Biggest US Power Sale to Offer Glimpse of AI’s Cost to Consumers

(Bloomberg) -- The biggest and most closely watched US power auction is set to offer an early glimpse of what the AI boom will cost consumers.

PJM Interconnection LLC, which operates the largest US grid and is home to the biggest concentration of data centers in the world, is scheduled to release the results of its annual power sale Tuesday. The auction, which determines how much generators will get paid for generating capacity at new and existing power plants, is also an indicator of how high consumer utility bills will be.

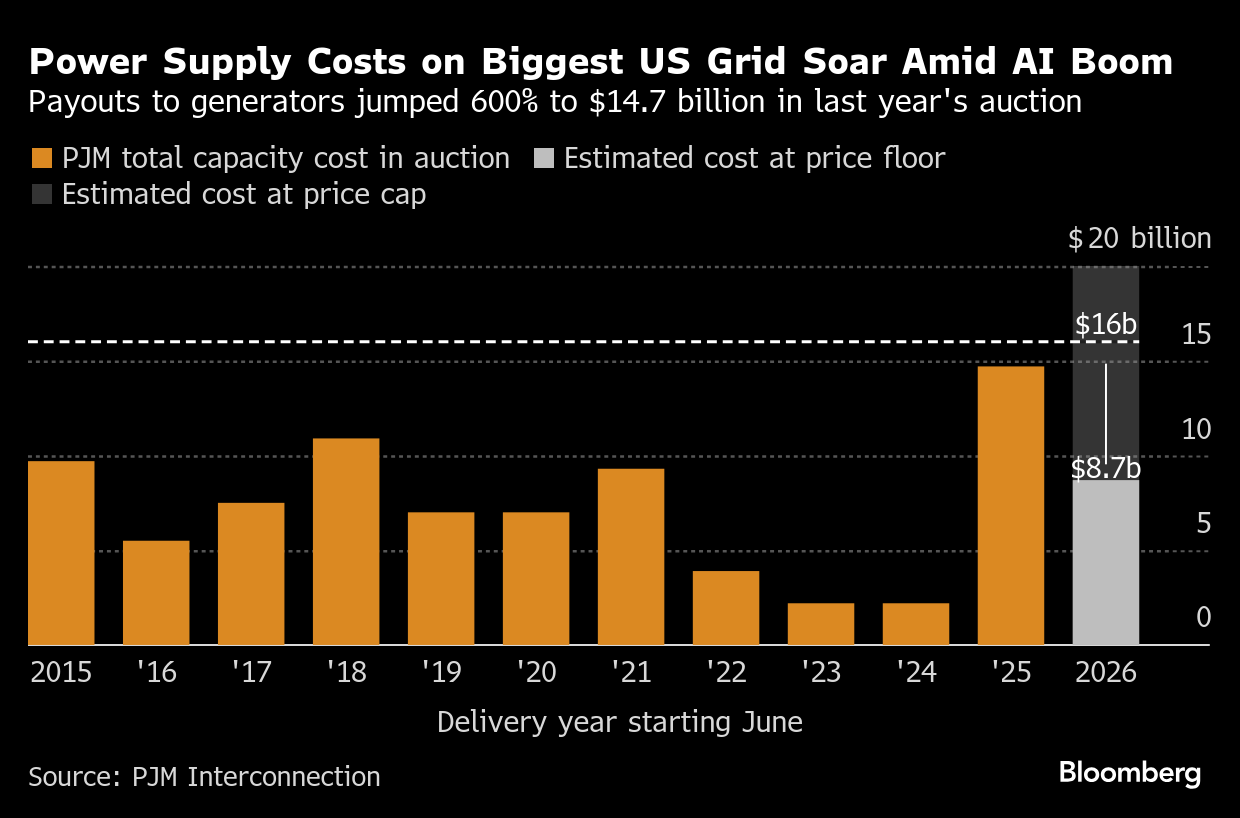

Last year PJM procured supplies for a record $14.7 billion, and this year similar costs per megawatt could result in total payouts of $13 billion to $16 billion. The soaring price tag is due to booming demand from data centers, according to recent analysis from the grid operator’s independent market monitor. That’s raising concerns that consumers — not technology companies — would bear the brunt.

READ: AI Needs So Much Energy It’s Distorting US Power for Millions

The explosive energy consumption of AI data centers is “leading to massive transfer of wealth from essentially existing customers and residential customers,”said Maryland People’s Counsel David Lapp, the state advocate for residential utility consumers.

Americans across the country are already grappling with climbing utility bills as aging infrastructure and more extreme weather raise operational costs and energy demand — and PJM is becoming a test case for AI’s voracious energy needs. At the same time, the Trump Administration’s recent rollback of renewable tax incentives means much of the massive queue of power projects waiting to get built will get a lot more expensive, compounding the hit to consumers.

Last year’s auction, which saw costs rise about 600%, created a political firestorm that ultimately led PJM and the governor of Pennsylvania to agree to set both a price floor and cap for the first time in the auction. This year’s results could similarly “put policy makers’ feet to the fire,” said Barclays Plc analyst Nicholas Campanella.

PJM declined to comment.

The cost of supply last year rose to about $270 per megawatt a day while Baltimore cleared more than 70% higher and Virginia, home to the biggest concentration of data centers in the world, was close behind. Maryland saw the highest capacity costs in the last auction, with Exelon Corp.’s Baltimore Gas & Electric utility tacking on $16-$20 to consumers’ monthly bills. However, the utility reached an agreement with regulators to pass through those costs in the spring and fall months to avoid adding to to already high summer bills. Both Maryland and Virginia should see capacity costs decrease under the cap.

Yet matching or exceeding last year’s prices would be a boon for independent power producers like Talen Energy Corp., Constellation Energy Corp., Vistra Corp. and, especially, NRG Energy Inc. after its $12 billion deal to buy power plants in PJM territory. Altogether, these companies have agreed to spend more than $34 billion to buy gas generators to supply data centers. Lower auction prices, meanwhile, would likely trigger a selloff in these publicly-traded generators while utilities with discounted valuations like Exelon, PPL Corp. and FirstEnergy Corp., could see their stocks rise, Campanella said.

The new price floor and cap will leave room for costs to rise across the grid while ensuring there are no extreme breakout zones. The difference between the floor and the cap is just about 1.5 gigawatts, said Mac McFarland, chief executive officer of Talen, which just agreed to buy two of the most efficient gas plants in PJM last week for $3.8 billion to serve AI demand. Looking ahead for years, “we are constructive” about capacity prices, he said on a July 17 call discussing the deal.

PJM said that the projected peak demand on its system plus required reserves will require an additional 146.1 gigawatts. However, if some of that demand is satisfied by direct contracting with the retail power providers, PJM may only need 134.5 gigawatts, it said. That means the auction will at minimum cost $8.7 billion. (A gigawatt is typically enough to power 800 homes in PJM.)

These capacity auctions are typically held three years in advance to give new power plants, especially those running on natural gas, time to be constructed. This year’s is two years behind schedule and only projects already under construction are likely get built in the next 11 months. With PJM’s projections showing demand growth ramping up significantly in 2028 and beyond, supplies may start to get strained.

“If the new build doesn’t show up and demand continues to uptick, you could see prices go even higher,” Campanella said.

©2025 Bloomberg L.P.