China’s Green Tech Firms Pour Billions Into Overseas Factories

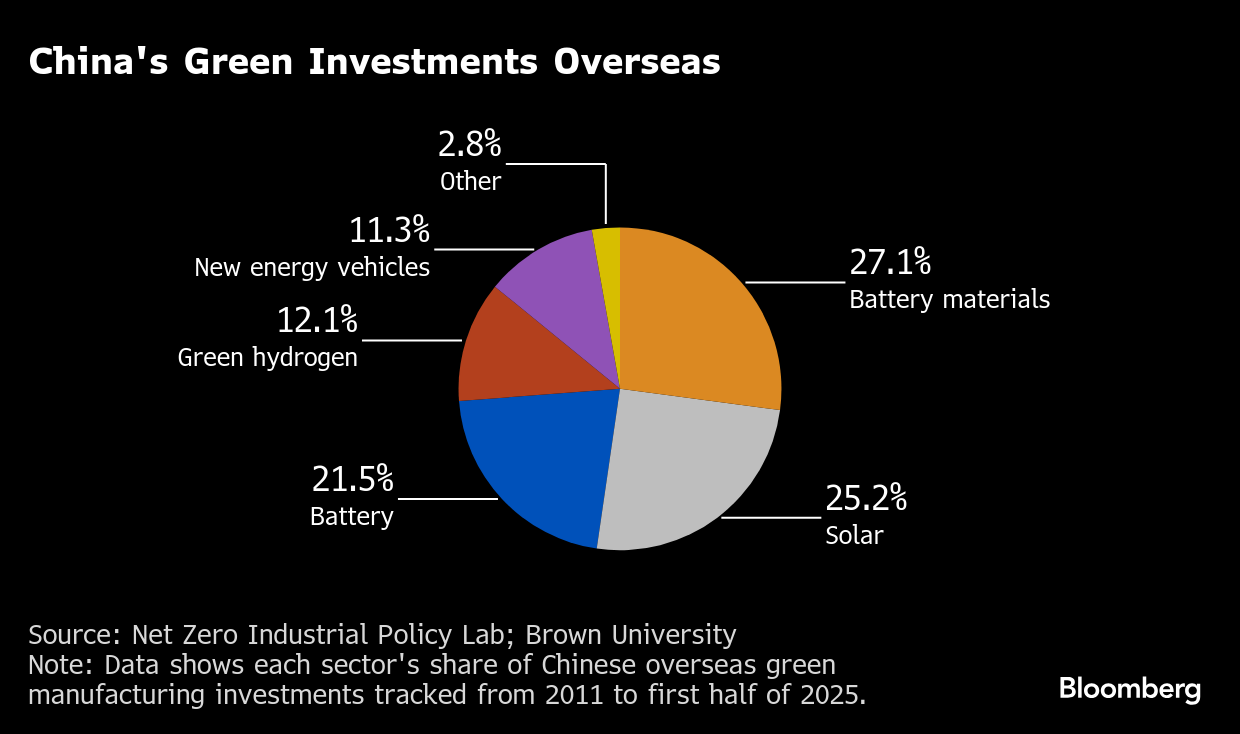

(Bloomberg) -- China’s world-leading solar, battery and electric vehicle companies have sharply increased foreign investment plans in recent years, pledging more than $210 billion since 2022, according to new research.

Chinese companies are expanding their supply chains abroad to capture new markets, avoid tariffs and get closer to sources of raw materials, Johns Hopkins University’s Net Zero Industrial Policy Lab said in a report. Researchers at the lab and Brown University have tracked more than 460 overseas green manufacturing projects announced by Chinese firms since 2011, finding that more than 80% of them came after 2022.

As US President Donald Trump dismantles his predecessor’s green policies and Europe struggles with regulatory gridlock, China has become the driving force behind the global energy transition. Its world-leading clean tech investments have brought down costs in China and abroad, while raising concerns about over-reliance on the country in some of its geopolitical rivals, as well as environmental and working conditions at some overseas facilities.

“Now China is exporting not just its green products but also in a sudden structural shift internationalizing its green manufacturing capacity and value chains by building factories overseas,” said Xiaokang Xue, a researcher at the Net Zero Industrial Policy Lab and one of the report’s authors.

Industry giants including Contemporary Amperex Technology Co. Ltd., BYD Co. and Trina Solar Co. have announced billions on overseas factories in more than 50 countries. While some announced projects may be abandoned before shovels hit the ground, the amount of pledged investment has already surpassed the inflation-adjusted equivalent of the Marshall Plan the US used to help rebuild Europe after World War II, according to Mathias Larsen, a researcher at Brown University and another of the report’s authors.

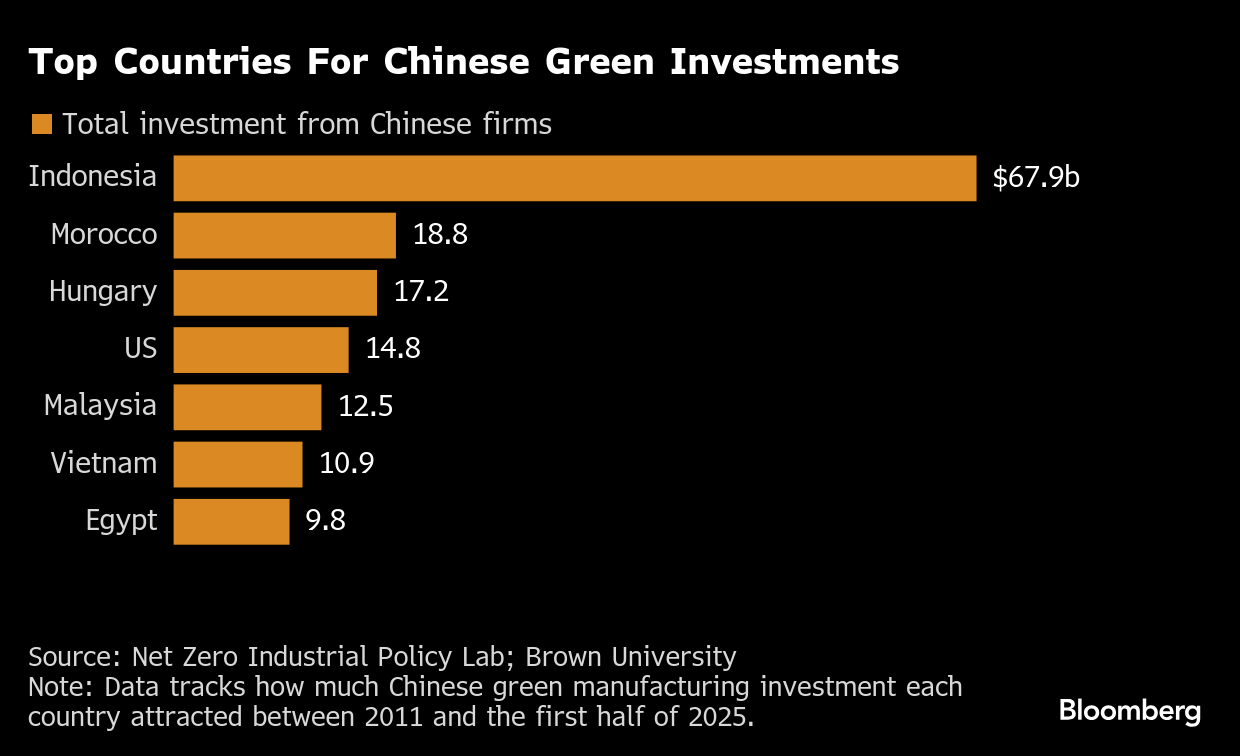

Firms channeled the most capital to Indonesia, focusing on nickel-rich battery materials and solar projects, the researchers found. Morocco was also a draw for battery materials and green hydrogen investments, thanks to natural phosphate resources and its proximity to Europe. Middle East nations have been attracting investments in solar module and electrolyzer plants, supported by sovereign offtake agreements.

In the US, investments have focused on the solar supply chain and lithium-ion battery plants, lured by a large domestic market protected by tariffs and incentives under the Inflation Reduction Act. But revisions to IRA tax credit rules and broad policy uncertainty could delay or derail some announced projects, the researchers said.

This year, “project counts are likely to plateau below the 2024 record as firms digest a pipeline of megaprojects and hedge against geopolitical risk,” they wrote.

Firms have shifted both where they invest and what they invest in over time. Southeast Asia, the preeminent destination, has seen its share fall, while investments in the Middle East and North Africa have risen from almost nothing to 20% of the total last year, the researchers said. Solar power got the lion’s share of funding before 2021; now it’s more evenly spread across areas also including batteries, electric vehicles and green hydrogen.

Not everyone has welcomed the expansion. Lawmakers in the US have raised barriers to entry for China-connected firms. And local communities from Indonesia to the Democratic Republic of the Congo have raised concerns about environmental degradation, limited labor protections and unsafe working conditions, further hamstrung by language difficulties.

As China’s firms expand abroad, “countries must plan, fund and implement green industrial policies and bargain hard with Chinese firms to achieve their priority of sustainable development,” said Tim Sahay, co-director of the Net Zero Industrial Policy Lab.

©2025 Bloomberg L.P.