China’s New Weapon in US Trade Talks: Batteries

(Bloomberg) -- China’s newly announced raft of restrictions on the export of batteries could have major impacts on US companies, analysts say.

Beijing has previously used rare earths as a tool in the trade war with Washington. But with its commanding position in the battery industry, China has identified another point of leverage in trade talks as the US increasingly needs energy storage to support data centers and stabilize the grid.

The restrictions, which take effect Nov. 8, span a wide swath of the battery supply chain. They include large-scale lithium-ion batteries used for energy storage as well as cathode and anode materials and battery manufacturing machinery, all technologies where China has a robust lead.

As with past restrictions, the new rules require battery companies to receive licenses from the Chinese Ministry of Commerce before exporting their goods. That system allows Beijing to selectively weaponize exports.

“While it doesn't impact as wide a range of industries as other Chinese export controls, the dominance of China in battery supply chains means they can squeeze hard and it can be felt pretty quickly by US companies,” said Matthew Hales, an analyst specializing in trade and supply chains at BloombergNEF.

In the first seven months of 2025, Chinese grid-scale lithium-ion batteries accounted for about 65% of US imports, according to the most recent data available from BNEF. The export curbs would affect these types of batteries, analysts said.

Battery storage is critical for the US as energy demand surges, driven by the artificial intelligence boom. US data centers more than doubled their electricity consumption from 2017 to 2023, according to a report by the Lawrence Berkeley National Laboratory. That figure is expected to as much as triple by 2028, the report notes.

While China’s AI boom is constrained by access to advanced chips from the US, ”the energy demand piece is the constraint in the US for AI data center infrastructure,” said Emily Kilcrease, director of the Energy, Economics, and Security Program at the Center for a New American Security.

Large-scale batteries help store excess renewable energy and release it when electricity is needed. That can help avert blackouts and bolster grid stability. Practically non-existent a decade ago, US utility-scale battery installation reached a total of 26 gigawatts in 2024. In Texas alone, some 4 gigawatts of battery capacity — enough to supply power for around 3 million homes — went online last year.

As much as 136 gigawatts of new capacity is expected to be added across the country over the next decade, according to BNEF. Much of that supply will need to come from China and can’t be easily replaced by other countries, Hales said.

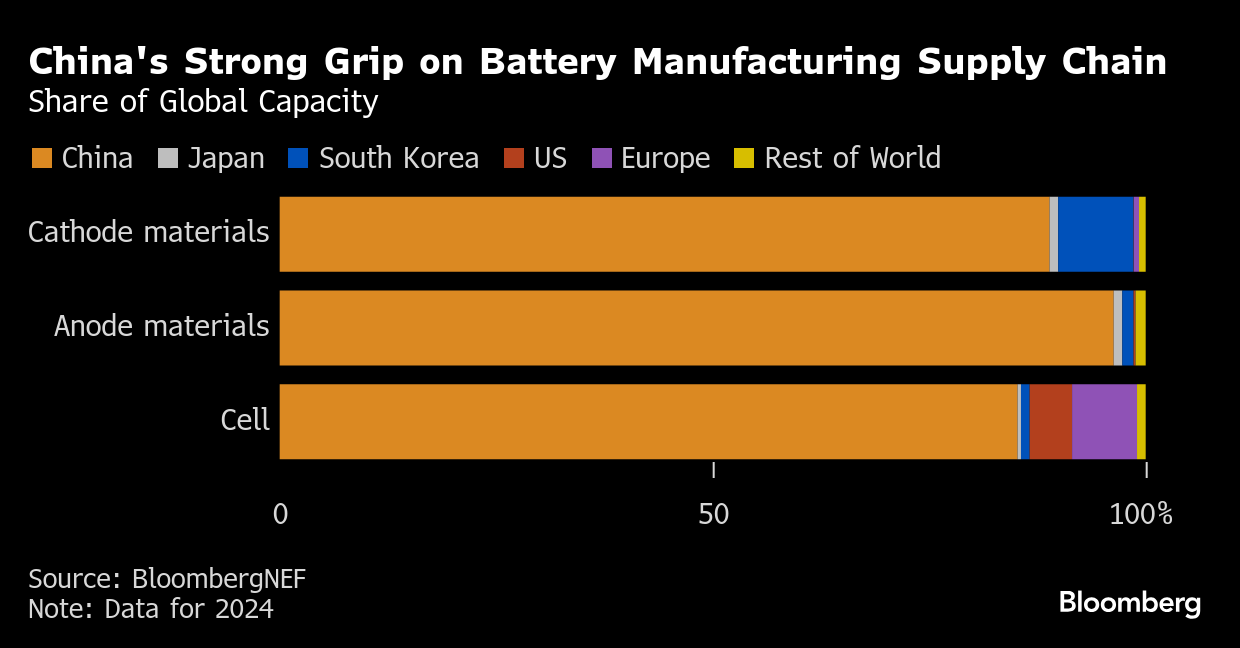

US battery manufacturing capacity has grown in recent years, but it can’t meet domestic demand for energy storage. Those factories will also be impacted by China’s new restrictions. The Asian nation controls about 96% of the world’s anode production capacity, according to BNEF, and 85% of its cathode capacity.

The inclusion of these key components in Beijing’s measures represents a “huge escalation,” because companies outside China are so reliant on them, said Cory Combs, head of critical minerals and supply chain research at the consultancy Trivium China.

“A lot of the battery factories that have been going up in the Southeast, they’re all going to be impacted by this — this is their raw material stream,” said Celina Mikolajczak, a battery executive who oversaw battery manufacturing for Tesla Inc. and Panasonic Corp.’s Nevada gigafactory.

Battery company Fluence Energy Inc.’s stock dropped more than 12% on Friday, the most since Aug 12, while Tesla shares fell 5%. Both companies rely in part on Chinese battery components.

The policy actions by China “add another layer of complexity to an already tight global supply chain and underscore the importance of accelerating domestic innovation,” said Denis Phares, the chief executive officer of Dragonfly Energy Corp., a battery manufacturer with an assembly plant in Nevada. The company is “actively working to reduce reliance on Chinese-sourced components as part of our long-term plan,” he said.

Export controls could also put China’s multibillion-dollar battery industry in the crossfire. In the face of overcapacity domestically, Chinese companies have become increasingly reliant on overseas markets, making it “unclear how China intends to enforce its new regime,” said Bryan Bille, a researcher on policy and geopolitics at Benchmark Mineral Intelligence.

There’s also another complicating factor: Analysts view China’s measures not only as a crucial source of leverage in trade negotiations, but also as a means to maintain its competitive edge.

“I think they've been very explicit about not wanting to give away core technologies,” said Ilaria Mazzocco, senior fellow focused on the Chinese clean energy industry at the Center for Strategic and International Studies. “I think they really are angling to become the leading power in this industry for decades to come.”

How much China ultimately decides to wield its battery leverage will likely depend in part on the outcome of trade talks. China allowed for the reinstatement of rare earth shipments to the US after reaching a deal with President Donald Trump’s administration in June.

Trump and President Xi Jinping were expected to meet in South Korea later this month to broker a new trade deal. But in response to China’s latest barrage of controls, Trump said there was “no reason” to attend the meeting and threatened to impose an additional 100% tariff on China in a series of social media posts on Friday.

©2025 Bloomberg L.P.