China’s Top Power Lobby Says It’s Ready for Winter Demand Surge

(Bloomberg) -- China’s electricity companies are confident that ample coal and gas supplies, and an abundance of renewables, will allow them to meet the usual end-year surge in demand without upset.

Power consumption growth in the fourth quarter is expected to increase at its fastest pace this year, thanks to a low base for comparison and improving economic conditions, the China Electricity Council said in a report on Monday. October has already seen coal consumption at power plants rise above historic trends due to prolonged heat in eastern megacities, according to a recent note from Morgan Stanley analysts including Hannah Yang.

Elevated heating needs over winter, along with air-con use in the summer, typically generate anxiety over whether China can deliver enough power to cope. Having pulled out the stops to bullet-proof supplies after widespread blackouts earlier this decade, the authorities have become more sanguine about the challenge.

Plentiful coal in particular should ensure supply, which is expected to be generally in balance with demand over the winter, although northern and eastern grids could see some tightness during peak hours, China’s top power lobby said in the report.

Power Mix

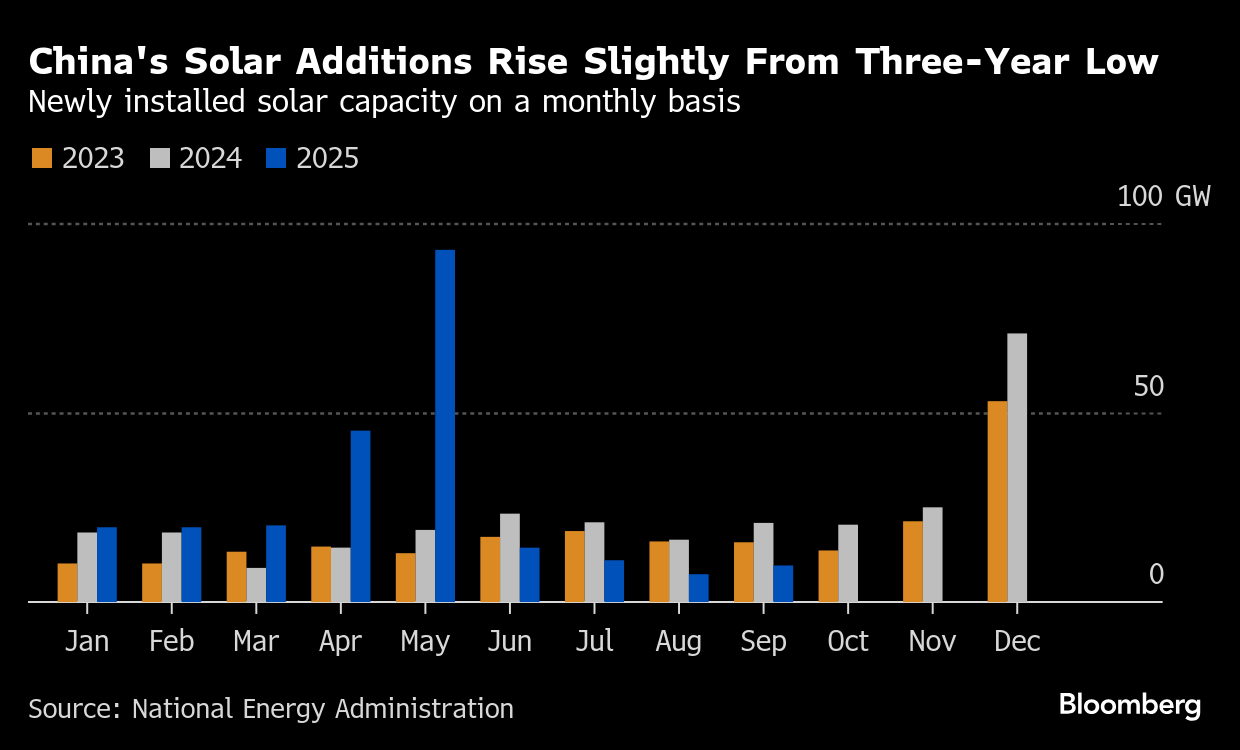

Clean energy is also becoming increasingly important. Accumulated wind and solar installations have already surpassed thermal power, and the expected addition of another 400 gigawatts this year would take their share to nearly 47% of China’s power mix, the council said.

New wind and solar generation have met nearly all of the increase in demand this year, with coal power falling 2.4% and hydropower also declining. The council’s forecast implies fourth-quarter installations will rebound to 99 gigawatts, after falling to just 38 gigawatts in the third quarter, following the adoption of new power market rules.

Even with the late-year surge in demand, total power consumption in 2025 should rise just 5%, the council said. That’s lower than its 6% forecast at the start of the year.

Manufacturing, which uses the most electricity, has seen relatively muted demand growth of 3.2% so far this year, although the high-tech industries favored by the government were nearly double that. At the other end of the scale, electric vehicle charging ballooned 45%, the council said.

On the Wire

Chinese and US trade negotiators have lined up an array of diplomatic wins for Donald Trump and Xi Jinping to unveil at a summit this week. Those easy hits are pleasing investors, but leave deeper core conflicts unresolved.

Dry-bulk shippers are watching to see when Beijing will resume purchases of US soybeans. The oilseed has been a flashpoint in the trade war with Washington, and China has yet to book a single shipment from the US for the new harvest season.

The European Union and China will hold talks this week to address trade disputes as Beijing’s restrictions on exports of key minerals and chips risk disrupting Europe’s auto industry.

This Week’s Diary

(All times Beijing)

Tuesday, Oct. 28:

- China international aluminum conference in Xian, day 1

- CMOC earnings webcast, 10:00

- EARNINGS: WH Group, Hesteel, Jiangxi Copper, Ganfeng Lithium, CGN Power, Sungrow

Wednesday, Oct. 29:

- China Nickel & Cobalt Forum in Lanzhou, day 1

- China silver conference in Wenzhou, day 1

- China international aluminum conference in Xian, day 2

- CCTD’s weekly online briefing on Chinese coal, 15:00

- CSIA’s weekly polysilicon price assessment

- EARNINGS: Sinopec, China Oilfield, Tianqi Lithium, Yunnan Energy, Jiangsu Shagang

- HOLIDAY: Hong Kong

Thursday, Oct. 30:

- China Nickel & Cobalt Forum in Lanzhou, day 2

- China silver conference in Wenzhou, day 2

- CSIA’s weekly solar wafer price assessment

- EARNINGS: PetroChina, Cnooc, Longi Green, Jinko Solar, Trina Solar, JA Solar, Xinte Energy, Yangtze Power, Three Gorges, GEM, China MCC, Baosteel, Angang Steel, Maanshan Steel, Anhui Conch, BYD, New Hope Liuhe, Cosco

- Cnooc earnings call at 17:00

Friday, Oct. 31:

- Commerce ministry to hold anti-dumping hearing on pork imports, 09:00

- China official PMIs for October, 09:30

- China Nickel & Cobalt Forum in Lanzhou, day 3

- China silver conference in Wenzhou, day 3

- China’s weekly iron ore port stockpiles

- SHFE’s weekly commodities inventory, ~15:30

Saturday. Nov. 1

- China removes a key platinum tax rebate among other VAT changes

- China silver conference in Wenzhou, day 4

©2025 Bloomberg L.P.