Top Thai Wind Power Firm to Fund $2 Billion of Spending With IPO

(Bloomberg) -- Thailand’s largest wind power producer plans to spend 65 billion baht ($2 billion) to almost triple its generation capacity over the next 12 years, and will go public to fund the expansion.

Wind Energy Holding Co. Ltd. is targeting 2,000 megawatts of domestic installed capacity by 2037, from the current 700 megawatts, Chief Executive Officer Nuttpasint Chet-Udomlap said in an interview in Bangkok. It’s also exploring projects in the Philippines, he said.

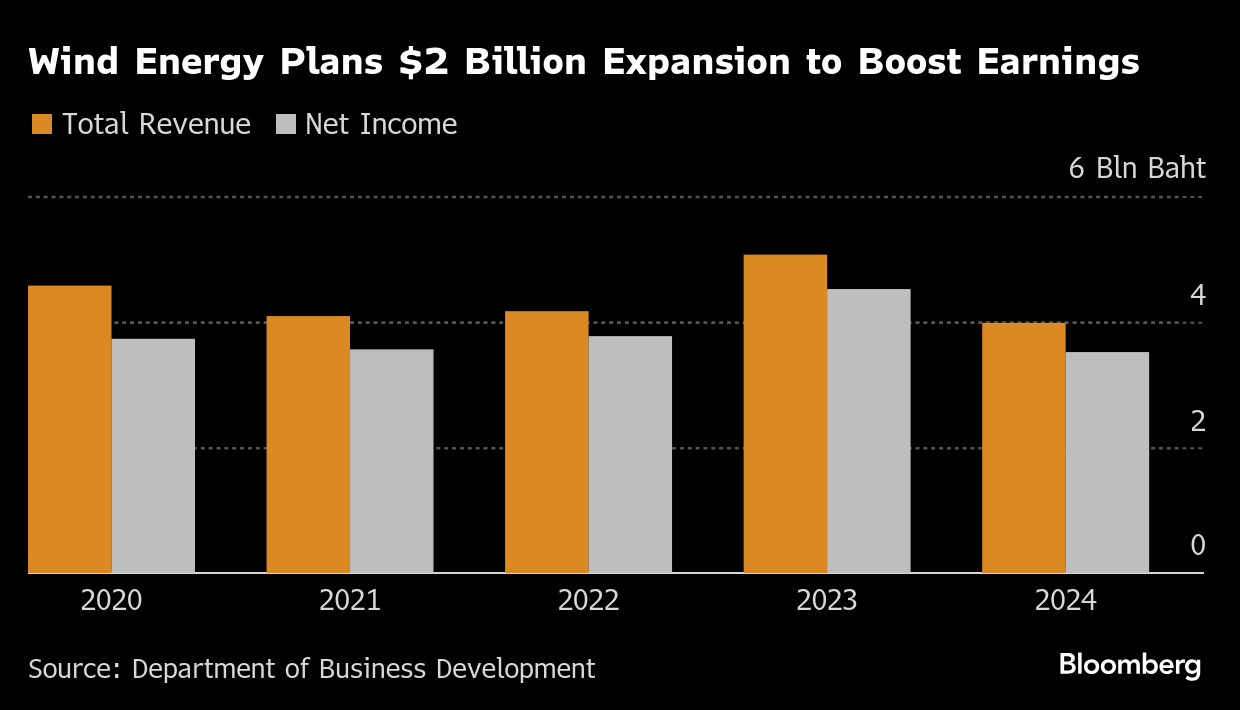

The closely held company will fund its growth with an initial public offering on the Thai exchange, although that’s currently in limbo while it resolves a legal issue, according to Nuttpasint. Wind Energy’s net income and revenue both fell by more than a fifth in 2024.

The wind generator’s expansion plan dovetails with the Thai government’s goal of adding around 16,000 megawatts of renewable power capacity, including atomic energy, from 2026 to 2037. That would take clean power in Southeast Asia’s No. 2 economy to more than a third of the total, up from 23% last year.

“Our expertise and specialist in wind energy will boost our leverage in the coming bids for the new projects,” Nuttpasint said. Wind Energy has acquired land and secured vendors to prepare for the government’s new auctions, he said.

Nopporn Suppipat, who founded the company in 2006, won a ruling in the UK court in 2023 to recover more than $800 million over allegations he faced political pressure and was forced to sell his stock at a massive discount. Wind Energy has also had to go to a Thai court regarding its dividend payout in relation to those shares.

The company will proceed with the IPO as soon as those disputes are settled, Nuttpasint said. He said he was closely following legal proceedings in Thailand, but had little knowledge about the progress of the court case in the UK.

Outside of China, the wind industry has struggled in recent years due to rising costs for materials like steel and cement. Annual additions outside China fell to 36 gigawatts last year, the lowest since 2019. The sector may rebound in 2025, with ex-China installations expected to rise 44%, according to BloombergNEF.

©2025 Bloomberg L.P.