China’s Green Steel Transition Set Back by Low Electric-Furnace Output

(Bloomberg) -- Chinese steel mills are set to miss a key emissions-reduction target because of low production from electric-arc furnaces (EAFs).

The country will generate roughly 10% of its total steel output this year from costlier-but-more-efficient EAFs, well below the goal of more than 15%, according to estimates from the Centre for Research on Energy and Clean Air. The global average was 29% last year, with the US at an estimated 72%.

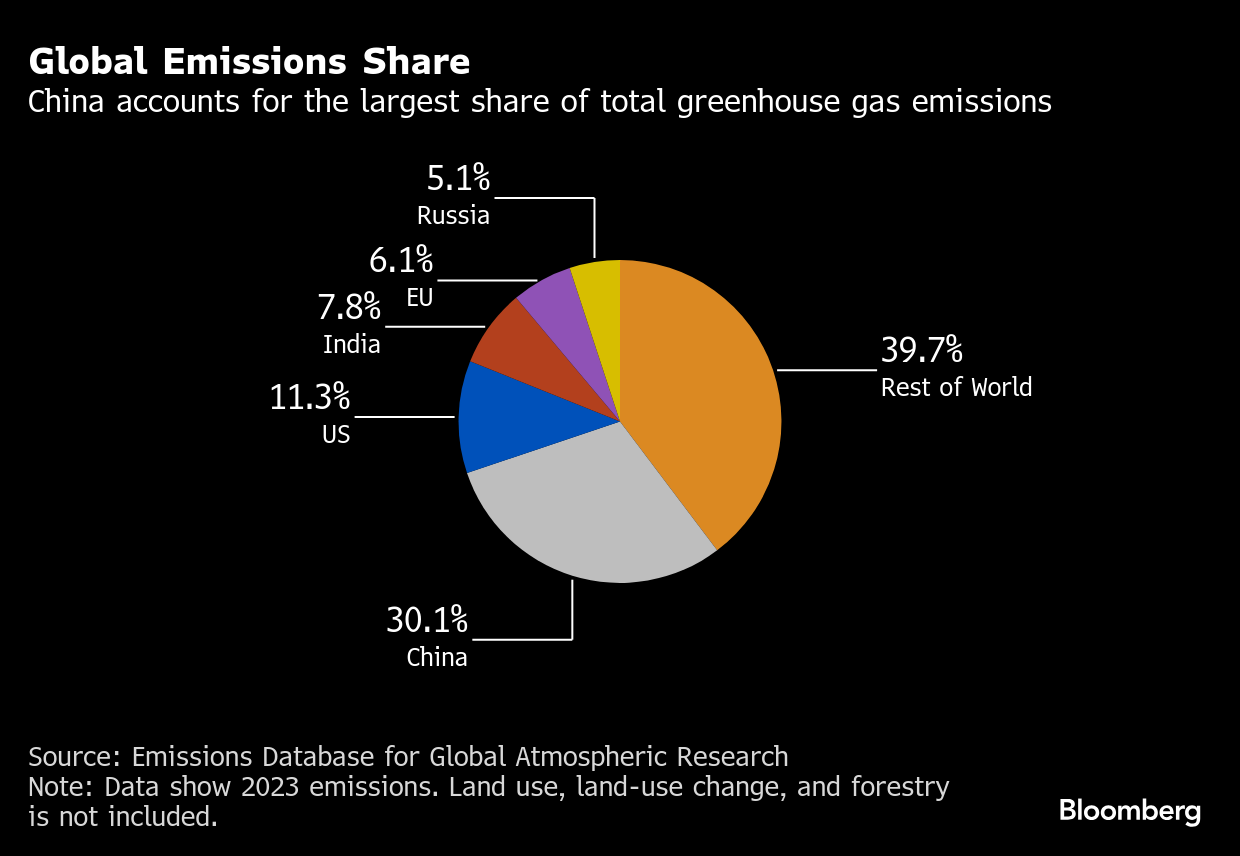

China has publicly stated its plans to lower emissions from steel companies by promoting the adoption of EAFs processing steel scraps to replace carbon-intensive blast furnaces that use iron ore. Steel production currently accounts for about 17% of China’s total carbon emissions, making it a significant contributor to the country’s greenhouse gases.

“Run rates at EAF units remain at very low levels and that’s not going to change in the near term,” said Xu Xiangchun, an analyst at Mysteel Global.

Using EAFs is seen as a major way to make the steel-production process greener, but high prices for scrap steel, the main feedstock for EAFs, are currently hampering the process.

Scrap steel prices have been boosted by insufficient supplies of old automobiles and other metal equipment, according to Xu. There’s also growing competition from blast furnaces for scrap steel, said Xinyi Shen, an analyst at CREA.

One way to increase run rates would be to make EAFs produce more higher grades steel used in sectors such as automobiles and move away from lower-margin construction steel, Shen said.

Any further decline in EAFs’ output will have profound implications for China’s vast steel industry, which accounts for half of the world’s supply. With the US backtracking on its climate-related policies with Donald Trump back in the White House, China is now seen by government leaders, including Brazilian Environment Minister Marina Silva, as taking a lead role in the fight against climate change.

China has set a target of lowering carbon emissions intensity by 65% by the end of the decade from 2005 levels and to achieve net zero by 2060. However, President Xi Jinping’s announcement on Wednesday of a 7% to 10% cut in economy-wide net greenhouse gas emissions over the next decade appears too modest to align with global efforts to avoid the worst impacts of climate change.

Production rates at EAFs have been stuck below 60% in recent years, compared with roughly 90% for blast furnaces, according to Mysteel.

Despite the EAFs setback, the country hasn’t backed away from its intention to accelerate low-emissions steel production. Analysts at BloombergNEF said this week in a report that China’s plan calls for “rewarding steelmakers that use scrap and clean power.” The companies will have “more financing channels for green upgrades in a regulatory environment that increasingly favors low-carbon production,” they wrote.

China’s steel industry requires investments of at least 132 billion yuan ($18 billion) to decarbonize over the next five years, according to the Climate Bonds Initiative and Transition Asia. China has been piloting financing guidelines for the sector’s transition in some provinces for the past two years. That’s helped the industry raise $3 billion via labeled bonds in 2024 and 42.5 billion yuan in transition loans as of January, the Climate Bonds Initiative reported.

“The policy signal across all the different stakeholders is so strong,” said Charles Nguyen, the Asia head of environmental, social and governance investing at Neuberger Berman. The efforts in China create “a higher probability of eventual absolute emissions reductions,” he said.

China, along with other countries, also are building hydrogen-based steelmaking furnaces. Two large-scale plants were commissioned in the past three years by China Baowu Steel Group Corp., the world’s largest steel producer, and HBIS Group Co.

Both projects have more than one million tons a year of production capacity and use coking gas, which is 60% hydrogen. The furnaces are being designed to cut emissions by 50% to 60% relative to blast furnaces, according to CREA’s Shen.

Still, the clock is ticking for Chinese steel mills to become greener. The industry may be subject to higher carbon taxes after being added this year to the domestic carbon market.

The companies’ exports to the European Union also face potential carbon taxes tied to the Carbon Border Adjustment Mechanism. CBAM will slap a levy on emissions-intensive imports like steel, cement and hydrogen from countries with less-strict climate rules.

China is among the countries most exposed to CBAM risks because it’s among the largest foreign suppliers of steel to the EU, according to analysts at Barclays Plc.

In the end, CBAM will likely have little impact for most Chinese manufacturers because they’ve been preparing for years for carbon-related penalties, said Xing Lan, director of Natixis Corporate and Investment Banking’s green and sustainable hub for the Asia-Pacific region.

(Adds comment from CREA analyst in seventh paragraph.)

©2025 Bloomberg L.P.