BlackRock Manager Says AI Bust Won’t Derail Clean-Tech Bets

(Bloomberg) -- Investors worried that artificial intelligence bets look too frothy shouldn’t assume the clean-tech companies powering AI would be trapped in the same bubble, according to a portfolio manager overseeing one of BlackRock Inc.’s flagship actively managed sustainability funds.

“We don’t correlate any potential ‘AI bust’ as an existential risk to sustainable energy equities,” BlackRock’s Charles Lilford told Bloomberg. “Sustainable energy equities could stand to even further benefit as US rates come down and we see a broadening out of the market.”

The comments come amid concerns that the vast amounts being spent on expanding AI may overstate its potential to make money. Such fears have led to speculation that any Big Tech correction would also drag down the alternative energy companies supplying AI data centers.

But according to Lilford, who co-manages BlackRock’s $4.2 billion BGF Sustainable Energy Fund, the clean-tech sector is strong enough to withstand such a shock. He says the irreversible spread of electrification, as well as lower interest rates, are among key factors driving green energy.

The bigger picture is that the “age of electrification is upon us,” he said. “This isn’t just about AI and data-center capex.”

The extent to which there’s a bubble brewing in AI is one of the biggest questions in financial markets today. Last week, investors got a glimpse of just how much Big Tech is spending on AI growth. Quarterly reports released by Alphabet Inc., Meta Platforms Inc. and Microsoft Corp. showed that the three together saw capital expenditures rise $78 billion, representing an 89% increase from a year earlier.

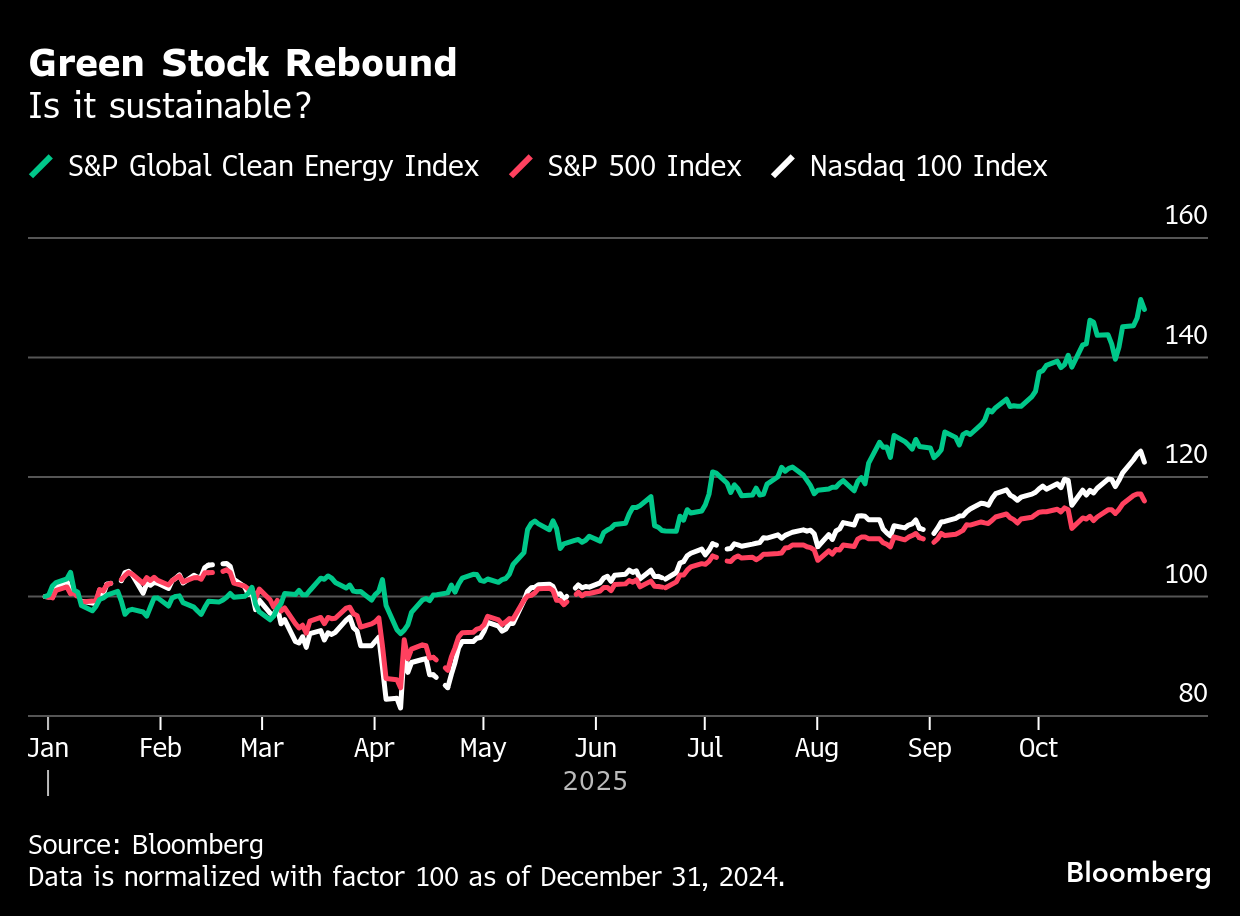

As Big Tech invests heavily in data centers, clean-tech companies have enjoyed a rebound in valuations thanks to skyrocketing demand for energy. The S&P Global Clean Energy Transition Index is up about 50% this year, outpacing the Nasdaq 100 Index and roughly on par with gains in spot gold prices.

The BGF Sustainable Energy Fund that Lilford helps oversee includes First Solar Inc., NextEra Energy Inc., SSE Plc and Vestas Wind Systems A/S among its biggest holdings, according to data compiled by Bloomberg. The fund is up 32% this year, and Lilford says that even after recent sector gains, clean tech remains broadly undervalued.

“Many sustainable energy equities, which typically trade at premiums to world markets, remain cheap relative to historical levels,” he said.

At BlackRock, “we see numerous long-term structural tailwinds driving increased power demand and a greater need for grid and electrical infrastructure,” Lilford said. “Much of this will be addressed by the adoption of clean energy technologies and infrastructure solutions. This provides a fundamental and structural opportunity for sustainable energy equity investments.”

It’s a view that’s been described by analysts at Jefferies as the “glory days” of the green rebound. Aniket Shah, global head of sustainability and transition strategy at Jefferies, says investors should look at the global level of capital piling into clean technologies: the $2 trillion dedicated to low-carbon spending last year is an “insane number” that indicates the green economy is enjoying a “wonderful moment,” according to Shah.

Lilford also suggests that investors initially overreacted to the Trump administration’s decision to wind back the Inflation Reduction Act. He says it’s worth noting that President Donald Trump’s so-called One Big Beautiful Bill “extends key IRA tax credits through 2030,” which “provides the market with energy policy clarity” for the rest of the decade.

“Our increasingly more constructive outlook on sustainable energy valuations over the medium to long term have been further underpinned following the establishment of greater clarity on US energy and tax policy, along with the continued favorable energy policy environment in Europe,” Lilford said.

(Adds Jefferies comment in 11th paragraph.)

©2025 Bloomberg L.P.