Australia Dials Back Forecast for Natural Gas Shortfall in South

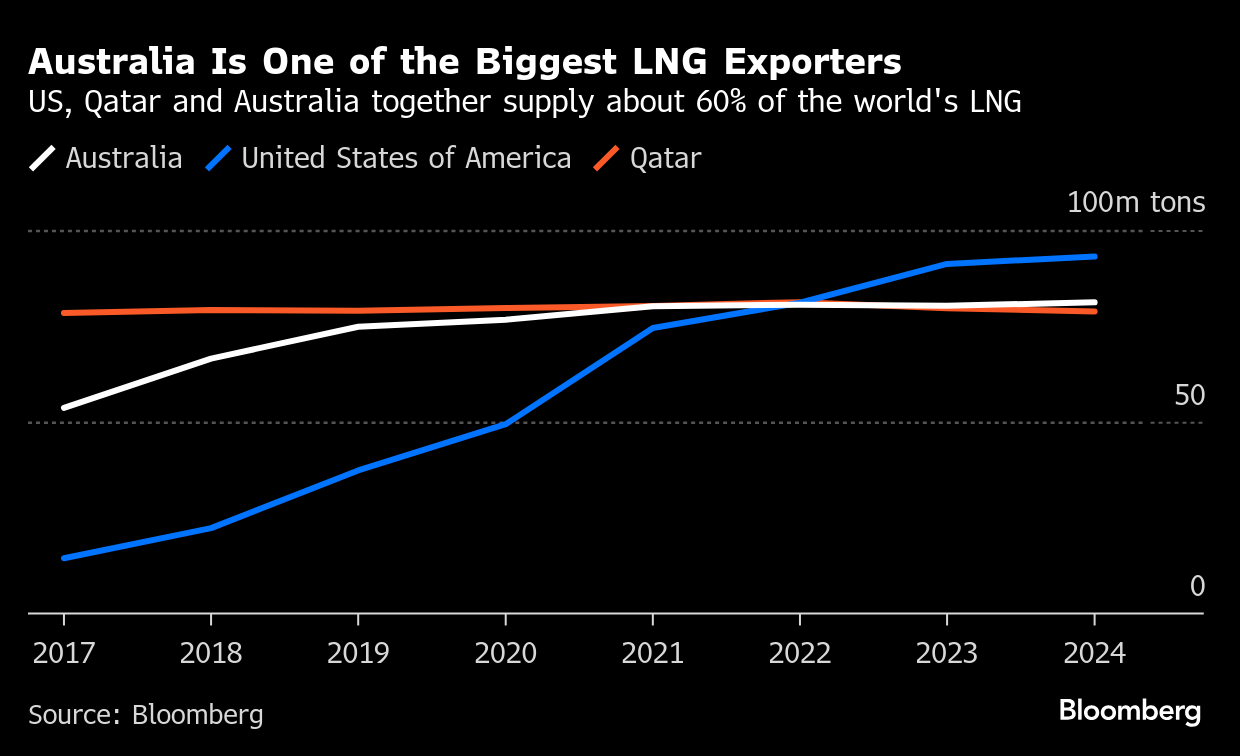

(Bloomberg) -- Australia, one of the world’s biggest natural gas exporters, has pushed back forecasts for anticipated shortfalls in some of its most populated regions as consumption declines.

The southern states and territories, which contain about two-thirds of the population, could see shortages in extreme winter conditions from 2028, three years later than expected a year ago, the Australian Energy Market Operator said in its annual Gas Statement of Opportunities report.

The reprieve is because factory closures are reducing consumption, while more households are turning to electrification, the grid operator said. It’s also partly the result of a two-year delay in the closure of Australia’s largest coal-fired plant, which will reduce the need for gas generation, AEMO added.

There is a risk of annual supply gaps from 2029 in New South Wales, Victoria, South Australia, Tasmania and the Australian Capital Territory, as supply in the region is forecast to fall 29%, according to the report. That will require new investment, especially as gas-powered generation will play a critical role as the nation transitions rapidly from aging coal plants to renewable sources and electricity demand rises, it said.

“Production is falling faster than demand in the southern states, reinforcing the need for investment in new gas supply,” AEMO Chief Executive Officer Daniel Westerman said. “Investment could include new production, storage, transportation, and liquefied natural gas regasification terminals, or a combination of these solutions.”

A venture between Exxon Mobil Corp. and Woodside Energy Ltd. earlier this week said it had approved further drilling in the Bass Strait between mainland Australia and Tasmania that is expected to start production before the winter of 2027. That has helped improve the supply outlook from 2027, AEMO said.

Meanwhile, companies including billionaire Andrew Forrest’s Squadron Energy, Viva Energy Group and Royal Vopak NV have proposed LNG import terminals, which could also alleviate supply concerns over the long term.

©2025 Bloomberg L.P.