China’s Wind Engineers Argue Merits of Going Big or Scaling Back

(Bloomberg) -- Renewable power is plentiful and cheap in China, a boon for consumers but a strain on firms that manufacture the equipment. Leading wind turbine makers are meeting the challenge with radically different solutions.

Pricing reforms this year are putting electricity from Chinese renewables at a steep discount to coal, the country’s mainstay fuel. It means stable returns on wind and solar are no longer guaranteed. The imperative is to reduce costs, and scaling up or scaling down seems to be the choice for turbine engineers seeking to deliver the most competitive power.

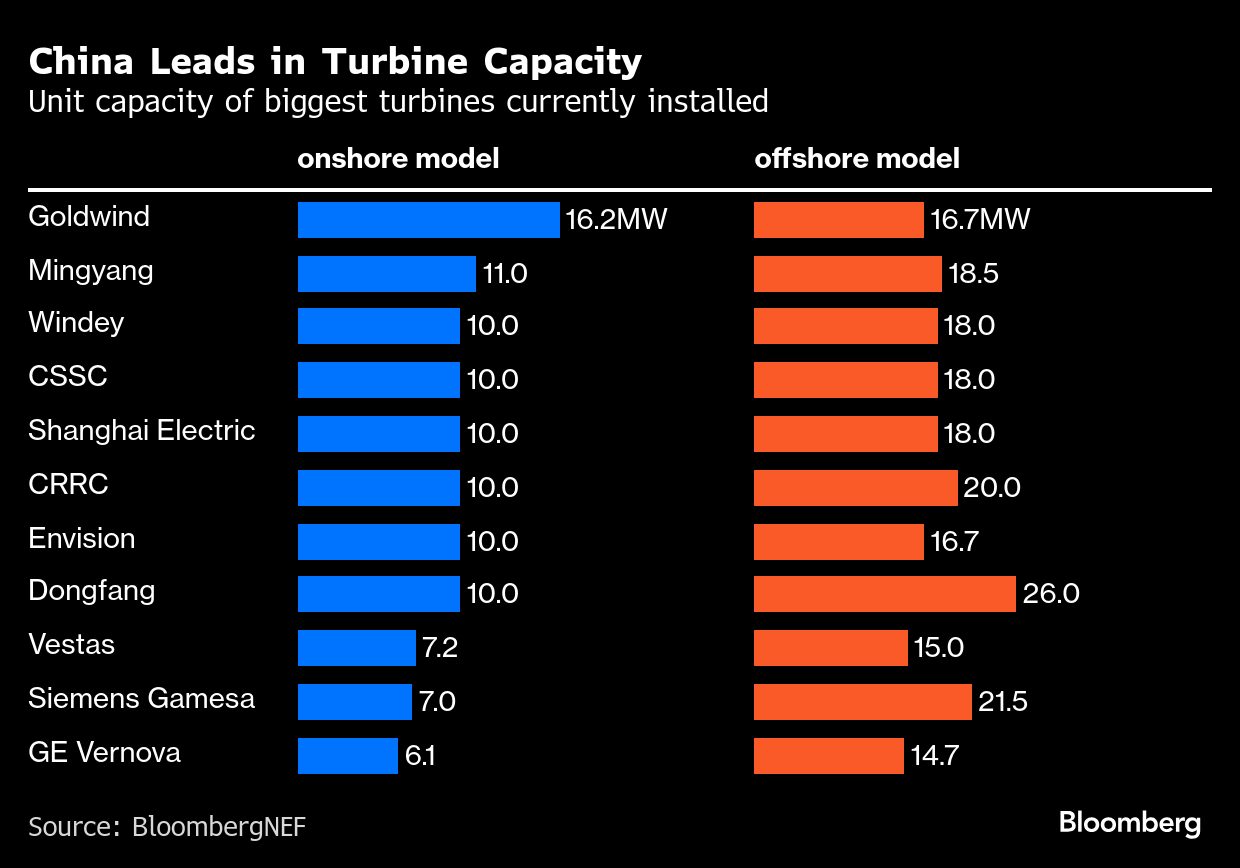

Ming Yang Smart Energy Group is all in on the first option. At this week’s annual China Wind Power conference in Beijing, the company unveiled plans for a twin-headed, offshore behemoth capable of delivering 50 megawatts, nearly double the size of the largest design currently available. The pitch: a per-kilowatt cost that’s much cheaper than Chinese rivals and perhaps just a fifth of similar turbines deployed in Europe.

“It’s obvious that electricity prices have dropped because of the new policy,” Chairman Zhang Chuanwei told reporters. “And the return on investment does not meet the standard.”

For Goldwind Science and Technology Co., smaller is better. At the same event, China’s top wind company launched products with capacities of between 10.5 and 14 megawatts, much less than its current offerings.

It’s a strategic shift for the firm, which until recently was focused on delivering ever-larger turbines to ward off ferocious domestic competition. Now, Goldwind is touting the longer service life and cheaper installation costs of its new models, as well as a smarter assessment of when power is most needed.

“Many projects can’t be approved because of power prices,” said President Cao Zhigang. “Therefore, we need to realize the value of electricity.”

Goldwind’s new products won’t generate as much power as other models when the wind’s up and turbines are flooding the grid. But they can produce more at lower wind speeds, when fewer turbines are operating and prices are likely to be higher.

Both approaches have merit. On land dotted with turbines, Goldwind’s nimbler models would have an advantage. But Ming Yang’s monster is a floating turbine that can be towed out as far as subsea cables will allow. On the less crowded ocean, its extra punch could be more decisively brought to bear.

On the Wire

China is pushing ahead with imports of US-sanctioned Russian liquefied natural gas, after the White House stopped short of putting additional restrictions on the trade in its latest wave of sanctions.

China’s aluminum surplus will halve in 2026 as demand outpaces supply, according to Bloomberg Intelligence. Electric vehicles and solar-power expansion remain the key drivers despite demand slowing from 2025.

Fortescue Ltd.’s shipments of iron ore increased 4% in its first quarter, as Chinese demand for the steelmaking product shows resilience despite concerns of a possible supply glut. BHP Group Chair Ross McEwan confirmed the mining giant was in commercial negotiations with China’s state-run iron ore buyer.

Donald Trump said he planned to speak to Xi Jinping about China’s purchases of Russian oil when the two leaders meet next week in South Korea, after the US president on Wednesday announced fresh sanctions on top energy companies with ties to the Kremlin.

The European Union is working on trade options to counter China’s planned export controls on critical raw materials should the bloc fail to reach a diplomatic solution with Beijing.

This Week’s Diary

(All times Beijing)

Thursday, Oct. 23:

- China’s Communist Party holds Fourth Plenum, day 4

- CSIA’s weekly solar wafer price assessment

- China Petroleum & Chemical International Conference in Ningbo, day 2

- EARNINGS: EVE Energy

Friday, Oct. 24:

- China’s weekly iron ore port stockpiles

- SHFE’s weekly commodities inventory, ~15:30

- China Petroleum & Chemical International Conference in Ningbo, day 3

- EARNINGS: Shenhua, Gotion, Goldwind, Tongwei, CMOC, Shandong Steel

©2025 Bloomberg L.P.