Green Investors Enjoy Huge Returns as Stock Market Powers Through Trump’s Attacks

(Bloomberg) -- A dramatic rebound in clean-tech stocks has investors in the green economy hoping they can finally turn the page on years of punishing underperformance.

The timing is somewhat unexpected. Even as President Donald Trump has canceled many US government programs dedicated to boosting wind, solar and electric vehicles, green stocks have become one of this year’s most lucrative bets.

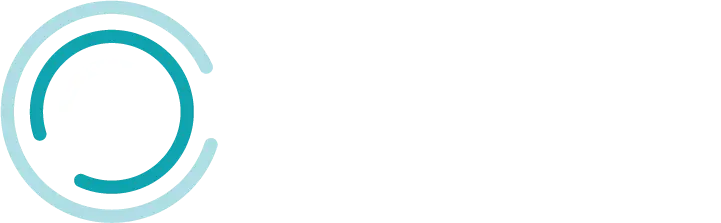

Those equities have significantly outpaced most other stock indexes. The S&P’s main gauge tracking clean energy is up about 50% this year; the MSCI World Index has gained less than 20% in the same period.

Much of that development is pegged to a near-insatiable demand for energy to power the data centers feeding artificial intelligence. It also reflects China’s relentless drive to build out its low-carbon economy. For investors, those factors have outweighed Trump’s attacks on what he often calls the “green scam.”

Analysts at Jefferies have seized on the moment to declare this the “glory days” for green investors, even dedicating an entire client event to the idea.

Aniket Shah, global head of sustainability and transition strategy at Jefferies, says investors have been too distracted by Trump’s anti-green rhetoric in the US. Instead, they should look at the global level of capital piling into clean technologies: the $2 trillion dedicated to low-carbon spending last year is an “insane number” that indicates the green economy is enjoying a “wonderful moment,” according to Shah.

He points to a whole array of factors, including the stunning ascent of China’s green economy and its clean-tech exports to the developing world. And then there are the so-called hyperscalers driving AI, such as Amazon.com Inc., Microsoft Corp. and Alphabet Inc.’s Google, all of which Shah says is “very much a sustainability story.”

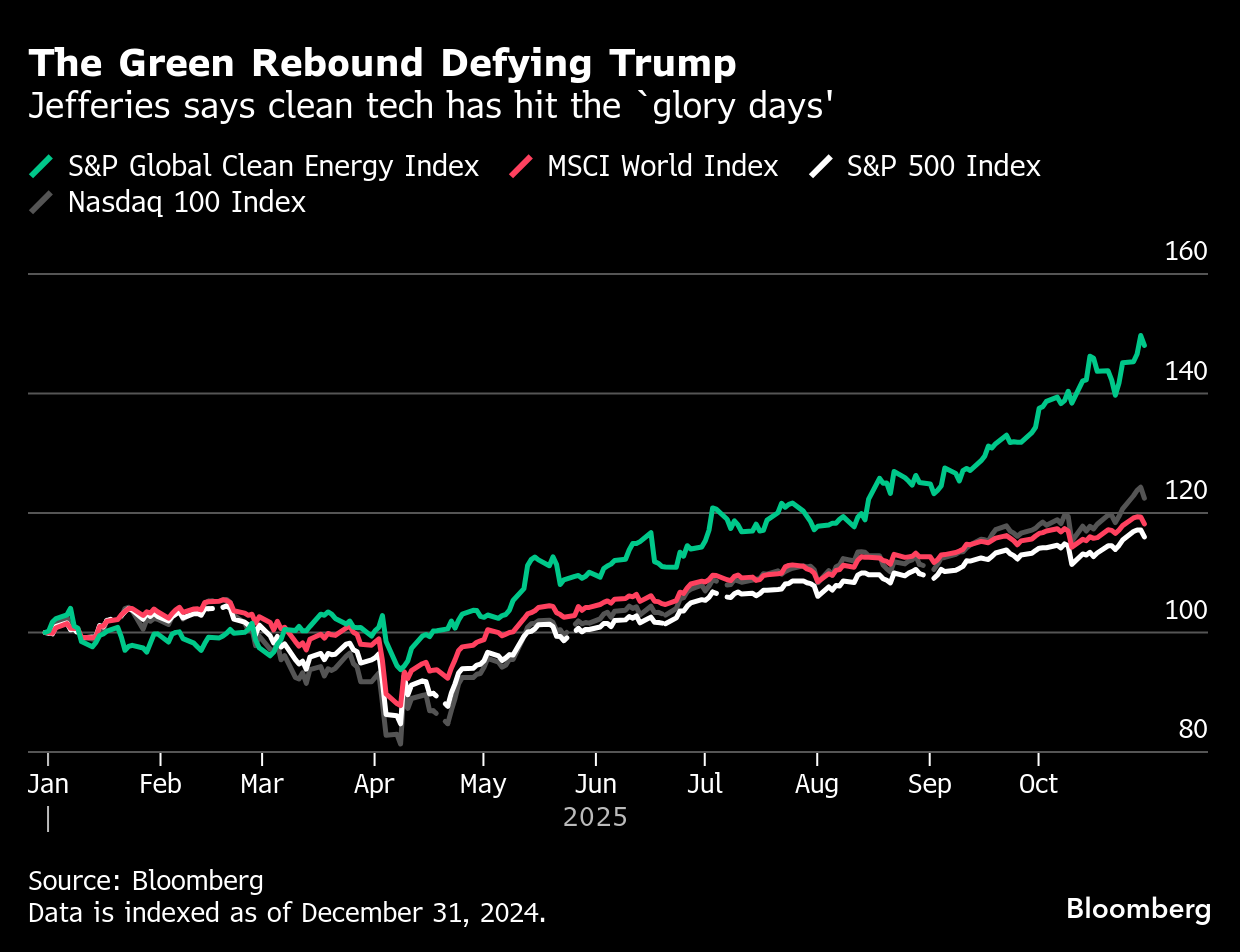

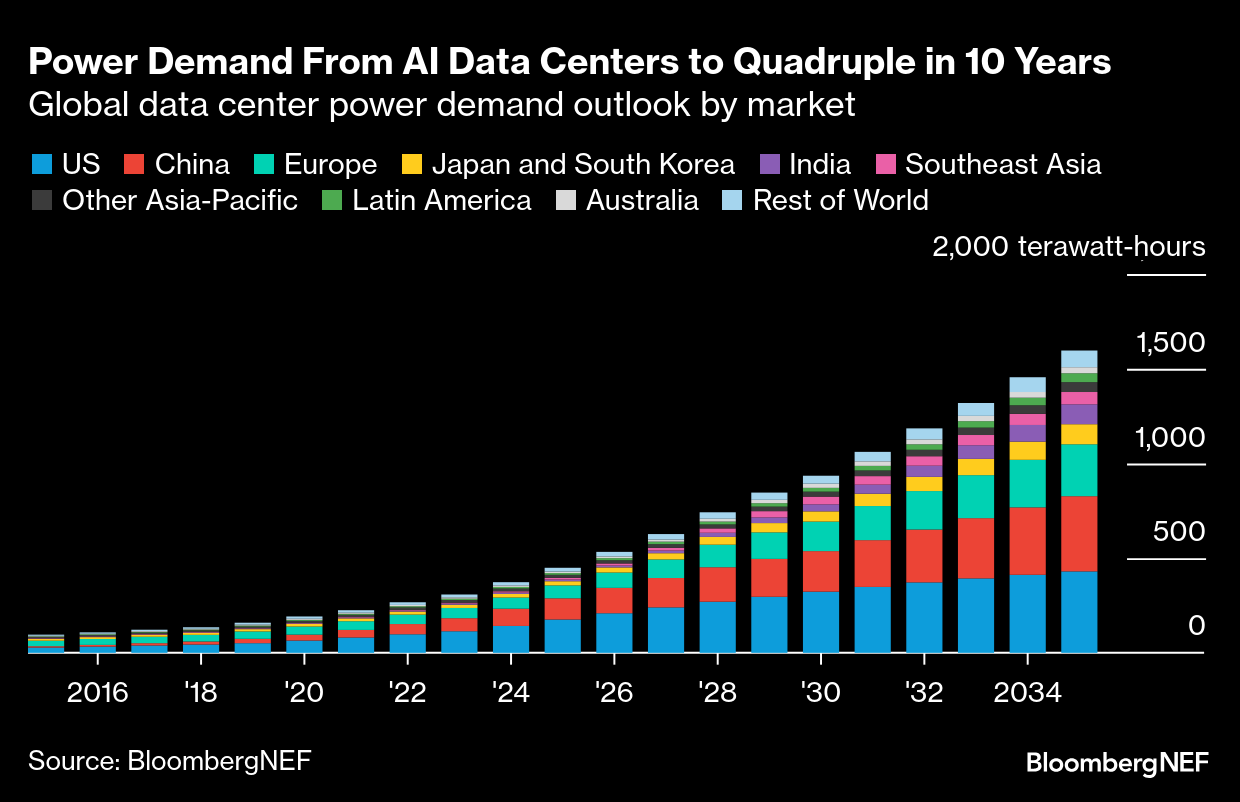

The new mood of euphoria among green investors also comes with a layer of irony, however. Electricity demand tied to AI is on track to quadruple within a decade, and though renewables will play a huge role in powering that development, fossil fuels will also be a big part of the mix, pumping up emissions in the process, according to BloombergNEF.

So as world leaders prepare to gather at the COP30 climate summit in Brazil, Shah says it’s important to acknowledge that even with this year’s green rebound, the planet is on track to miss not only the critical temperature threshold of 1.5C, but also 2C. “You have to keep both of those stories in your mind at the same time,” he said.

But not all investors are convinced the green stock rally is solid. And some worry that too much of it is tied to AI, around which bubble speculation persists.

Renaud Saleur, founder and chief executive of Anaconda Invest, a Geneva-based boutique hedge fund that specializes in the energy sector, says some of the stocks that have outperformed are “not really the quality ones.”

He also questions whether the insatiable energy needs of the data centers powering AI can ever be met. “The extra demand for AI is impossible to fuel,” Saleur says. The end game will be “a lot of disappointment.”

Tim Bachmann, a climate-tech portfolio manager at the fund management unit of Deutsche Bank AG, DWS, says investors should be prepared for another “Deepseek moment,” referring to the Chinese startup that stunned the world earlier this year after it unveiled a low-cost, energy efficient version of AI.

The idea that it might be possible to power AI with considerably less energy than assumed in the US was “a shock not only in the data-center operators, but also in the suppliers of cooling, ventilation equipment, cables, transformers,” Bachmann said.

Deirdre Cooper, head of sustainable equity at Ninety One Plc, says the Anglo-South African asset manager is being “careful to avoid the hype” around parts of the green rally. It’s clear that some clean-tech stocks have been “caught up in the speculative end of the AI trade,” she says.

And Alex Monk, a portfolio manager for the global resource equities team at Schroders, says the alternative energy sector would likely be dragged down by a bursting AI bubble, along with the wider market.

At the same time, he also notes “it was really interesting during the DeepSeek moment,” because the sustainable energy sector actually “held up relatively well compared to maybe some of the more baseload power-type parts of the utility scale space and power demand space.”

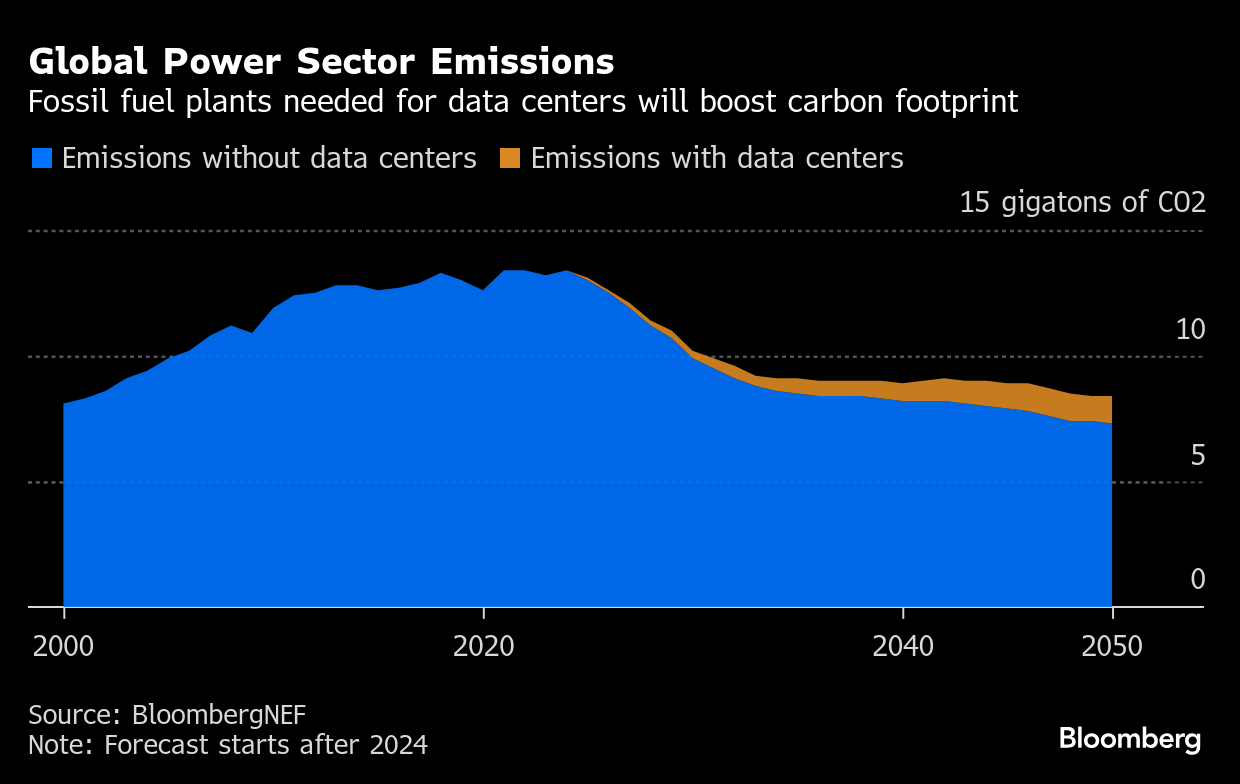

The best-performing stock in the S&P Global Clean Energy Transition Index is Bloom Energy Corp. The company, which makes solid-oxide fuel cell systems that can generate electricity where it’s needed, is up almost 500% this year.

Bloom Energy, which agreed in July to provide on-site power to Oracle Corp.’s AI data centers, is planning to double its manufacturing capacity by the end of 2026 to meet demand. And with the construction of new power plants proving slow, combined with a shortage of gas-fired turbines, Bloom’s fuel cells – which have a deployment time as short as 90 days – have generated considerable interest.

“Their product is very much tailored and levered to the whole AI data center demand dynamic,” said Christopher Dendrinos, an analyst at RBC Capital Markets. “That has been a huge driver for the stock,” Dendrinos said.

And because Bloom Energy’s fuel cells are — for now, at least — largely powered by natural gas, they actually benefit from Trump-administration incentives that didn’t exist under the Biden administration.

But others urge caution. Analysts at Bank of America Corp. say Bloom Energy’s “fundamentals don’t justify” its share price gains, according to a September note sent to clients.

Michael Tierney, Bloom’s head of investor relations, says the company’s valuation is based on both strong anticipated demand for electricity and an improving financial condition, including revenue that’s expected to climb more than 30% this year to almost $1.9 billion.

“We’re not a startup anymore,” he said. “We have a significantly better balance sheet than in the past.” Tierney says that positions Bloom Energy for sustained growth, which is attracting investors.

Many investors in green stocks will still remember seeing the sector sink at the end of the pandemic. And even after this year’s rebound, clean-tech equity indexes are far off the highs of 2020 and 2021, when interest rates were at crisis lows and Covid-19 lockdowns stifled demand for traditional sources of energy.

But this rally feels different, according to some of the biggest asset managers investing in the sector.

Natalie Adomait, chief operating officer for Brookfield’s renewable power and transition unit, says demand for low-carbon energy sources to power AI is strong, “not only because they’re cheap and abundant, but critically because they’re quick to bring online.”

Brookfield Asset Management recently announced it had raised $20 billion for the world’s biggest private fund dedicated to the clean-energy transition. And Brookfield just agreed to invest as much as $5 billion to deploy the fuel cells of Bloom Energy at new data centers that operate AI.

Inside BlackRock Inc., there’s a view that the green rebound could even withstand an AI bubble.

“We don’t correlate any potential ‘AI bust’ as an existential risk to sustainable energy equities,” BlackRock’s Charles Lilford, a portfolio manager who helps oversee one of the asset manager’s flagship actively managed sustainability funds, told Bloomberg. “Sustainable energy equities could stand to even further benefit as US rates come down and we see a broadening out of the market.”

Among money managers predicting a near-limitless need for energy to power data centers is Apollo Global Management, whose outgoing chief sustainability officer says the demand gap “will not be closed in our lifetime.”

Even in the US, where Trump’s anti-green sentiment dominates policy, low-carbon energy sources look to be emerging as a popular bet for powering data centers. And Trump’s One Big Beautiful Bill has proved less punitive for US solar and wind than many investors initially feared. The upshot is that demand for clean energy won’t necessarily be powered by ideological views on climate change, but by the economic benefits.

“If you’re offering green electrons to a company, they can be agnostic as long as you can promise the delivery of the electricity when they need it,” says Timothy Ho, European utilities and renewables analyst at Amundi SA, Europe’s biggest asset manager.

Trump’s policies remain “quite challenging” for certain renewable energy segments such as residential solar projects, says Joseph Osha, an analyst at Guggenheim Securities. So the huge gains in some clean-tech stocks are best explained as a “recognition that the business can survive,” he says.

For example, after triple-digit percentage gains this year, both SunRun Inc. and SolarEdge Technologies Inc. are “still trading at a fraction of their historic highs,” Osha says.

Amundi’s Ho says the green sector should still be treated with some caution.

Investors need to be aware that “sometimes, when you have these broad thematic flows, you can detach a bit from valuations,” he says. And that means markets “can end up detaching a bit from fundamentals, at least temporarily.”

(Adds Schroders comments in 14th paragraph, BlackRock in 29th.)

©2025 Bloomberg L.P.