Why Ford Is Expanding a Partnership With Top Chinese Battery Maker

(Bloomberg) -- Ford Motor Co. cut back its EV plans last week in a major announcement, but it simultaneously placed a big bet on a new business line: producing batteries for energy storage.

The pivot was made possible by Ford’s unique access to Chinese technology. When it set out to delve deeper into the EV battery business in 2023, the company inked a deal with Chinese battery juggernaut Contemporary Amperex Technology Co. Ltd. to license its lithium iron phosphate (LFP) technology. Under the new plan, it will leverage the same deal to produce larger-scale batteries for stationary storage.

“Given the fact that we already had a license to build that technology in the US, you couple that with our manufacturing experience, over a century of high-scale manufacturing, it just made a lot of sense as a natural adjacency for us,” Lisa Drake, Ford's vice president of technology platform programs and EV systems, said in a Dec. 15 briefing where the automaker announced the overhaul of its EV strategy.

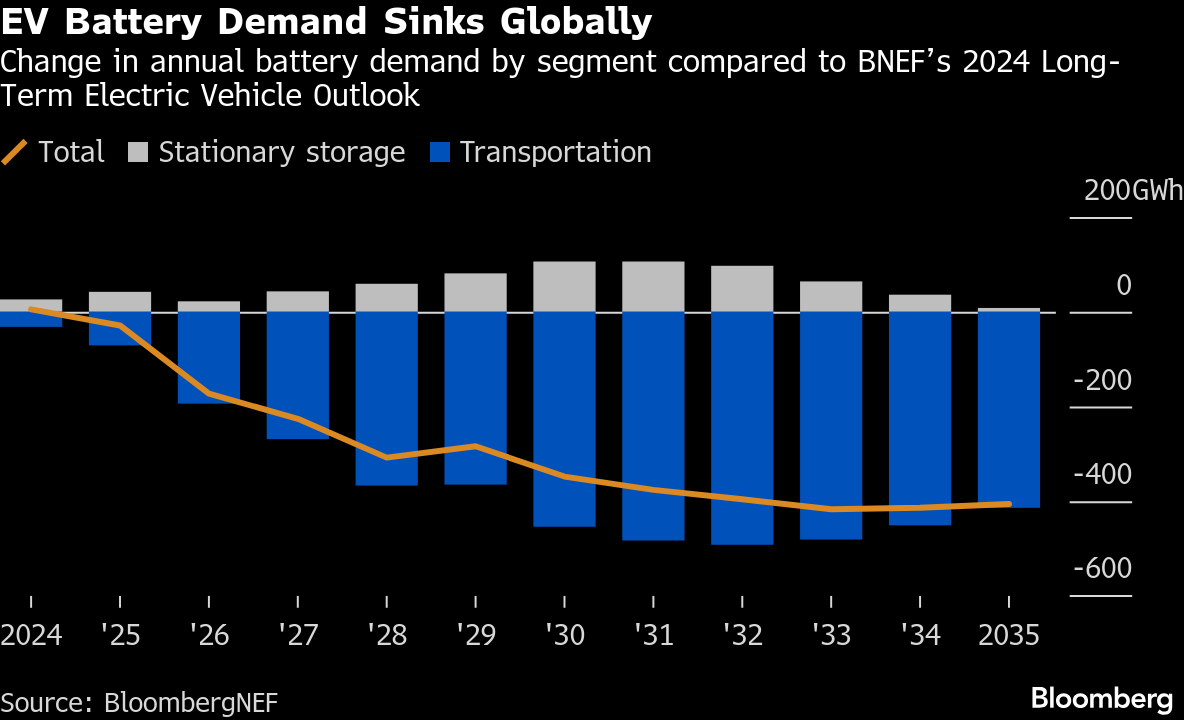

The move is part of a trend of battery makers in North America switching from products for EVs to those for grid and data center use. EV economics have dimmed after President Donald Trump slashed support for the industry. Electricity demand in the US, meanwhile, is projected to rise 12% by 2030, with demand from data centers accounting for more than a third of that increase, according to BloombergNEF.

Ford’s foray into big batteries is not only a first for the US automaker, but also an experiment in how much Chinese tech should feature in US industrial policy. With its CATL partnership, Ford expects to claim valuable federal tax credits while also leveraging Chinese innovation — an acrobatic feat under former President Joe Biden that has become almost impossible under Trump.

The US market has been a sought-after destination for China’s world-leading battery makers, but it has also been a political minefield. After years of local opposition and national security concerns from US lawmakers, a subsidiary of Chinese battery company Gotion scrapped its plans to build a plant in Michigan this fall, according to the state. A few months prior, Chinese-owned battery maker Automotive Energy Supply Corp. paused construction on a plant in Kentucky.

Ford has also faced headwinds. Virginia Governor Glenn Youngkin rejected the automaker’s potential plans to build a battery plant using CATL technology in his state. The company also came under heat from Republicans in Congress and in Michigan, but its plant remains under construction in the state and is expected to open next year.

The automaker tested the waters in Washington, DC before making its Kentucky announcement. Because imported Chinese batteries are already widely used for energy storage in the US and the project fits within the Trump administration’s goals to reduce reliance on key Chinese inputs, Ford felt comfortable moving forward, according to a source familiar with the matter.

“Given the ongoing needs of US energy producers, it seems like a no-brainer to support efforts to produce batteries in America instead of importing more of them from China,” the company said in a statement.

Ford also checked with potential customers to see if there would be a market for an automaker selling energy storage cells and received resounding affirmation. The company originally got into its partnership with CATL because LFP batteries are a low-cost alternative to traditional EV batteries, helping address one of the biggest impediments to consumer adoption — the high price of battery-powered cars. LFP cells, it turns out, are also the technology of choice in the growing energy storage market.

While Trump’s July tax law cut most of Biden’s other clean energy subsidies, it maintained them for batteries. But to qualify for the benefits, companies will have to comply with limits on using Chinese technology, including through licensing deals. Critically for Ford, that restriction applies to deals signed after the law’s passage, which spares its CATL partnership.

The deal will still have to adhere to a separate set of conditions to get tax credits, and Ford is confident the partnership will comply. “Our business model is fully compliant with all legal requirements, and consistent with the Administration’s policy to promote US energy independence,” Ford said in a statement.

Ford’s expansion is “part of the existing licensing agreement,” a CATL representative said in a statement, adding “we are committed to supporting energy transition across the globe, including the US market, where we see rapidly growing demand for battery energy storage.”

US companies can still license Chinese battery technology, but they would lose out on tax credits — at least for now. The Treasury Department is expected to finalize the rules early next year. In the meantime, the CATL deal gives Ford “a kind of rare comparative advantage,” said Derrick Flakoll, senior policy associate at BloombergNEF.

Some experts have argued that US policymakers should support such licensing because it fulfills several strategic goals at once: reducing a reliance on imports and allowing US companies to close the gap with leading Chinese firms while minimizing national security risks.

“You have to learn from the best, that’s what they did,” said Bentley Allan, a political scientist at Johns Hopkins University, referring to China’s history of licensing IP and acquiring technology from Western cleantech companies.

Ford has embraced this philosophy. Chief Executive Officer Jim Farley said on a podcast last year that he imported an EV from Chinese company Xiaomi Corp. and didn’t want to give it up after driving it for six months. And Drake has been outspoken about the importance of CATL to the company’s battery plans.

“It probably would have taken us a decade to catch up and have LFP technology on our own with our own R&D,” she told reporters during a tour of the Michigan plant in June.

Ford executives have indicated that their ultimate goal is to develop their own low-cost batteries, building on what they learn from CATL. Whether that can help the US compete against China’s substantial green tech lead, though, remains to be seen.

“It's possible that this could end up being in an area where you are teaching Ford how to do something that Ford can ultimately do quite well,” said Allan. But, he pointed out, the licensed technology isn’t at CATL’s cutting edge, so Ford and other US battery makers will have to continue playing catch-up.

(Updates with details about additional compliance rules and statement from Ford in paragraph 12.)

©2025 Bloomberg L.P.