Saudi Arabia’s Mega Neom Hydrogen Project Faces Demand Risk

(Bloomberg) -- The world’s largest green hydrogen project being built in Saudi Arabia’s Neom is facing an uncertain future as it struggles to find international buyers for the fuel.

All of the hydrogen from the project was originally intended for export as green ammonia, but with only one committed buyer lined up, it is shifting focus to local consumers to fill the gap, according to people with knowledge of the matter. But demand is still uncertain within the kingdom, and plans are under consideration to slow the full development of the facility, they said.

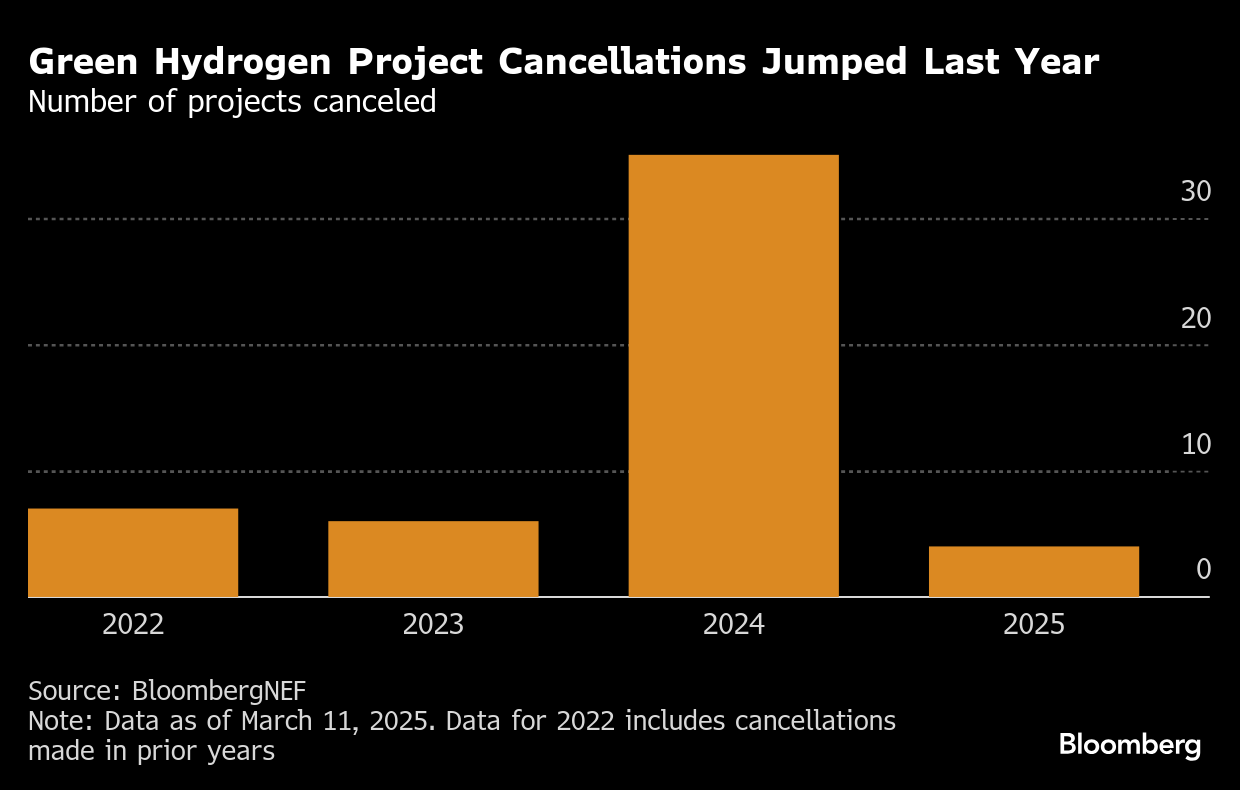

The $8.4 billion project is the latest example of the challenges facing green hydrogen — a fuel billed as critical for net zero — because of a lack of buyers. The Saudi facility, with financing approved and without the bureaucratic delays that have beset projects elsewhere, was one of the few expected to succeed as co-developer Air Products & Chemicals Inc. had committed to buying the entire output and selling it onward to end users.

But it has yet to find customers for more than half of the supply, people familiar with the situation said, asking not to be named because the matter is not public.

Should the project eventually be scaled down, it would also be another setback for Neom, the centerpiece of Saudi Crown Prince Mohammed Bin Salman’s multitrillion-dollar plan to transform the economy. The kingdom has already curtailed some spending for Neom, amid a ballooning budget deficit and rising debt levels.

The Neom facility is an equal joint venture between Neom, Air Products and Acwa Power Co., the Saudi renewable energy firm backed by the sovereign wealth fund. The project website says the intention is to commission the plant next year with the capacity to produce as much as 600 tons of green hydrogen a day. It plans to use power from 4 gigawatts of renewables plants.

Air Products said the facility is progressing well, and expects to start commissioning electrolyzers once renewable power units are completed by mid-2026, and sees products available in 2027. Neom referred a request for comment to the companies building the project. Neom Green Hydrogen Co. and Acwa Power didn’t reply to requests for comments.

Rising Cost

The project was one of the few green hydrogen ventures that was meant to go on full steam, even with costs rising from $5 billion initially to $8.4 billion when financial close was reached two years ago. Pennsylvania-based Air Products had signed a deal last year to sell 70,000 tons of fuel a year — equivalent to around one-third of the intended project output — to TotalEnergies SE between 2030 and 2045.

But no other buyers have been secured yet, people familiar with the matter said.

Another route to potential customers was sending some volumes to Air Products’s receiving terminals in Europe, but the company has since opted to delay investments in these facilities, incoming Chief Executive Officer Eduardo Menezes said on a call with analysts on May 1.

“In the near term, we are focused on completing construction and selling clean ammonia” from Saudi Arabia “until hydrogen regulations are fully developed,” Air Products said in a statement. “And we will delay investment in downstream facilities in Europe until specific regulatory frameworks are clear for each country and we have firm customer commitments.”

Green hydrogen, made by using renewable electricity to split water molecules, has been promoted as a potential solution to cut emissions from just about anything that currently relies on coal or natural gas, such as steel production, shipping and even home heating. But the uneconomic cost of production has forced multiple developers to scrap plans, leaving the sector struggling.

In response to the challenges, the developers are considering building the Neom project in smaller chunks, with investment dispersed only after offtake agreements have been signed, people familiar with the plan said. But doing so would be challenging as major parts of the project have already been built, one of the people said.

Local demand is also uncertain as large projects, including the city of Neom, is still under construction. Green hydrogen could be used to make other clean fuels, but there’s no certainty of the market for such products either.

New Company

Beyond Neom, Saudi Arabia had intended to spur investment in green hydrogen production through a new company that would facilitate multibillion-dollar investments in the sector. But that was scrapped before it was even officially announced, according to people with knowledge of the plans.

But hydrogen remains a part of Saudi strategy as it intends to use the fuel to remain a major energy supplier to the world even as economies looked to favor cleaner fuels in a bid to combat climate change.

Earlier this year, Acwa signed a memorandum of understanding with German company SEFE to supply 200,000 tons of the fuel a year by 2030. Acwa also recently partnered with Baker Hughes Co. to advance green hydrogen production. It’s unclear how or if those developments will eventually relate to Neom.

Separately, the kingdom has cut back on plans to make blue ammonia — produced from natural gas where carbon dioxide is captured in the process — citing low international demand. On an investor call in March, Saudi Aramco CEO Amin Nasser said the company wouldn’t start building any projects without offtake agreements in place.

(Updates with renewables capacity in the sixth paragraph.)

©2025 Bloomberg L.P.