Money Is Raining Down on Green-Tech Firms That Have an AI Story

(Bloomberg) -- Green firms in the US have found something of a lifeline in artificial intelligence after being bogged down by high interest rates, shrinking funding and, more recently, President Donald Trump’s sharp rollback of support.

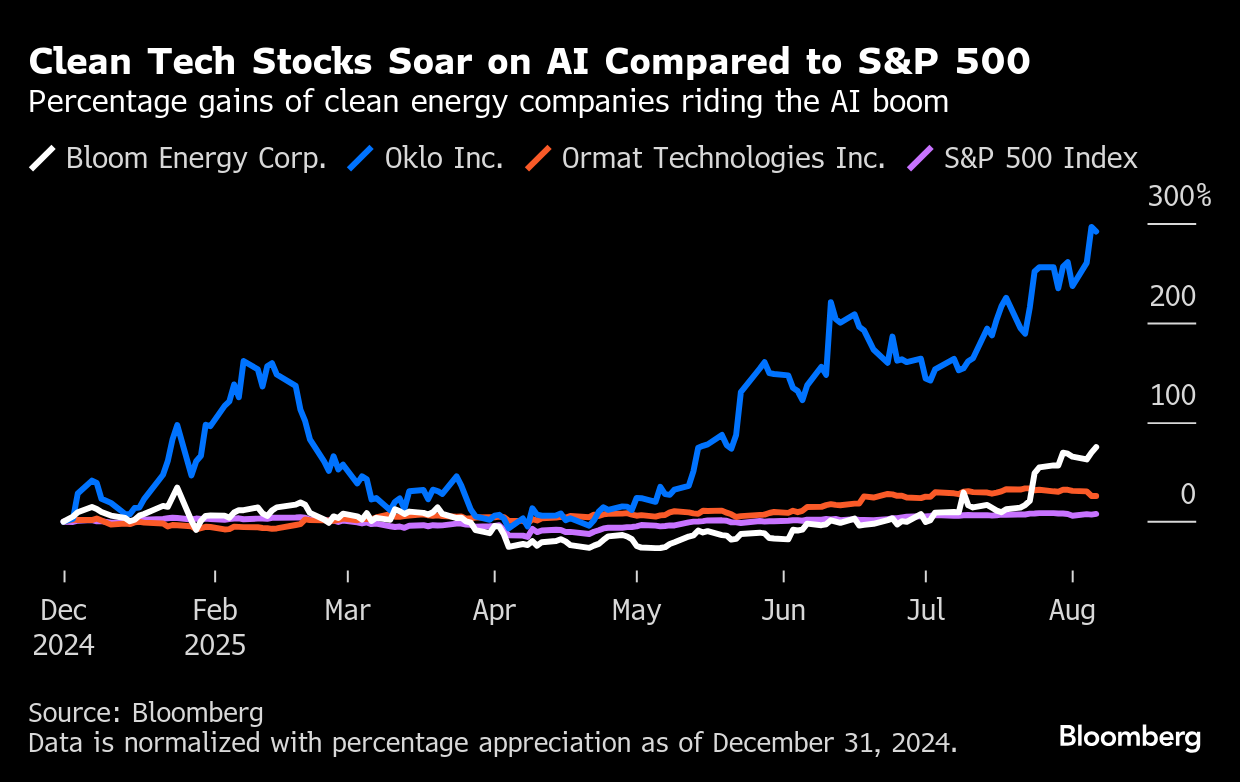

Clean technology companies that have inked deals to support data centers have seen their stocks soar this year, outperforming the S&P 500. Nuclear power startup Oklo Inc.’s shares are up nearly 275% year-to-date while the stock price of fuel cell provider Bloom Energy Corp. has risen 66%. Energy storage and clean power snagged the most public and private investment among climate tech sectors last quarter, according to BloombergNEF.

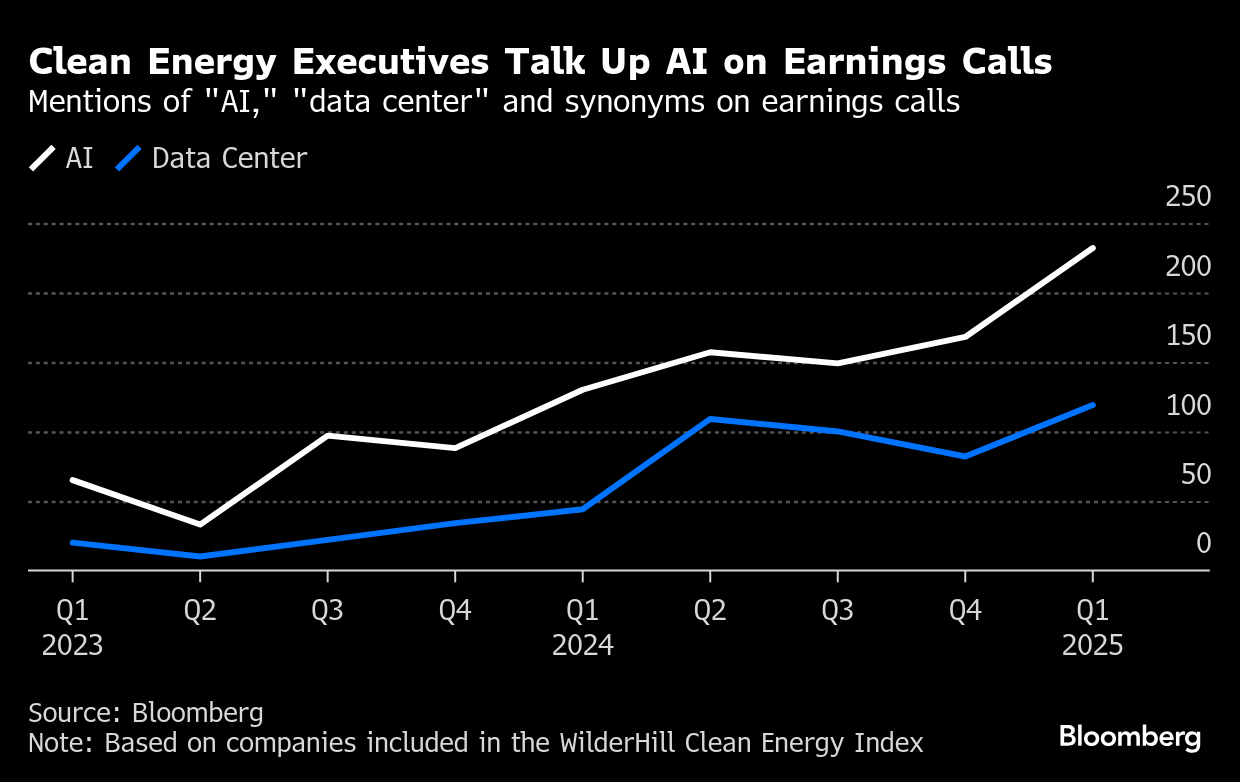

Even as some clean energy firms struggle to convince investors that they can thrive during Trump’s second term, the AI-driven surge in electric demand — the most in decades — is providing clear tailwinds for others.

“That has reinvigorated enthusiasm for companies that benefit from the trend,” said Jeff Osborne, a senior clean energy analyst with TD Cowen.

But the data center boom may prove short-lived for some carbon-free tech companies. While the age of AI is just starting, the ability of renewable firms to continue benefiting could be limited by a White House keen to boost fossil fuels and kill wind and solar.

Other clean technologies aren’t facing the same headwinds. Trump is an unabashed supporter of nuclear power, which is also seeing a rebound in public support. Geothermal today provides less than 1% of US generation capacity, but new drilling techniques and support from both tech giants and Energy Secretary Chris Wright have positioned it for growth.

Nuclear is an “ideal supply source for data centers,” and companies are willing to pay a premium for carbon-free, round-the-clock power, said David Brown, director of the energy transition practice at Wood Mackenzie.

Even before Trump took office for a second term, tech giants like Microsoft Corp. were seeking nuclear power. The company signed a deal with Constellation Energy Corp. last year for energy from the Three Mile Island plant, set to restart in 2027. Constellation struck a similar deal with Meta Platforms Inc. in June to sell power from an Illinois nuclear plant.

Almost a quarter of all venture funding for the US climate tech sector went to nuclear startups in the first half of this year, with firm TerraPower LLC closing the largest deal in the clean power sector at $650 million, according to BNEF. Funders include Bill Gates, who also founded the company, and Nvidia Corp.’s venture capital arm.

In addition, firms focusing on grid-enhancing technologies are also attracting funding, Osborne said. That includes startups like Veir Inc., which is making superconducting powerlines it thinks can solve the AI-fueled power crunch, and Heron Power Electronics Co., which signed a letter of intent to sell next-generation transformers to data center developer Crusoe in June.

A senior official said the Trump administration is working with states and utility regulators to speed data center development while looking to lift restrictions and roadblocks. These successes come as tax credits for some renewables are set to be wound down as part of Trump’s tax law.

“It is dangerous out there for a solar and wind company right now,” said Nancy Pfund, managing partner of impact investment firm DBL Partners and an early Tesla Inc. investor, adding that firms will need to cut costs and look at developing projects in other countries.

Altogether, companies canceled, closed or scaled back more than $22 billion in clean-energy investments during the first half of the year, according to research group E2. That’s about 17% of green projects announced since the start of 2022.

“Even though AI is a national priority for the Trump administration, the energy sector policies that the president has ultimately put forward threaten to slow down US momentum in AI,” Woodmac’s Brown said.

“The Trump administration is working with states and utility regulators to facilitate data center development, fostering a productive and symbiotic relationship among grid operators, developers, and hyperscalers,” a senior administration official said in an emailed statement. “This approach avoids imposing unreasonable or onerous restrictions on American tech companies at the forefront of AI development.”

While the Trump administration has created incentives for geothermal and nuclear, that support alone is not going to make those resources “readily available or plentiful in the next five years,” said Gabriel Kra, co-founder of climate tech venture capital firm Prelude Ventures. Both will take significant time and capital to get permitted and deployed at scale.

Nuclear power plants have historically faced long construction delays, permitting challenges and cost overruns. The last two nuclear reactors built in the US, Vogtle Units 3 and 4, took over a decade to get up and running, compared to utility-scale solar projects, which can be stood up in a year-and-a-half on average.

“The tools we have to scale are gas, solar, wind, batteries,” said Kra. And with natural gas turbine shortages, the hit to the renewables industry means “we just shut down the ability to produce cheap electricity for those customers who want to pay for it.”

For geothermal producer Ormat Technologies Inc., though, the policies in place are set to be a boon. Its shares have risen more than 29% so far this year, and the company has power purchase agreements with utilities and community choice aggregation programs in California. Ormat expects to finalize contracts to support data centers and hyperscalers in the “second half of the year and beyond,” Chief Executive Officer Doron Blachar said on an investor call on Thursday. He added the firm is benefitting from faster permitting timelines and quicker responses from the federal government due to recent regulatory reform.

By extending the production and investment tax credits for geothermal and energy storage, Trump's legislation is “positioning us uniquely within the renewable energy sector,” Blachar said.

©2025 Bloomberg L.P.