JPMorgan Pitches ‘Compelling’ Mideast Energy Pivot to Clients

(Bloomberg) -- JPMorgan Chase & Co. is giving a group of its clients front-row access to the energy transition that’s underway in the Gulf states, as the region’s efforts to pivot away from fossil-fuel dependence generate growing investor interest.

“It’s a very compelling story,” said Hannah Lee, Asia-Pacific equity thematic and head of sustainable investing research at JPMorgan Securities. That applies “both for their own electricity generation, but also for the potential to export clean energy at some point in the future.”

JPMorgan will be taking a group of institutional clients, some with an emerging markets and Asia focus, to Saudi Arabia next month. The trip will serve to raise investor awareness around the energy transformation that’s underway across many of the Gulf states, Lee said.

For now, the Middle East remains a bastion of fossil-fuel dominance. It’s home to about 30% of global oil production, and is coming to the clean-energy transition later than many other major economies, including the US, India and China. But the low base from which the Middle East is starting underpins the opportunity to generate returns from early green investments, according to Lee.

“Our entire renewable energy complex of analysts” has been following the build-out in the Middle East, she said. That analysis, which has covered “batteries and renewables and transformers and everything,” has identified “interesting new commitments out of some of the Middle Eastern, Gulf states on renewable energy and energy transition, of which Saudi Arabia is very notable.”

Gulf state efforts to explore clean energy gathered pace after Dubai hosted the annual United Nations climate change conference in 2023, also known as COP28, according to JPMorgan.

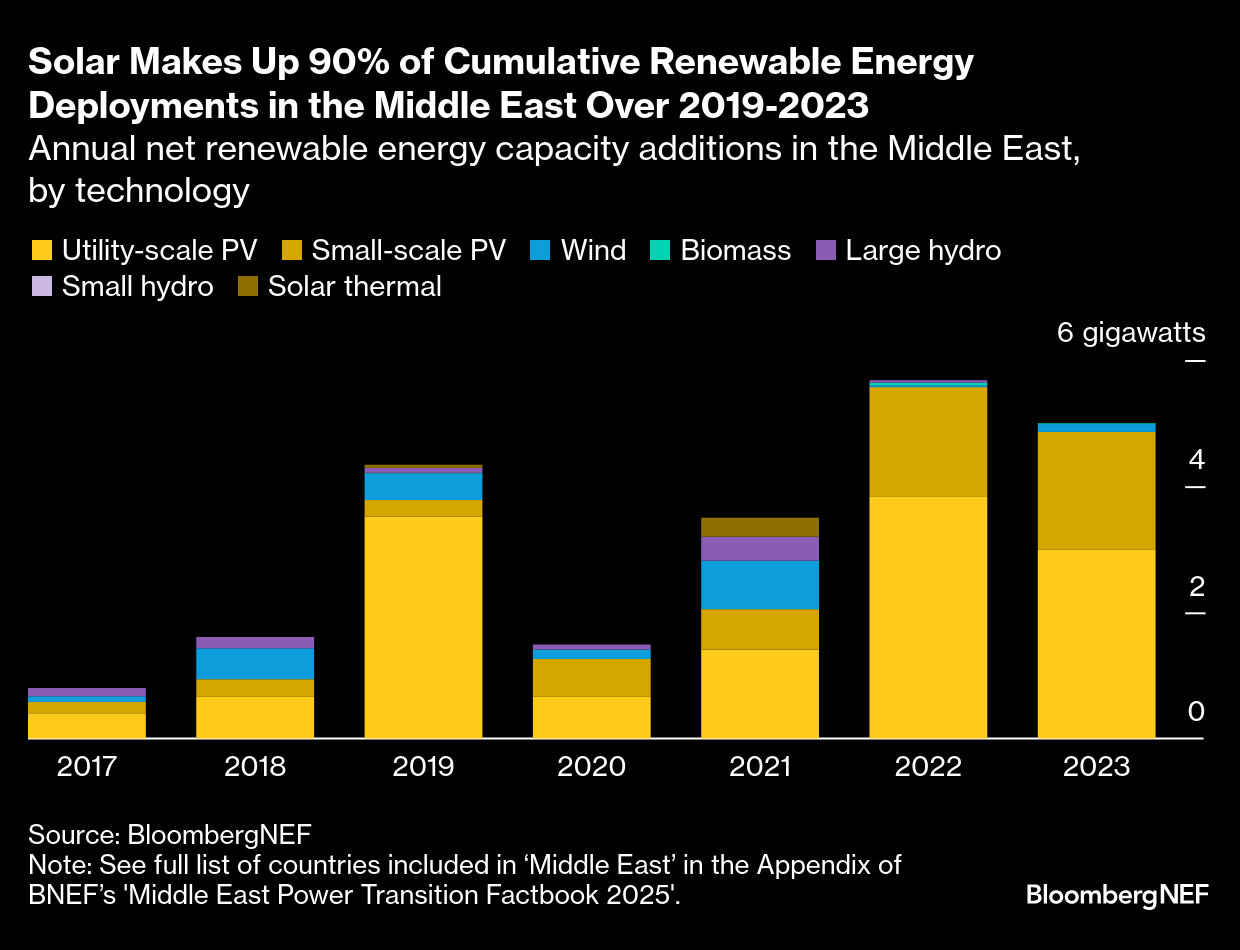

This year, the region is expected to spend $10 billion on renewable and nuclear power generation. That’s still less than a tenth of its projected investment in supplying oil and gas, according to the International Energy Agency. In the coming decade, however, solar photo-voltaic capacity in the Middle East and North Africa is expected to increase tenfold, the IEA estimates.

JPMorgan is drawing investors’ attention to clean-energy opportunities in the Middle East at a time when capital previously destined for the US looks for other destinations. That’s amid growing evidence that a number of institutional investors have been put off by President Donald Trump’s escalating attacks on green energy.

Saudi Arabia has set a target of 130 gigawatts of installed renewable capacity by 2030, and will rely on renewables for half the electricity it generates. Abu Dhabi aims to produce 60% of its electricity from renewables and nuclear by 2035. Both sets of targets will require significant investments.

Data provider Kpler estimates that Saudi Arabia is installing 12.8 gigawatts in renewable energy capacity this year. Power demand from data centers and water desalination are further expected to drive renewables growth in Saudi Arabia. As of 2024, the Saudi Water Authority reported that 20% of the energy used in its new desalination plants came from renewable sources, primarily solar power, the Kpler report stated.

However, the stock market has yet to reward some of the biggest players in the region, with the share price of Saudi Arabian utility Acwa Power Co. down by roughly half this year.

Fossil-fuel behemoth Saudi Aramco, meanwhile, has lost about 13% of its market value in the same period, as excess supply drives down oil prices. The company’s importance to the Saudi economy means its share price losses have left a dent on the kingdom’s main stock index, which is down about 7% this year. Dubai’s benchmark equity index, meanwhile, is up about 14%.

Investor interest in the Gulf states has picked up more broadly of late, as the region’s low taxes and light-touch regulations lure hedge funds, private equity firms and wealthy individuals. At the same time, Middle Eastern efforts to dedicate capital to data centers is laying the foundations for a surge in energy demand. Deals to date include a $3 billion agreement backed by Qatar Investment Authority to finance and invest in data centers.

Lee says JPMorgan also expects the region to benefit from growing trade and investment ties with China, as the world’s biggest clean-tech economy steps up exports to developing nations. Chinese companies have sharply increased foreign investment plans in recent years, with more than 360 manufacturing projects announced since 2022.

The Silk Road Fund and various Chinese firms have already signed billions of dollars worth of investments in Saudi Arabia to help the kingdom achieve its renewables targets under Vision 2030.

Saudi Arabia’s abundant sunshine combined with its ability to pump capital into projects it decides to back has already helped it achieve some of the world’s lowest average costs of producing electricity (known as levelized costs of electricity, or LCOE), according to Norway-based energy research firm Rystad Energy.

“It’s quite an interesting trend and plays into the increased South-South trade corporation that we’ve seen kind of growing over the last couple of years,” Lee said.

(Adds reference to impact of data centers and desalination projects on energy policies in 10th paragraph. A previous version corrected a reference to an estimate for renewables capacity by 2030, based on figures provided by Kpler.)

©2025 Bloomberg L.P.