US Biofuel Makers Are Stuck in a Slump While Waiting for Trump Policy

(Bloomberg) -- The White House is gearing up to finally announce its new rules on biofuel blending, critical support for the industry that’s underpinned American farming over the past two decades. But for some producers of diesel made from soybeans, the move won’t be enough to rescue them from a months-long downturn that’s led to plant closings and layoffs.

In Iowa, Western Dubuque Biodiesel LLC currently only has sales booked through August instead of the typical 21 months in advance. Houston-based Renewable Biofuels Inc., owner of the country’s biggest plant making the soy-heavy fuel, is running at less than 30% capacity — and at a loss. And just this week, biodiesel firm Hero BX, based in Pennsylvania, was forced to go up for sale after it had slashed production down to zero and defaulted on a loan.

“Margins are very compressed,” said Aluizio Ribeiro, president of Incobrasa Industries Ltd., a biodiesel maker and soy processor with a facility in the No. 1 soybean-growing state of Illinois. The plant expects to make about a third less fuel this year.

Across the US heartland, biodiesel makers have been thrown into chaos awaiting rules from the Trump administration that will determine their profit outlook. And while fresh blending mandates are set to be released soon, the timeline is still unclear for an even bigger piece of outstanding policy — this year’s replacement of a federal tax credit that had helped to keep the industry afloat.

“The uncertainty is a great problem in the market,” Ribeiro said.

Tax Credit Policy

At issue is a Biden-era fuel production credit that’s known as 45Z for its Internal Revenue Service code. The credit rewards companies that produce and transport fuels with lower emissions. Soybean oil, along with growers of the legume, have historically benefitted from similar subsidies, with the commodity used to produce biodiesel. The Biden administration punted on finalizing 45Z, and the industry has been awaiting guidance from President Donald Trump on what comes next.

Biofuel policy proved tricky for Trump in his previous term. At the time, traditional fuelmakers found themselves at odds with biofuels, with a federal blending mandate dividing the two traditionally right-leaning sectors of energy and agriculture. Since then, the rivalry has partly faded as more fossil fuel companies started pumping out products made from corn and soybeans, America’s two biggest crops. Even then, the old tensions can flare, and that may be part of the reason behind delays from the Trump administration over new policy. Rules for biodiesel can be particularly wrought since under the Biden administration the tax credit became an avenue for advancing the larger green agenda that Trump has sought to unwind.

In the meantime, US production of biodiesel has plummeted. Data from the Energy Information Administration shows that output in the first quarter plunged more than 30% from the same period a year ago. And farmers, in turn, are planning to plant about 4.1% fewer soybean acres this year than last, according to initial estimates from the US Department of Agriculture. Soy futures traded in Chicago are down about 9% in the past 12 months, also hit by US-China trade tensions.

“It really comes back to profitability for us here on farms,” said Greg Anderson, who grows mainly soybeans on his family plot in Nebraska.

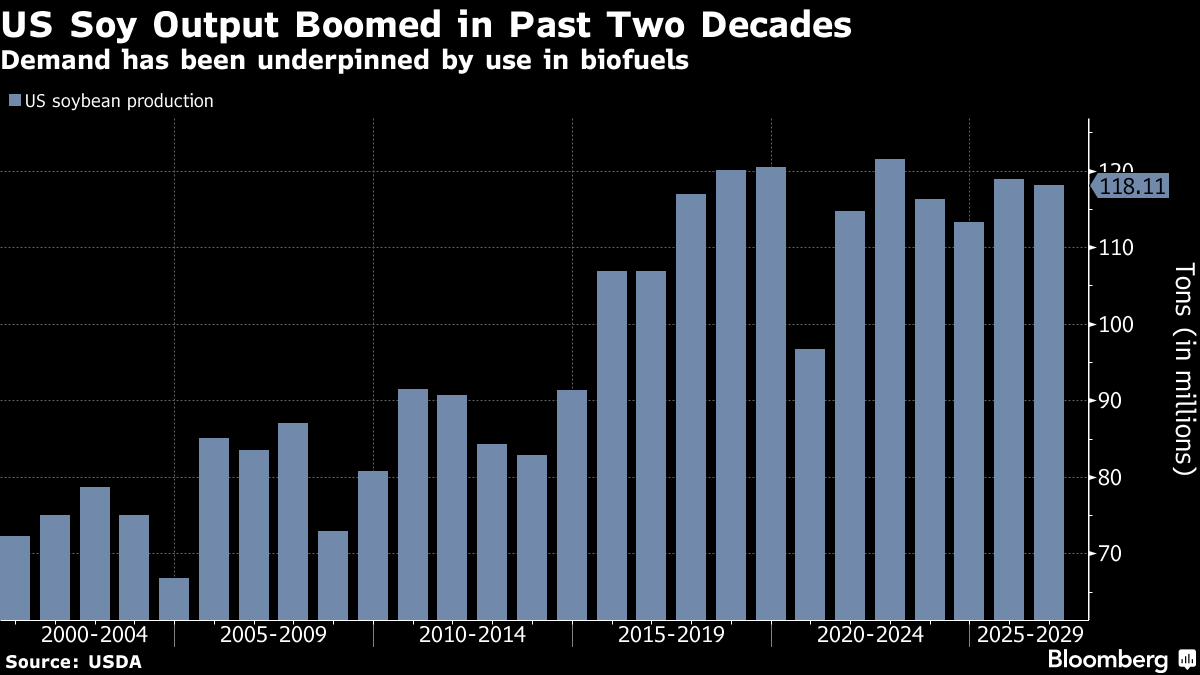

The industry woes are a long way from the optimism of two decades ago, when biodiesel began to take off after struggling soybean growers in need of new markets helped create a nationally mandated fuel. US production of soybeans has roughly doubled since 2004 as demand grew for the crop’s use as a so-called feedstock in fuel making.

At the moment, tax legislation making its way through Congress deals with 45Z, but it’s far from clear whether potential changes will end up being more beneficial to farmers and soybean processors or to makers of traditional fossil fuels.

“The math just doesn’t work anymore for plants to make biodiesel,” said Joe Jobe, former head of the industry’s main lobby, Clean Fuels Alliance America, and who now heads an organization that advocates for makers of the fuel, Sustainable Advanced Biofuel Refiners.

While the policy chaos has hurt some other biofuels, it is biodiesel that’s been the most at risk. That’s especially true as the industry has faced increased competition from makers of renewable diesel, a similar product that’s now overtaken biodiesel in production terms.

“It’s been really tough, and then you have a couple of these big renewable diesel players coming online who are able to pay more for feedstocks,” said Chris Peterson, president of Hero BX. “Everything is lining up to where this is going to be Big Soy and Big Oil, and all the independents are just going to disappear.”

©2025 Bloomberg L.P.