Global Investors Are Pouring More Money into Climate Tech

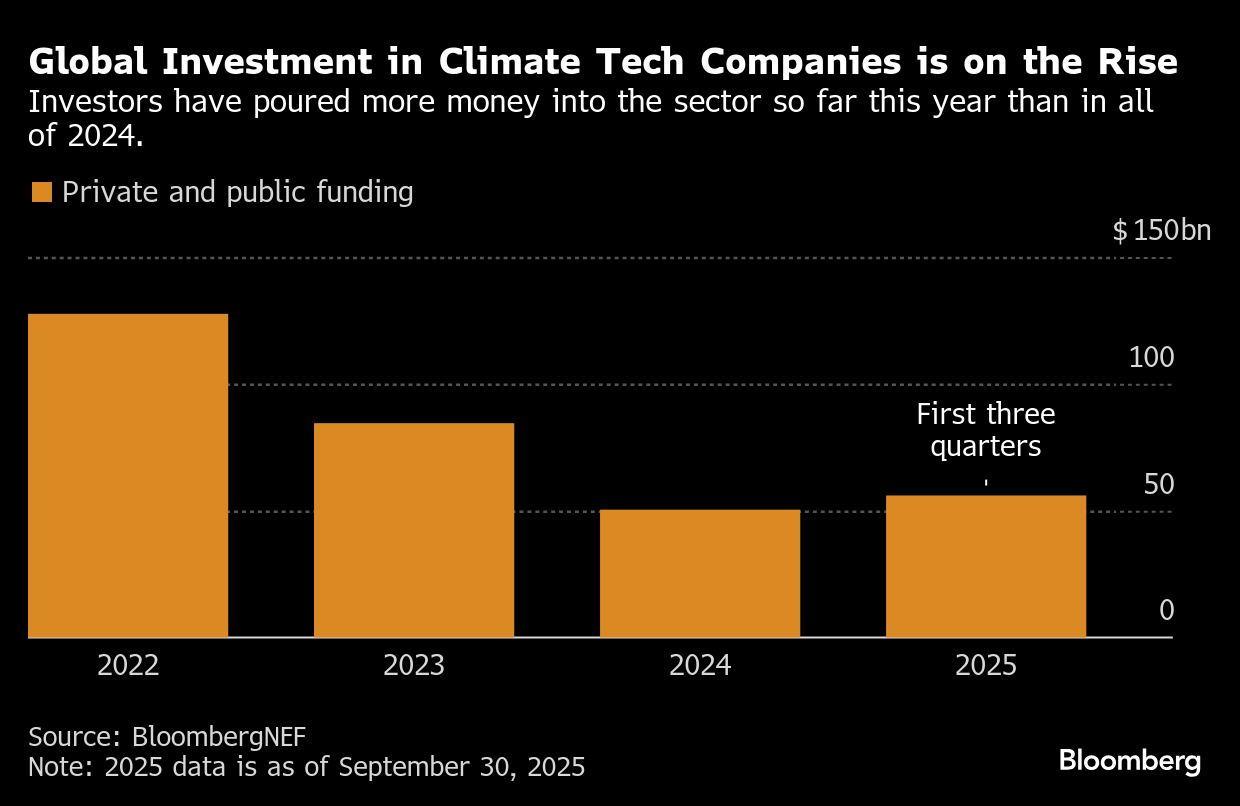

(Bloomberg) -- Global investment in green technology for the first three quarters of the year has already surpassed all of 2024. The fortunes of the sector have been in decline for three years, but explosive energy demand fueled by data centers has sparked a reversal.

Private and public investors worldwide channeled as much as $56 billion into green businesses ranging from clean energy to storage and electric vehicles during the nine months ending in September, according to a new BloombergNEF report. By contrast, the climate tech industry snagged less than $51 billion in 2024.

The renewed interest is being driven by clean energy and power storage deals, and comes despite the Trump administration's backpedaling on climate policy. Major deals include Chinese battery giant Contemporary Amperex Technology Co. Ltd., which raised about $5 billion from its Hong Kong initial public offering in May. The country’s electric car maker BYD Co. also raised $5.2 billion in share sales in March, while Spanish renewable energy giant Iberdrola SA sold $5.9 billion worth of shares in July.

Nuclear energy drew a fifth of all climate venture capital funding, in a large part "driven by the AI hype," said Musfika Mishi, a BNEF analyst. That includes a $863 million raise by Commonwealth Fusion, which drew funding from Nvidia Corp.’s venture arm.

Institutional investors are reupping their interest in the sector, particularly around climate tech that can also improve energy independence and help address national security. In early October, Brookfield Asset Management said it raised $20 billion to fund the clean-energy transition. Earlier this week, JPMorgan Chase & Co. announced it will put as much as $10 billion in direct equity and venture capital investment as part of a $1.5 trillion initiative for what it’s deemed critical industries that batteries, nuclear and solar technology.

The US will struggle to generate the energy it needs to power tech industry growth without including wind and solar, according to Chuka Umunna, JPMorgan’s global head of sustainable solutions.

“It’s difficult to conceive of a situation in which they won’t need to tap into those sources of energy,” he said in an interview with Bloomberg Television on Tuesday.

Those new funds come as clean energy stocks outperform major equity indexes.

But it remains to be seen whether the uptick will continue into 2026, Mishi added. She expects Trump's assault on renewable energy projects will weigh on investors' confidence. BNEF projects VC investment — which makes up a portion of the climate funding the group tracks — to stand at around $25 billion by the end of 2025, compared to last year's $31.7 billion.

©2025 Bloomberg L.P.