Microsoft Signs Major Carbon-Removal Deal With Montag’s Rubicon

(Bloomberg) -- Microsoft Corp. has agreed to finance the extraction of 18 million tons of carbon dioxide from the atmosphere, in what’s set to be one of the largest-ever purchases of carbon removal credits.

The cloud computing and AI behemoth has entered into an agreement with Rubicon Carbon, a company run by former Bank of America Corp. executive, Tom Montag, and backed by TPG Inc.’s Rise Climate fund. The deal entails delivery of carbon credits generated from projects that sequester CO2 by planting trees or restoring degraded land, according to a statement on Thursday.

Pulling vast quantities of carbon from the atmosphere will be essential if the planet is to have a chance of avoiding catastrophic levels of overheating. That’s driving a wave of startups who are exploring a range of techniques to draw down CO2. For Big Tech, it’s a solution that’s increasingly relevant as the development of AI brings with it an insatiable thirst for energy.

The partnership with Microsoft, for which no financial details have been disclosed, is Rubicon’s biggest transaction since it was established 2 1/2 years ago.

Montag, who sits on the board of Goldman Sachs Group Inc., said in an interview that now is a “good time” to do a “transaction of such size.”

Worldwide, capacity for removing carbon from the atmosphere is currently just a fraction of what scientists say is needed. Startups keen to fill that hole are exploring techniques ranging from what’s known as direct-air capture to so-called bio-energy with carbon capture and storage (BECCS) and biochar.

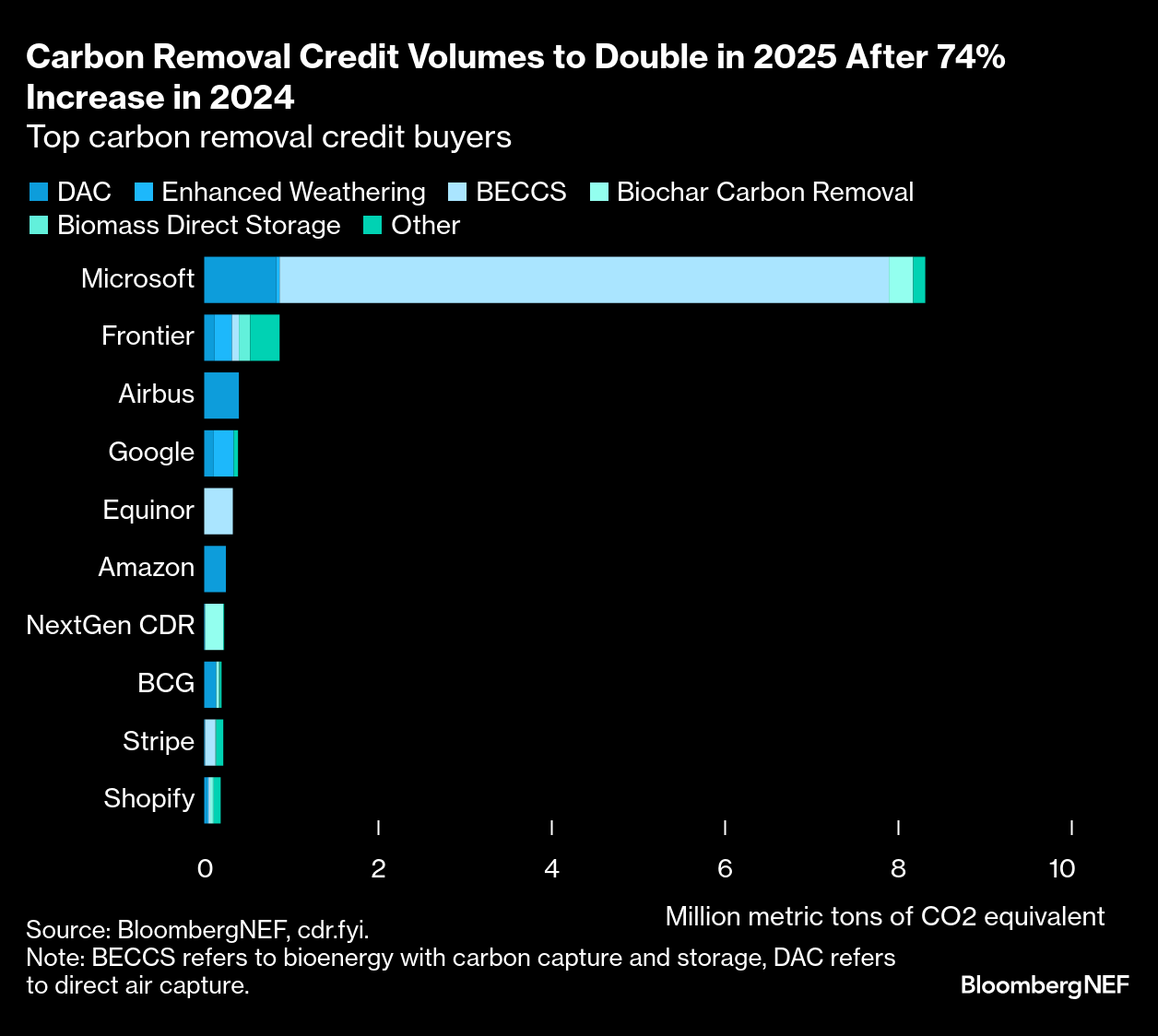

Microsoft, which has said it wants to be carbon negative by 2030, was an early supporter of the carbon removal industry, signing several deals across a variety of technologies. The company is also the largest investor in removal credits, having purchased more than 20 million tons across its portfolio, according to the industry tracker cdr.fyi.

“This deal signals the long-term demand for carbon removal necessary to mobilize infrastructure-grade investment and world-class execution,” said Brian Marrs, senior director of energy and carbon removal at Microsoft.

Anne Finucane, who chairs Rubicon’s board and was formerly vice chairman at Bank of America, says the nonprofits that have shaped how the carbon market has evolved in recent years have “provided very good frameworks for integrity.”

“But any market mechanism conceived in that way is unlikely to take hold and scale, because it doesn’t follow the tenets of the financial services industry,” she said in an interview. “The financial markets need to step in now” and carbon credits “can be a real market solution.”

Montag said he hopes the deal between Rubicon and Microsoft will help the carbon market attract more investors. Transactions with 15-year offtake agreements may be particularly well-suited to infrastructure investors, he said.

Montag is among a group of prominent Wall Street figures promoting offsets on what’s known as the voluntary carbon market, which BloombergNEF expects to expand to more than $1 trillion by 2050. The offsets market has struggled to gain traction, however, after a series of setbacks.

“The voluntary carbon market is still small,” and is “not growing as fast as we would like,” Montag said.

The 18 million ton deal would be almost three times the size of the next largest sale of carbon removal credits in cdr.fyi’s database, though that data doesn’t cover reforestation projects. Meanwhile, a Microsoft deal with startup Chestnut Carbon to provide 7 million tons of credits from tree planting in the US, and a separate transaction for 8 million credits with BTG Pactual Timberland Investment Group, appear to be the largest deals to date in the market for nature-based removals before the Rubicon transaction.

In its agreement with Microsoft, Rubicon will source credits from a variety of afforestation, reforestation and revegetation projects worldwide. The company plans to conduct due diligence, quality assurance and ongoing monitoring on credits. Projects that get selected will also need to meet Microsoft’s science and quality criteria.

Each transaction will be structured to deliver credits over a 15- or 20-year period, with the first due for delivery around 2027, Montag said.

The goal is to “bring scale and expertise into a market that could use it,” he said.

©2025 Bloomberg L.P.