Nuveen Plans $330 Million Australian Solar-Battery Project as It Shifts Focus From US

(Bloomberg) -- American asset manager Nuveen LLC plans to spend as much as A$500 million ($330 million) on a solar and battery project in Australia within the next year, as political uncertainty clouds the outlook for clean energy in the US.

It will be the firm’s first green-energy investment in Australia, Nuveen Infrastructure’s Global Head of Clean Energy Joost Bergsma said in an interview. Nuveen expects to commit more capital locally over the next three years, with onshore wind among the potential opportunities, he said.

The project will operate within Australia’s National Electricity Market, with a focus on the most populated regions, Bergsma said. Talks with local developers are underway but remain at an early stage, he added.

Political turbulence in the US is prompting Nuveen to redirect capital to friendlier jurisdictions such as Australia and Europe, where there is government support for clean energy investments, Bergsma said.

US President Donald Trump’s administration has taken aim at renewables projects on federal lands and oceans, stopping work on wind farms, revoking permits, and making it more difficult for new developments to secure approval.

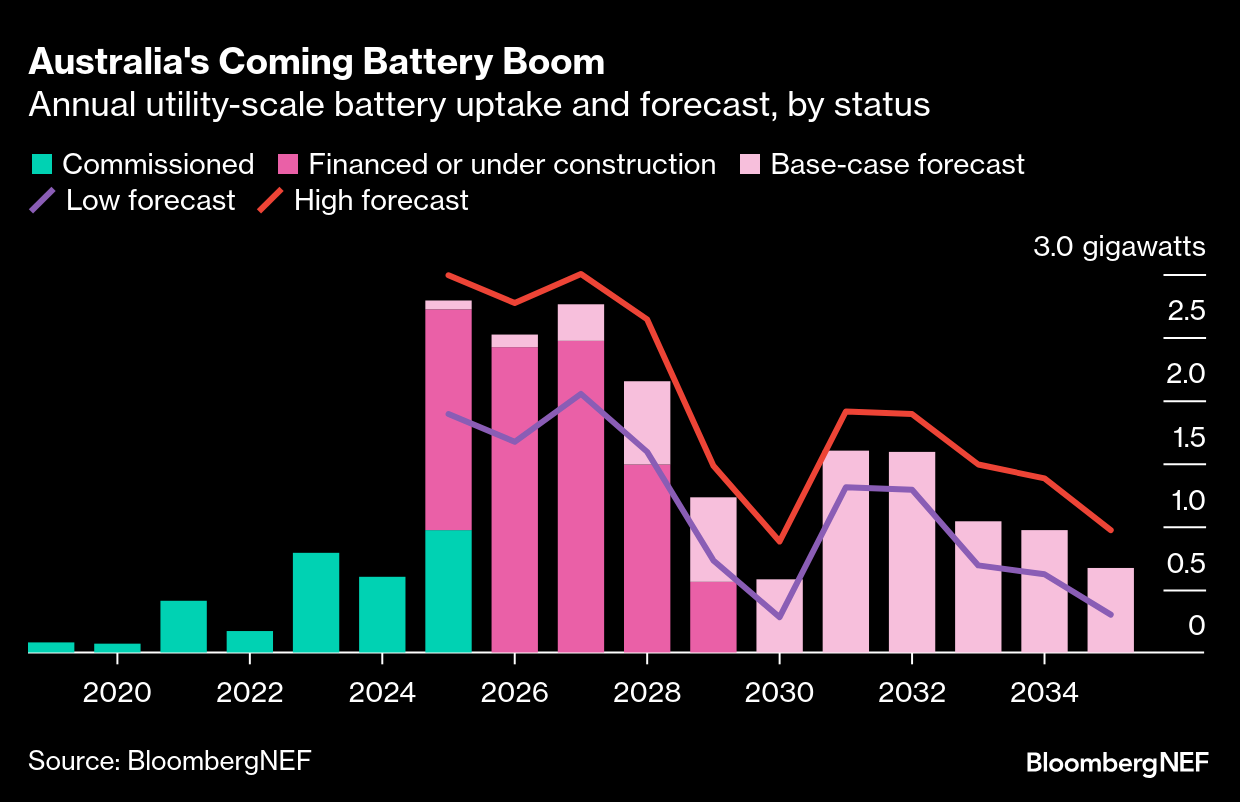

Australia was slower to adopt energy storage than early movers such as China, the US and Germany, but has since vaulted into the top five utility‑scale battery markets, according to Rystad Energy. The nation is set to install more than 20 gigawatts of large-scale batteries by 2035, a more than 500% jump from the 3.3 gigawatts in operation as of July, according to BNEF.

Solar and battery projects are especially attractive in Australia, Bergsma said, with grid volatility creating multiple revenue streams and the market still far from saturation.

Australia leads globally in rooftop solar per capita, which floods the grid with cheap daytime power but also creates challenges for system stability. The country’s electricity market is the world’s most volatile, with wholesale power rates regularly dropping below zero when solar generation peaks around noon, before spiking after sunset.

It comes after Australia — one of the world’s top fossil fuel exporters — pledged to cut greenhouse gas emissions within a range of 62% to 70% by 2035, from 2005 levels. The goal relies on a continued roll-out of renewables, fresh transmission infrastructure and boosting clean fuel usage.

Nuveen’s clean-energy investment arm manages about $5 billion worth of assets globally, mostly through funds backed by institutional investors such as pension funds, insurers and banks.

©2025 Bloomberg L.P.