China’s Solar Industry Signals Hope Despite More Heavy Losses

(Bloomberg) -- Chinese solar manufacturers are still heavily in the red, but investors are beginning to detect signs of progress in their battle against overcapacity.

Four of the biggest panel makers reported first-half earnings on Friday, racking up a combined net loss of over 13 billion yuan ($1.8 billion) — testament to the ruinous impact of cutthroat competition that in some cases has involved selling below cost.

Three of the firms, Tongwei Co., JA Solar Technology Co. and Trina Solar Co. posted worse results than last year, although the largest, Longi Green Energy Technology Co., succeeded in narrowing its deficit after reducing expenses and impairment charges.

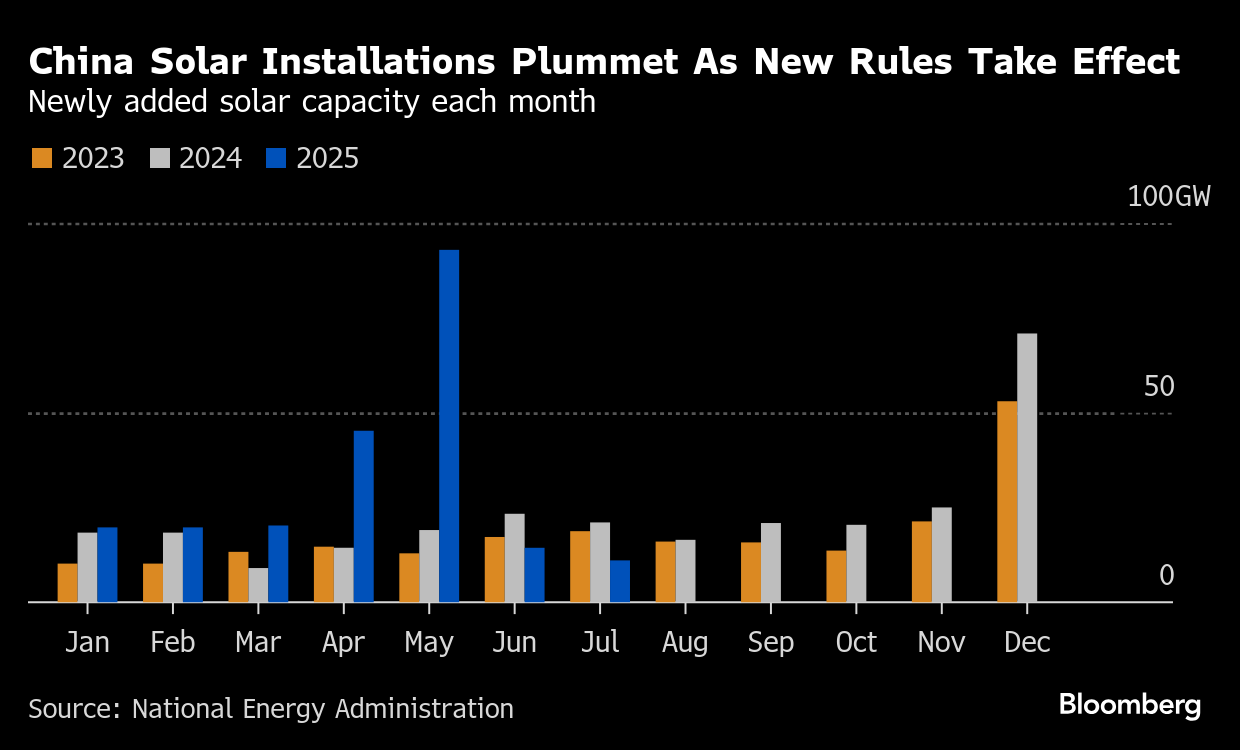

Moreover, the companies incurred those losses at a time of unprecedented demand in China for solar products, after developers front-loaded projects before a less favorable pricing policy came into effect in June. As that demand subsides, the industry’s prospects will hinge almost entirely on whether it can turn the government’s anti-involution mantra into reality.

The authorities are ratcheting up the pressure, even if they are yet to directly intervene. A meeting between government departments and solar makers early last week prompted the top industry body to urge stronger efforts at self-discipline to combat the sector’s prolonged downturn.

The readout from the government session suggests a turning point could have been reached, Trivium China said in a research note. The meeting was an upgrade from a previous get-together with the industry in July, according to the consultancy, and included regulatory heavyweights like the country’s top economic planner, the National Development and Reform Commission, and the State Administration for Market Regulation, which typically aren’t involved in solar matters.

Attendees also included the solar industry’s customers in state-owned power generation, along with the regulator responsible for overseeing them.

The upshot could be government oversight of solar pricing, removing export tax rebates to hasten the failure of the weakest companies reliant on overseas sales, and new programs to lift renewables demand, Trivium said.

Despite their poor results, all of the companies except Trina saw their stocks rise on Monday, roughly in line with gains in the wider market. “A consensus on anti-involution has been reached in the industry, although specific plans have not yet been released,” Longi said in its earnings report, adding that companies could still find themselves under short-term pressure.

One risk stems from a stronger market for polysilicon, a key element in solar panels. The gains are due in part to the industry’s plan to establish a fund to retire capacity. The 18% rise in price since June could tempt producers to bring units back online, according to BloombergNEF.

Still, the polysilicon market seems to be ground zero in the fight against overcapacity, and success there could be the start of a revival in the industry’s fortunes.

On its earnings call, Trina said that “polysilicon is the first step of anti-involution in the solar sector and more steps would follow in the second half,” according to a note from Citigroup Inc. Trina declined to comment.

On the Wire

President Donald Trump said the US has more leverage over China on trade than the other way around, citing airplane parts as a key item Washington has to counter Beijing’s restrictions on rare earths.

The American Iron and Steel Institute has asked the White House to intervene in a $500 million deal in Brazil that could hand China greater control over global nickel reserves.

Fortescue Ltd.’s full-year profit fell 41% on lower prices for its iron ore, as Chinese demand for the steelmaking ingredient weakens amid its protracted property-sector slowdown.

A German offshore wind project that came under fire for choosing Chinese turbines to power its North Sea site is looking at canceling the controversial order.

China is accelerating the expansion of its carbon market with a plan to incorporate major industrial sectors by 2027.

This Week’s Diary

(All times Beijing)

Tuesday, Aug. 26

- China’s energy administration briefs on the last 5-year plan, 10:00 in Beijing

- EARNINGS: PetroChina, COSL, Anhui Conch, Angang Steel, Zijin Mining, Modern Dairy

Wednesday, Aug. 27

- China’s industrial profits for July, 09:30

- CCTD’s weekly online briefing on Chinese coal, 15:00

- PetroChina earnings briefing in HK at 16:00

- CSIA’s weekly polysilicon price assessment

- EARNINGS: Baosteel, Chalco, Cnooc, ENN Energy, CGN Power, Ming Yang, Mengniu Dairy

Thursday, Aug. 28

- CSIA’s weekly solar wafer price assessment

- Cnooc earnings call, 17:00

- EARNINGS: Jiangxi Copper, Hesteel, Maanshan Steel, GEM, Cosco Shipping

Friday, Aug. 29

- China’s weekly iron ore port stockpiles

- SHFE weekly commodities inventory, ~15:30

- EARNINGS: Jinko, GCL-Poly, Three Gorges, Yangtze Power, Shenhua, BYD, Gotion, Tianqi Lithium, Citic Ltd.

Saturday, Aug. 30

- Nothing major scheduled

Sunday, Aug. 31

- China’s official PMIs for August, 09:30

©2025 Bloomberg L.P.