EU’s $750 Billion Energy Deal With Trump Looks Hard to Reach

(Bloomberg) -- The European Union’s promise to buy $750 billion of American energy imports over three years was pivotal to securing a trade deal with President Donald Trump, but it’s a pledge it will struggle to keep.

The deal would require annual purchases of $250 billion of natural gas, oil and nuclear technology, including small modular reactors, according to EU officials. European Commission President Ursula von der Leyen said the bloc’s estimates were based on the existing plan to shift away from remaining Russian fossil fuel supplies and purchasing “more affordable and better” liquefied natural gas from US producers.

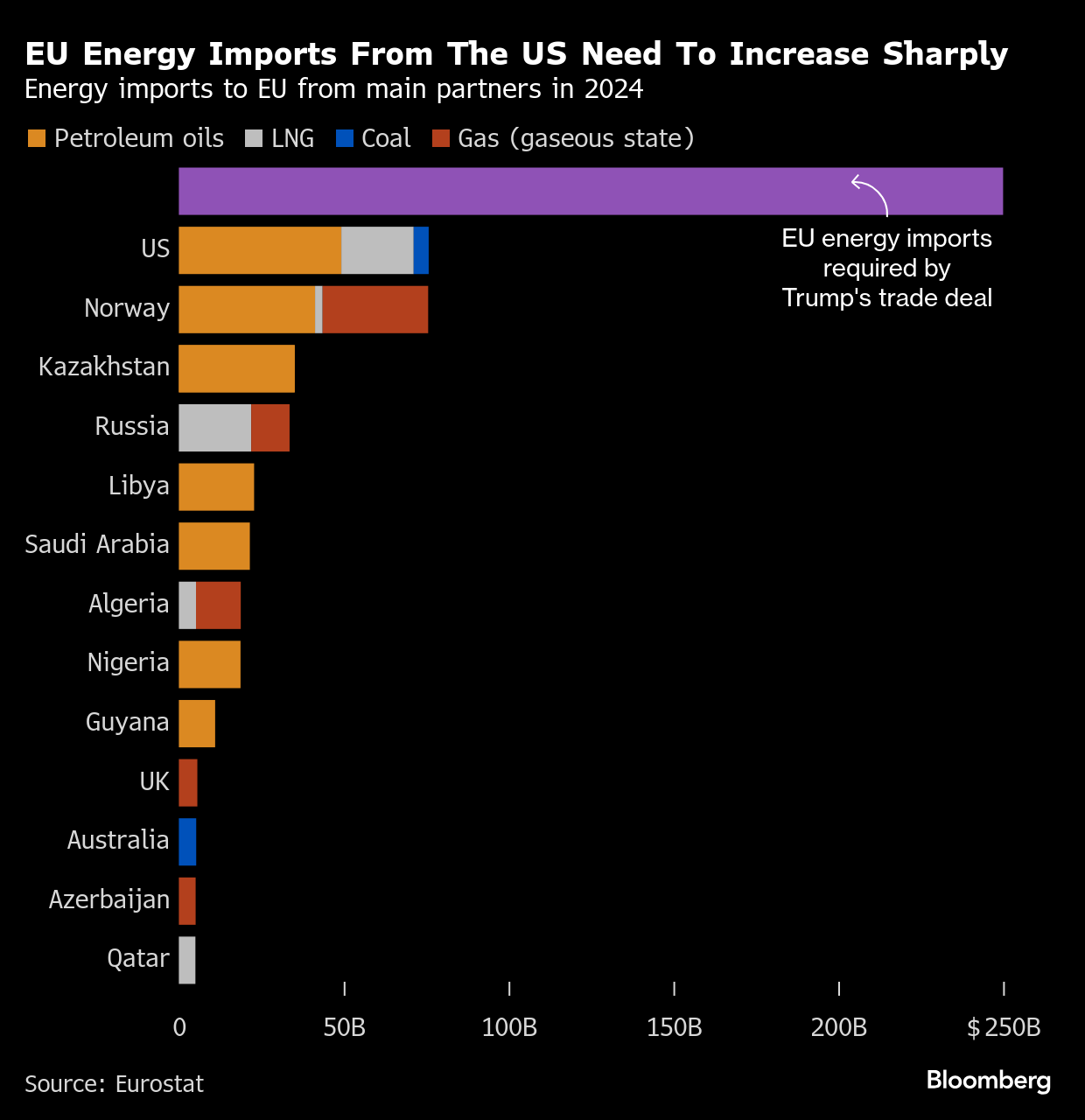

Yet it’s hard to see how the EU attains such ambitious flows over such a short time frame. Total energy imports from the US accounted for less than $80 billion last year, far short of the promise made by von der Leyen to Trump. Total US energy exports were just over $330 billion in 2024.

The huge figure for energy imports “is meaningless, as it’s unachievable not only because EU demand cannot grow that much, but also because US exporters cannot supply that much either!” said Davide Oneglia, an economist at TS Lombard.

The lack of detail underlines that the deal finalized by von der Leyen and Trump in Scotland is a pragmatic, political agreement, rather than a legally binding pact.

The EU has yet to provide a breakdown of the figures, and it remains unclear how private companies can be convinced to purchase or sell US oil and gas. There’s also uncertainty around how European investment in the US energy sector might count toward the EU’s pledge.

Deals on nuclear, particularly for so-called small modular reactors, may be one way the EU sees to spur billions of dollars of trade, yet the first ones are not expected to be commercially viable before 2030 at the earliest. Encouraging such investment may also be seen at odds with trying to promote its domestic nuclear industry.

“We believe these numbers are achievable,” Maros Sefcovic, EU trade commissioner, said at a press conference in Brussels, where he also highlighted the “nuclear renaissance” taking place in Europe. “That’s the offer. We are ready to go for those purchases.”

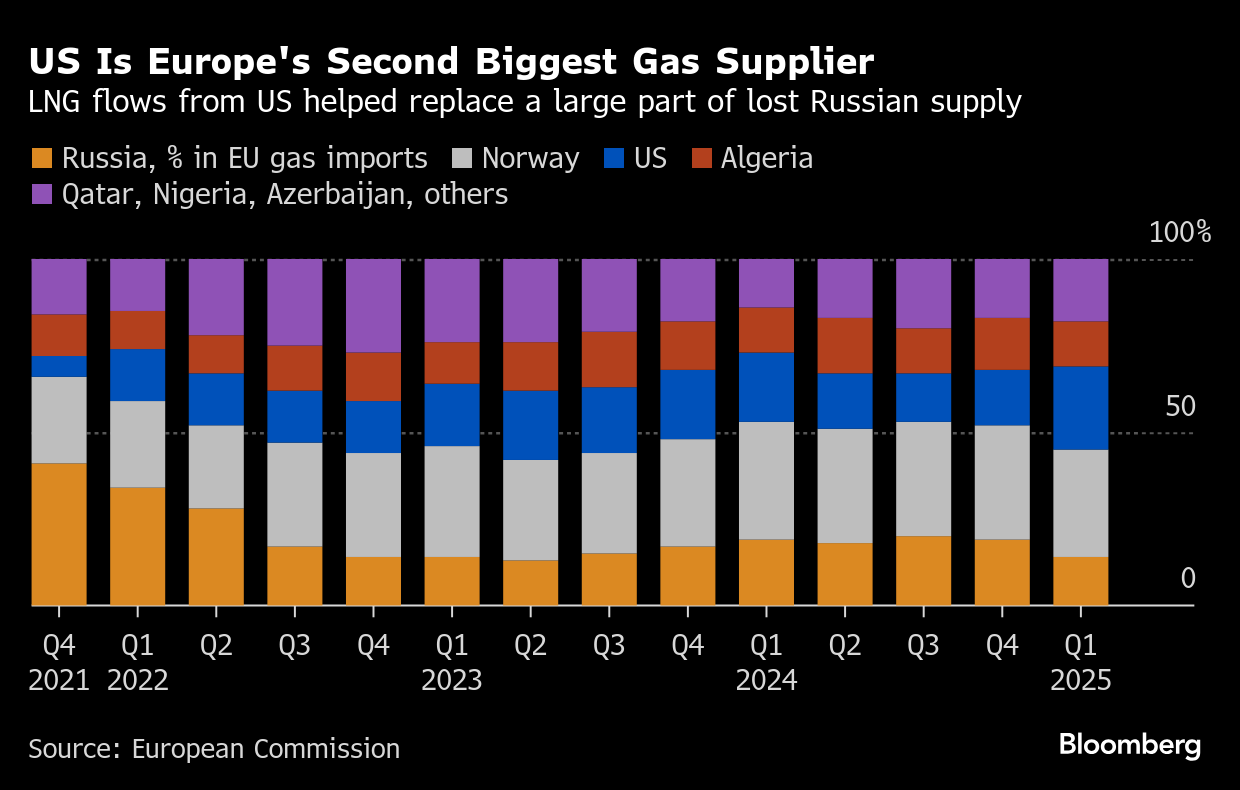

Europe has become a major buyer of US barrels since the region began dialing back its purchases from Russia after the invasion of Ukraine. At times, flows from the US Gulf to the continent have reached more than 2 million barrels a day, about half of total American crude export volumes.

Any further increase in purchases could prove problematic for the region’s oil refineries which need a mix of supplies to make a enough of the right kind refined fuels like gasoline and diesel.

In the first half of 2025, EU countries imported about 1.53 million barrels a day of oil from the US, of which 86% was in the form of crude, according to data from analytics firm Kpler. Those imports were worth about $19 billion.

That represented about 14% of total EU oil consumption, which averaged 10.66 million barrels a day last year, according to data from the Energy Institute Statistical Review of World Energy.

EU officials have long seen energy purchases as a way to win favor with the Trump administration, and it’s not the first time the EU and the US have made such a commitment. During the height of the EU energy crisis in 2022 following Russia’s invasion of Ukraine, von der Leyen agreed with former President Joe Biden to boost short-term supplies of LNG.

“The EU-US agreement on higher energy purchases — including LNG — will make no difference to the market balance unless the US administration decides to sell the LNG itself or unless the EU decided to purchase LNG itself at a higher rate to other market participants in Asia,” Rabobank Energy Strategist Florence Schmit said.

Even if this agreement leads to more EU spending on US LNG projects, flows are unlikely to materialize before the end of Trump’s term, she said.

The 27-nation bloc’s own modeling suggests that gas demand will weaken as it accelerates the transition to a greener economy over the course of this decade.

The US, already the world’s biggest LNG producer, is about to unleash a fresh wave of supply in the next few years. There are further projects being planned and those would need new buyers and financing to materialize, and Trump may be eager to get new deals done even if not all the supply ultimately ends up in Europe.

Investment Boost

“What the Trump administration cares the most is new supply agreements with European buyers for supply from new projects, which will help them secure financing,” said Han Wei, an analyst at BloombergNEF.

US LNG is also typically destination-free, meaning that even European buyers of the fuel can ship it wherever the best priced market is at any given point. The continent has been the biggest recipient of US LNG since the 2022 crisis, but it would still be competing in a global market against buyers from Asia.

A joint purchase platform — designed to aggregate EU demand and match buyers with sellers — has seen only limited buy-in, and the details on what concrete deals have been made as a result of it remain scarce.

“I have a hard time seeing this as a victory for the EU,” said Jean-Christian Heintz, a former energy-trading executive who is now an independent consultant at Wideangle LNG. “It will remain each state’s decision to move on with Trump.”

Energy commissioner Dan Jorgensen has said that the EU is willing to work with the Trump administration and US energy suppliers to help them conform to the bloc’s strict rules on methane emissions, but any tweaks are likely to be technical in nature.

The EU’s ambition to scale up nuclear energy as part of its 2050 climate neutrality goal will cost €241 billion ($280 billion). Von der Leyen’s deal with Trump includes so-called SMRs that are still under development in both the US and Europe.

(Updates with comment from Sefcovic in seventh paragraph)

©2025 Bloomberg L.P.