Senate Pulls All-Nighter on Trump Tax Bill With GOP Divided

(Bloomberg) -- Senate Republican leaders continue to scrounge for votes to pass Donald Trump’s $3.3 trillion tax and spending bill as lingering intraparty fights threaten to upend the legislative centerpiece of the president’s domestic agenda.

Senators voted through Monday night and into Tuesday morning on a series of amendments to the massive bill, including proposed energy and health care provisions that could further fan the flames of division in a party split over cuts to social safety-net programs, clean energy tax credits from the previous administration and the overall cost of the bill.

There are currently eight major Republican holdouts, and Senate Majority Leader John Thune can afford to lose only three senators and still pass the measure. Two — Rand Paul of Kentucky and Thom Tillis of North Carolina — have said they are solidly against it, leaving very little room for error as the South Dakota Republican tries to get to 50 votes on the package.

Winning Paul’s vote would require removing the $5 trillion debt ceiling increase in the bill and risking a US payment default as soon as August.

Trump, leaving the White House Tuesday morning, expressed optimism, telling reporters “I think we’re going to get there. It’s tough. We’re trying to bring it down, bring it down so it’s really good for the country.”

Treasury Secretary Scott Bessent, who has been heavily involved in the negotiations, predicted on Fox News that the Senate would approve the legislation by Tuesday afternoon.

Before the Senate even gets to an up-or-down vote on the legislation, lawmakers must work their way through dozens of amendments, the vast majority of which will fail. But the outcome of some of these votes will test Trump’s limits as a dealmaker and could ultimately determine the fate of his bill.

“The Republicans are still in disarray,” Senate Democratic Leader Chuck Schumer told reporters Monday.

One amendment on artificial intelligence, however, passed with overwhelming bipartisan support. Senators voted 99-1 early Tuesday to strip a measure that would have prevented US states from regulating AI. That marked a setback for technology companies and Trump allies in Silicon Valley who had pushed for a regulatory pause of the nascent technology.

Clean Energy

A group of Senate Republicans is pushing to soften an aggressive planned phase-out of subsidies for wind and solar projects under Trump’s tax-and-spending package.

The amendment being circulated by Republican Joni Ernst of Iowa would also do away with a proposed new excise tax the Senate bill would slap on wind and solar projects that use components from China and other “foreign entities of concern.”

Ernst’s language, supported by key holdout Lisa Murkowski of Alaska, broadly seeks to ease requirements governing which wind and solar projects can qualify for a clean electricity tax credit created under the 2022 Inflation Reduction Act.

Under the current version of the Senate bill, qualifying projects would have to be placed in service by the end of 2027 to qualify.

The Ernst amendment would shift to a more lenient timetable tied to the start of construction, allowing projects to qualify for at least some of the credit as long as they begin construction in 2026 or 2027.

If adopted, however, the change could displease fiscal conservatives who have insisted on the more stringent requirements to qualify for the tax credits. The chamber’s leadership has focused on getting Murkowski’s vote with long conversations on the Senate floor.

Rural Hospitals

Democrats, angered by the Medicaid cuts in the bill, voted to defeat an amendment from Republican Susan Collins of Maine that would have doubled the rural hospital fund in the bill to $50 billion, in exchange for a tax increase on some of the highest-earning Americans.

Many rural lawmakers are concerned that the Medicaid cuts, if enacted, would force hospitals in sparsely populated areas to close even with the new dedicated aid fund.

Ron Wyden, the top Democrat on the Senate Finance Committee, equated Collins’ amendment to “a band aid on an amputation.” Her amendment would have increased the top tax rate on individuals earning more than $25 million in a year to 39.6%.

Medicaid Cuts

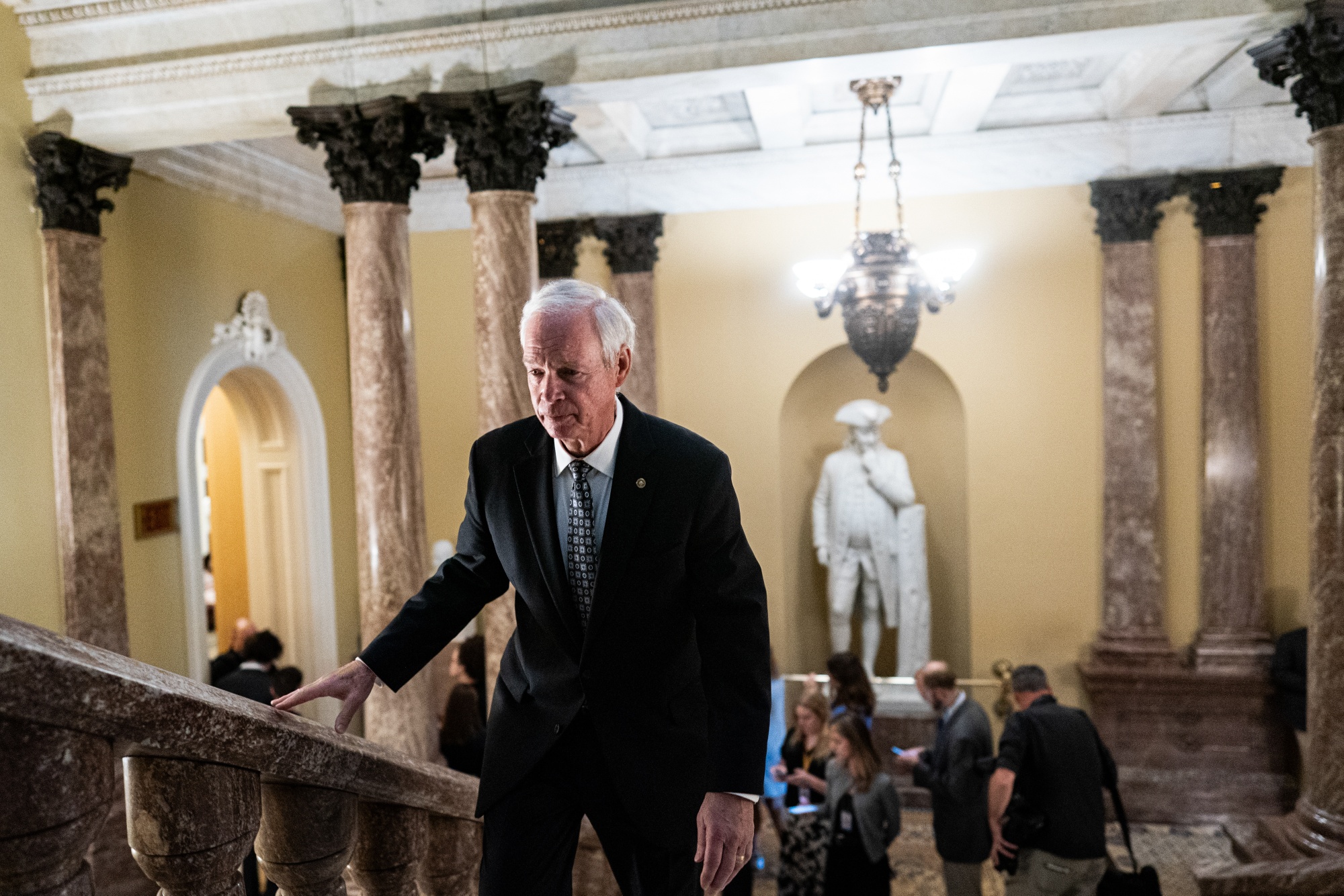

A group of conservatives including Ron Johnson of Wisconsin, Cynthia Lummis of Wyoming, Rick Scott of Florida and Mike Lee of Utah are offering an amendment to roll back the expansion of Medicaid under President Barack Obama’s Affordable Care Act.

Thune told reporters he’d back the amendment but said he couldn’t guarantee it would pass.

If it fails, it remains unclear how this block of conservatives will vote on final passage. And if it passes, it could spark a rebellion from moderates like Collins and Murkowski.

‘Wraparound’ Amendment

As leaders continue to twist arms on the bill itself, they also need to ensure they have enough votes on a final “wraparound” amendment tweaking the legislation ahead of a vote on final passage.

Part of the calculus is to strip language that could threaten the bill’s odds in the House, which is planning to vote on the Senate measure later this week. The House’s own version of the bill passed by a single vote.

The Senate’s deeper Medicaid cuts — which caused Tillis to defect — will put pressure on swing-district Republicans, while Freedom Caucus hardliners are angry that the Senate bill would create larger deficits than the House-passed measure.

At least one New York Republican — Representative Nick LaLota — has said he’d vote against the bill over a compromise on the state and local tax deduction that he says doesn’t do enough to deliver savings to his district. LaLota had supported the House measure.

Yet so far, unlike in 2017, Trump has been able to corral his party at the end, with only a few willing to buck the pressure to vote for his signature legislation.

(Updates to add Trump, Bessent remarks.)

©2025 Bloomberg L.P.