrictions to technology — I think it’s better to have the business more regionalized.

Q: After 70 years in the US, Volvo faces the risk of a sales ban linked to its Chinese ownership. How serious is that threat?

A: I’m not too nervous. We are a listed company, not a division of a Chinese company. We have governance rules and an arm’s-length relationship with our owner. Data stays with Volvo and the customer — it’s not passed on anywhere. And there are no Chinese components in our cars. These are the things we must demonstrate to the authorities, and I am confident we will.

Q: How do you navigate such regulatory uncertainty while also trying to execute a global turnaround?

A: You don’t speculate too much about tariffs or politics. You concentrate on the core issues. America will be very interested in data security and protection. Who has access to data going into the cloud and what does our governance system really look like? We are sorting that out.

Q: How do you see the car industry evolving from here?

A: The industry will be electric — there’s no turning back. It may take a bit longer in some regions, but the direction is clear. In (about) 10 years, cars will all be electric and they will be lower cost.

There will be new dominant players, exactly as Ford, GM, Toyota and Volkswagen were in the old world. In the new world, there will be two or three very strong Chinese brands. That makes the room for the old ones tougher. So this will trigger a (wave of) restructuring. Some companies will adapt to new circumstances and survive. Others will not.

Q: Who or what inspires you as a leader?

A: I am inspired by people who are authentic. My motto has been: if nothing else works, tell the truth.

I listened to Finland’s president, Alexander Stubb, the other day and the way he talks at press conferences is rather refreshing. He was talking about Ukraine and how Finland had a similar experience in the winter war. You see he’s talking from his own head, not from a script. I think that’s inspiring.

©2025 Bloomberg L.P.