Cold Blasts Set to Test Energy Resilience in Europe and Asia

(Bloomberg) -- Energy markets in Europe and Asia are heading for a turbulent winter, as forecasters expect recurring cold snaps that risk pushing up power prices.

Weather models show high pressure developing over the North Atlantic and Arctic regions, allowing polar air to spread across much of Europe next week. It’s a pattern that forecasters say will be repeated through the heating season that started this month. Early winter cold is also possible in Japan, while energy traders are also scrutinizing the outlook for an unseasonably cool winter in India and southeast Asia.

On Thursday, the boss of Russian gas giant Gazprom PJSC also issued a warning. Alexey Miller said long-term weather forecasts indicate that an abnormally cold winter — a once in 20-year event — is looming for Europe and Russia in the near future.

Miller didn’t elaborate further, but Citigroup Inc. analysts say that rising gas benchmarks in Asia and Europe could get a further leg up if the winter turns icy. Cold weather in both regions would see competition for liquefied natural gas cargoes intensify, as both Europe and Asia vie for seaborne cargoes when fuel demand increases.

European gas stockpiles are nearly 83% full, but last week’s cold spell in the southeast has already forced some countries to tap into their reserves. Tanker shortages and other logistics bottlenecks have also helped weaken the LNG market, according to Citi, adding that Chinese demand could also surprise to the upside after a mild start to the winter last year.

While some government and commercial forecasters see the potential for a warmer-than-normal heating season, there’s a growing consensus that frequent waves of high pressure will see Europe repeatedly gripped by unseasonal cold.

“We may see heating demand fluctuate substantially while being not far from typical when looked at across the whole period,” said James Peacock, the lead meteorologist at Leeds-based weather analytics firm MetSwift.

High Pressure

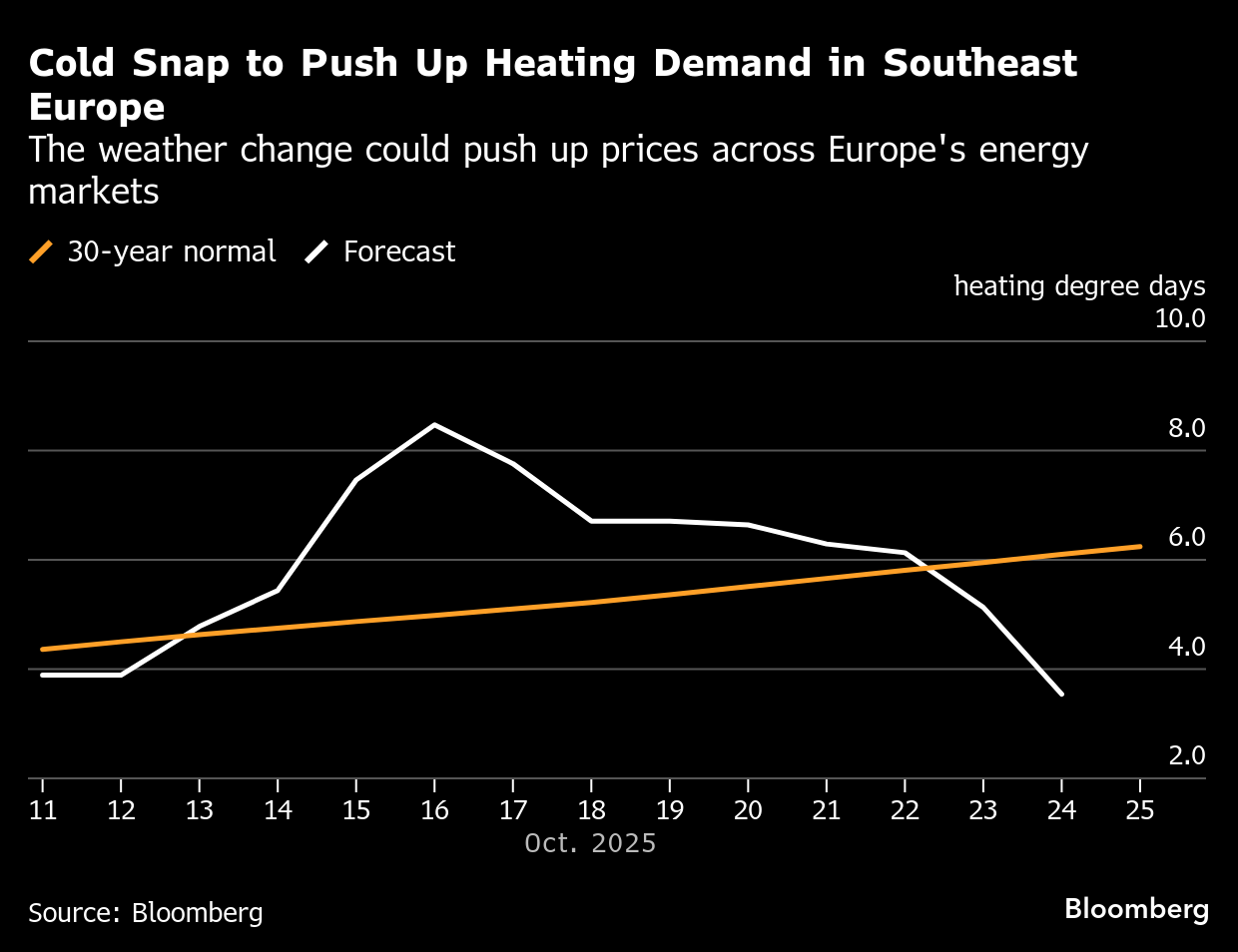

Next week, temperatures in central and southeastern Europe could briefly drop several degrees below normal, raising heating demand in France, Germany, Italy and much of eastern and southeastern Europe, data from Atmospheric G2 and Bloomberg models show.

Those high-pressure systems could also curb the output of wind and solar power, according an analysis from weather analytics firm MetDesk.

Longer term, there are signs suggesting that an atmospheric phenomenon known as sudden stratospheric warming could send shots of Arctic air across Europe in January and February, said MetDesk meteorologist Matt Dobson. Those events “load the dice in favor of cold spells in the six weeks that follow them,” he said.

The phenomenon refers to rapid warming high above the Earth’s surface, which causes a circulation of winds known as the polar vortex to break down. In 2018, a sudden stratospheric warming triggered a deadly winter storm known in the UK as the “beast from the east,” with temperatures as low as -12C (10F) disrupting energy infrastructure.

Asian Risks

Parts of Asia also face winter weather risks.

In Japan, there are higher chances of early season cold snaps due to a combination of atmospheric and oceanic factors, according to the Japan Meteorological Agency.

That includes La Niña conditions, which formed last month and are likely to last through February, the US Climate Prediction Center said on Thursday. That typically leads to cooler weather in Japan, as well as westerlies being positioned further south than normal, which can enhance cold-air outbreaks from the north.

Conditions are set to return to normal from mid-winter onward, the Japanese forecaster said in its cold-season outlook. There’s also a 40% chance for the northern Tohoku and Hokkaido regions to see higher-than-normal winter temperatures.

India and parts of Southeast Asia are expected to see below-normal temperatures from November through February, according to Maria Madsen of US-based Salient Predictions, which uses its own proprietary model and climatology data to make forecasts.

By contrast, areas including Bangladesh, Nepal, and Central Asia are likely to see warmer-than-usual conditions.

©2025 Bloomberg L.P.