Green Stocks Are Quietly Beating the World’s Biggest Trades

(Bloomberg) -- A global benchmark of clean energy stocks is outperforming major equity indexes and even gold, as investors respond to soaring demand for renewables needed to power the boom in artificial intelligence.

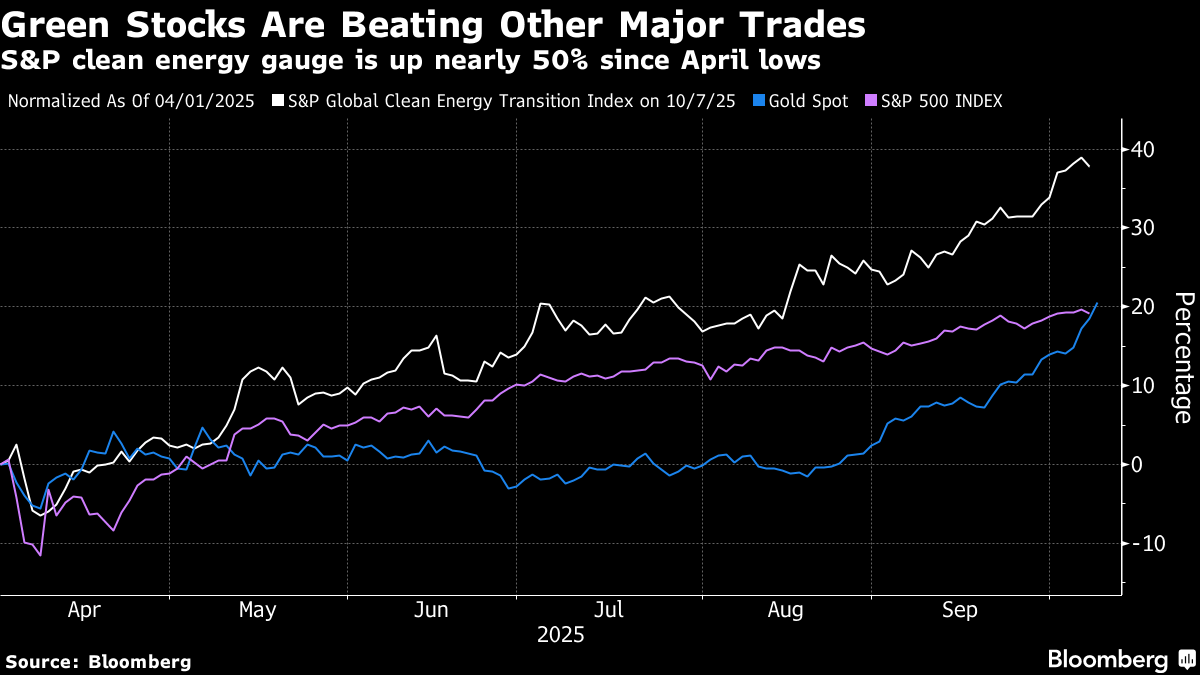

The S&P Global Clean Energy Transition Index has surged close to 50% since US President Donald Trump’s April tariff announcements caused havoc across markets. That compares with the roughly 35% gain delivered by both the S&P 500 Index and gold over the same period.

Investors have turned more positive on green stocks as the energy needed to power AI can’t be delivered without renewables. That’s despite efforts by the Trump administration to ax green policies, as China, India, Europe and some US states stay committed to low-carbon sectors.

Lower US interest rates are also buoying green sectors that have traditionally been capital intensive and debt-reliant. In China and Hong Kong, green shares are seeing a rebound as the government in Beijing stems overcapacity in solar subcomponents such as polysilicon and wafers.

The S&P index for clean energy stocks has also outperformed the S&P Global Oil Index since early April and is doing better than all major country equity gauges in the world, save for South Korea.

Clean energy indexes “tend to have little correlation with the broad market and can hence serve as tactical allocations when catalysts emerge,” Shaheen Contractor, senior ESG analyst at Bloomberg Intelligence, wrote in a note on Friday. “AI-driven energy demand, which may more than double by 2028, favors fast-to-deploy solar, storage and gas capabilities,” she said.

US-based Bloom Energy Corp., which manufactures fuel cells for power generation, and Goldwind Science & Technology Co. in China, the world’s largest wind turbine maker, are among the biggest gainers on the clean energy index, boasting triple-digit percentage increases in their share prices this year.

The S&P clean energy index’s rebound still only leaves it at half its level compared with 2021, when green investing was at its peak. That coincided with interest rates at crisis lows as the pandemic dragged down the global economy.

Aniket Shah, managing director and global head of sustainability and transition strategy at Jefferies Financial Group Inc., describes the latest move into green investments as the arrival of the “glory days.”

“We are in this wonderful moment where both the capital markets and the real economy are actually accelerating their efforts around sustainability and the energy transition,” Shah said.

©2025 Bloomberg L.P.