China’s Solar Industry Gathers as Gloom Deepens Over Demand

(Bloomberg) -- China’s despondent solar manufacturers face a new threat — an imminent drop-off in demand for their products that’s likely to heap pressure on an already oversupplied market.

Investors will have an opportunity to gauge the industry’s underlying mood amid the glitz of the world’s biggest solar fair in Shanghai this week. The conference and exhibition kicks off on Tuesday and typically attracts hundreds of thousands of visitors.

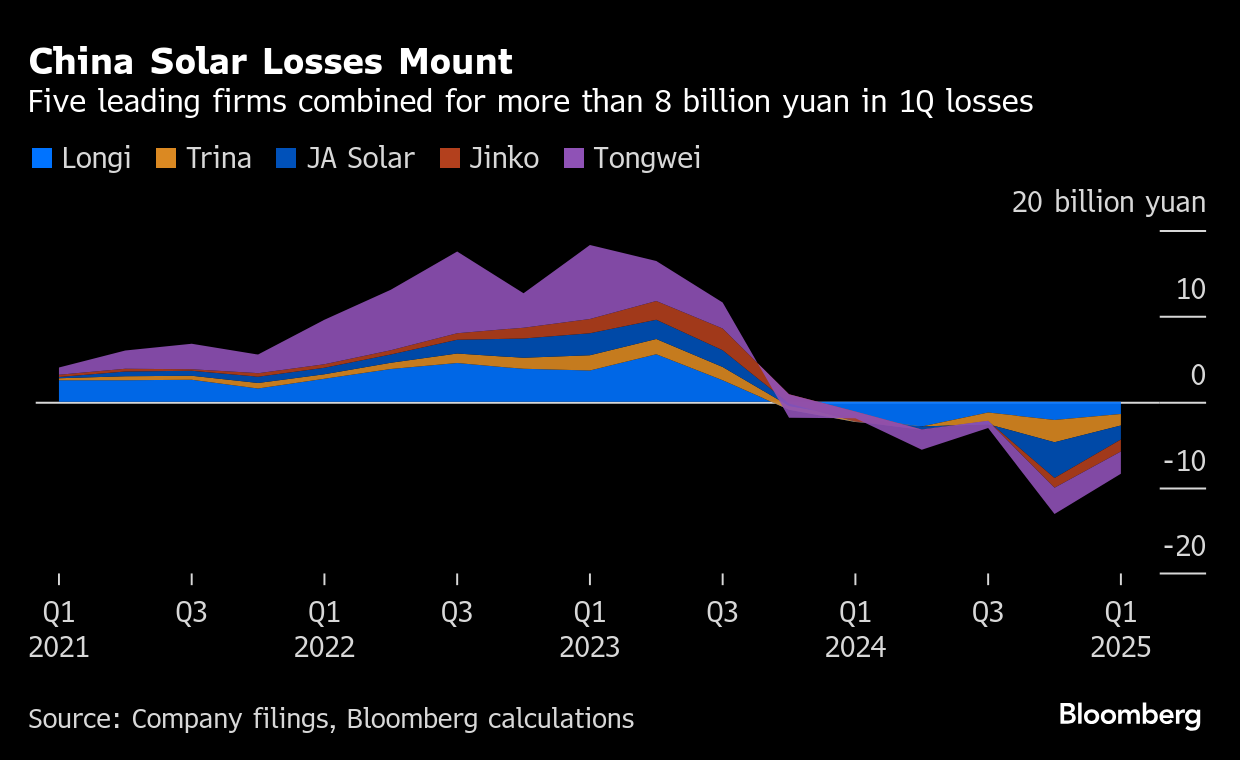

The solar industry’s record growth in China masks some brutal economics confronting equipment makers. Margins have collapsed as fierce competition forces them to sell at a loss. Mounting protectionism is choking off exports. Those circumstances will become even more difficult to navigate once a policy-driven rush to install panels in China peters out in the second half of the year.

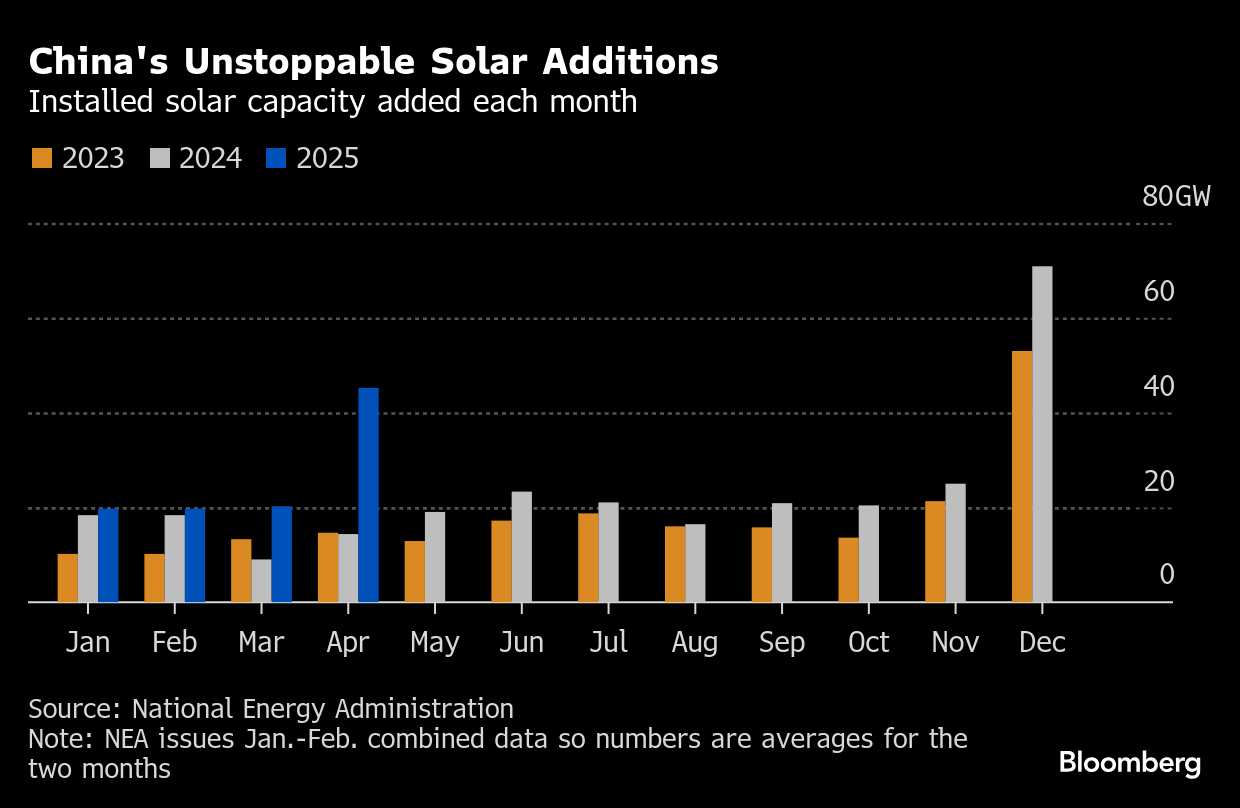

In April alone, China installed about 45 gigawatts of solar power, more than triple the amount in the same month last year. It brings the country’s total to just a few gigawatts shy of one terawatt, roughly half the world’s total.

That surge wasn’t driven by real demand, though. Instead, developers front-loaded projects to lock in more favorable conditions before two new policies took effect.

The first, beginning in May, restricts rooftop installations in particular, an area of rapid growth in recent years. The second, which came into effect earlier this month, removes price protections for generators and forces them to compete for buyers on the open market at a time when electricity supplies are ample.

“Once the current boom ends, the outlook for China’s solar industry in the second half remains deeply uncertain,” Trivium China said in a note last month, which cast doubt on whether the record pace of expansion can be maintained.

Equipment makers might struggle to recognize those boom conditions, in any case, after building too much capacity to effectively reap the rewards. Their profitability has been declining for the past two years. Five of the biggest names - JA Solar Technology Co., Jinko Solar Co., Longi Green Energy Technology Co., Tongwei Co. and Trina Solar Co. - reported a combined loss of over 8 billion yuan ($1.1 billion) in the first quarter.

There’s probably worse to come as the developers that buy their panels scale back in coming months. Citigroup Inc. expects installations to slow to 90-95 gigawatts in the second half, from 155-160 gigawatts in the first, according to a note last month.

The industry’s response to its problem with overcapacity has so far been piecemeal. Last year’s Shanghai event was preceded by belt-tightening, including job losses and production halts. At the end of the year, some companies initiated a program of self-discipline to manage supply. The possibility of output cuts among suppliers again surfaced in May.

China’s solar sector has shied away from more decisive action because the longer-term policies underpinning its growth remain intact. The government’s commitment to renewables to meet its climate targets is undimmed. Beijing has made upgrading the grid to handle more clean energy a priority. Market-based pricing and cheaper solar should help displace other power sources.

Although the third quarter may prove particularly bleak, construction could rebound later in the year once developers have had time to assess local implementation of the government’s new pricing rules, said BloombergNEF analyst Zhao Tianyi. Additionally, installations should pick up in the fourth quarter as developers rush to meet deadlines for the utility-scale mega-projects under construction in the interior, she said.

For all of the industry’s travails, BNEF is still forecasting year-on-year growth in solar installations of 9% to 302 gigawatts. But executives at the conference were under no illusions about the struggles ahead.

“Overcapacity remains a Sword of Damocles hanging over our heads,” said Zhu Gongshan, chairman of GCL Technology Holdings Ltd. “The second half of this year to the first quarter of next year is a crucial window period for the supply-side reform of the photovoltaic industry. We need to work together to push the industry onto a high-quality development path.”

On the Wire

China’s natural gas producers are lobbying Beijing to increase the number of power plants that run on the fuel, in a bid to help prop up faltering demand.

Copper smelters in China are planning to export spot cargoes to take advantage of higher international prices, putting the spotlight on a tightening global market, shifting stockpiles and concerns over tariffs.

Trade talks between the US and China will continue into a second day, according to a US official, as the two sides look to ease tensions over shipments of technology and rare earth elements.

China is tapping an often overlooked pool of funds worth 10.9 trillion yuan ($1.5 trillion) to salvage its housing sector, offering people an alternative to bank mortgages.

When the world’s two biggest economies go head-to-head, collateral damage is inevitable — just ask China’s petrochemicals executives.

This Week’s Diary

(All times Beijing)

Tuesday, June 10:

- SNEC PV+ solar and smart energy conference & exhibition in Shanghai, day 1

- Coaltrans China in Beijing, day 1

Wednesday, June 11:

- SNEC PV+ solar and smart energy conference & exhibition in Shanghai, day 2

- Coaltrans China in Beijing, day 2

- CCTD’s weekly online briefing on Chinese coal, 15:00

- CSIA’s weekly polysilicon price assessment

Thursday, June 12:

- SNEC PV+ solar and smart energy conference & exhibition in Shanghai, day 3

- Coaltrans China in Beijing, day 3

- China’s monthly CASDE crop supply-demand report

- CSIA’s weekly solar wafer price assessment

- EARNINGS: Chow Tai Fook

Friday, June 13:

- SNEC PV+ solar and smart energy conference & exhibition in Shanghai, day 4

- China’s weekly iron ore port stockpiles

- Shanghai exchange weekly commodities inventory, ~15:30

(Updates with comment from GCL Tech’s chairman in last paragraph)

©2025 Bloomberg L.P.