Chinese Solar Losses Deepen Even Before Worst of US Tariffs

(Bloomberg) -- Chinese solar manufacturers continue to plunge deeper into the red, and the outlook is getting gloomier as sky-high tariffs on exports threaten to compound domestic oversupply.

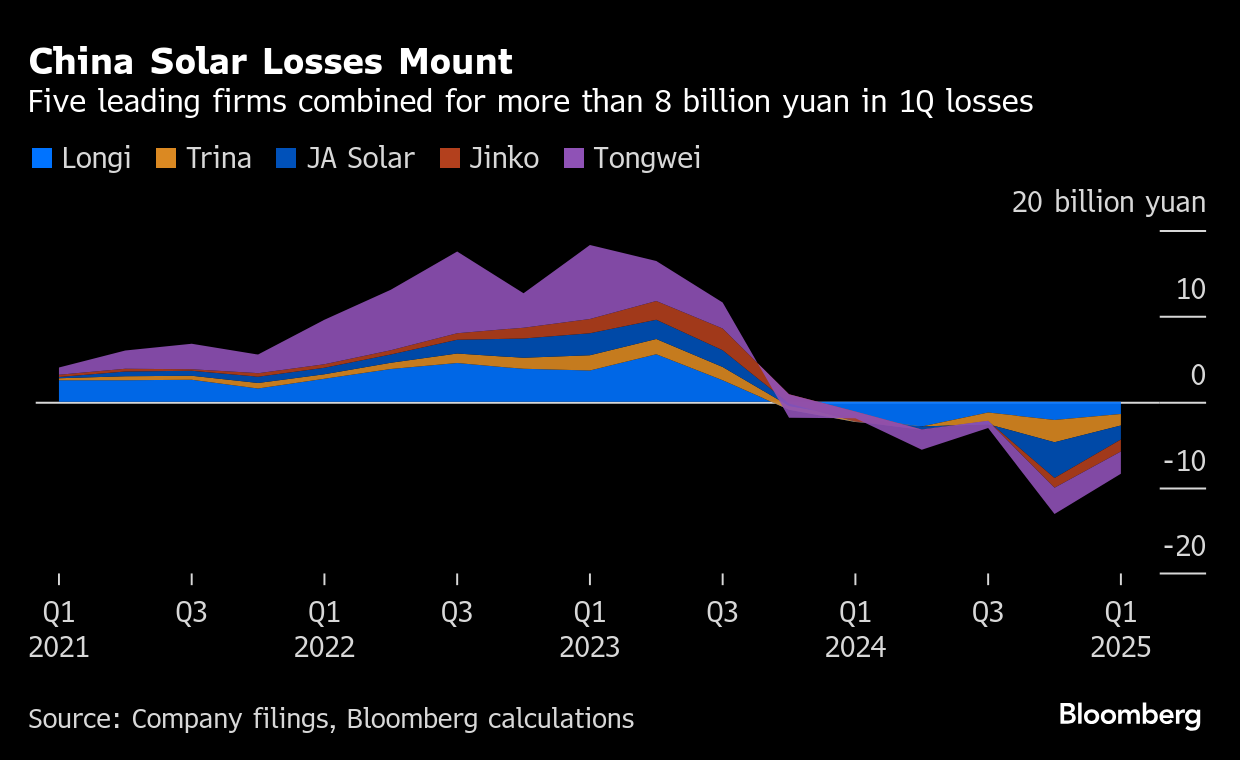

Five of the biggest names in the industry — JA Solar Technology Co., Jinko Solar Co., Longi Green Energy Technology Co., Tongwei Co. and Trina Solar Co. — published first-quarter earnings overnight, racking up over 8 billion yuan ($1.1 billion) in losses between them. Their combined loss last year was less than 2 billion yuan, when two of the companies were still profitable.

“Prices across the main segments of the solar industrial chain were low in the first quarter,” Jinko said in its earnings statement. “This, combined with disruptions in demand caused by changes in international trade policies, pressured profit margins in each segment of the integrated solar supply chain.”

So, the first takeaway is the industry’s so-called self-discipline measures — basically voluntary output controls agreed by dozens of manufacturers last year — haven’t really worked yet, although Jinko said in its statement that self-regulation had shown a gradual improvement over the period.

The second is that conditions will only deteriorate if the worst of the Trump administration’s tariffs come into force. Those include staggering levies as high as 3,521% on four Southeast Asian nations where Chinese firms had based much of their production to circumvent US duties.

New Tariffs

The new tariffs, which were announced earlier in April, should be finalized in coming weeks, assuming that the US trade regulator determines the imports have been detrimental to American producers. That could force another round of costly relocation for the troubled industry.

CSI Solar Co., an affiliate of Nasdaq-listed Canadian Solar Inc., said on Monday it’s preparing to move capacity to other regions facing lower duties. JA Solar said earlier this month it’s planning to speed up efforts to globalize its manufacturing, including by opening a plant in Oman.

For China’s largest solar company, Longi Green, the uncertainty over how tariffs will affect demand in the US means pausing on any big changes. The firm “will continue to follow the supply chain path we have established in the past and steadily advance our business in the US, while continuing to monitor future policy changes,” Chairman Zhong Baoshen said on a conference call on Wednesday.

The company also has a factory in Ohio, which was built to capitalize on incentives launched by the Biden administration.

In the meantime, the ramp up in domestic installations that’s supported demand in recent months is likely to meet dead air after a June 1 deadline, when less favorable policies on solar pricing come into effect.

So, expect profitability to improve sequentially in the second quarter, said Daiwa Capital Markets analysts including Dennis Ip. But that’s “likely to be unsustainable due to a potential demand vacuum in the third quarter,” according to a note from the brokerage.

On the Wire

High-frequency data on China’s outbound shipments suggest exports to the US may have started to drop sharply in the final 10 days of April, reflecting the kicking-in of high US tariffs that threaten to largely wipe out bilateral trade.

A gauge of strength in China’s copper market has jumped to the highest since late 2023 as buyers scramble to secure supplies.

China has waived the 125% tariff on ethane imports from the US that was imposed earlier this month, Reuters reports, citing two people familiar with the matter.

China has asked some of its state-owned drugmakers to study how they can reduce reliance on the US for pharmaceutical products and raw materials, people familiar with the matter said, as Beijing prepares for a potential decoupling that threatens its medical supply.

This Week’s Diary

(All times Beijing)

Wednesday, April 30:

- Shanghai auto show continues (through May 2)

- Canton Fair continues in Guangzhou (through May 5)

- China’s official PMIs for April, 09:30

- Caixin’s China factory PMI for April, 09:45

- CSIA’s weekly polysilicon price assessment

- CCTD’s weekly online briefing on Chinese coal, 15:00

- Shanghai exchange weekly commodities inventory, ~15:30

- EARNINGS: HKEX

- Longi Green holds earnings webcast at 10:00

Thursday, May 1:

- China’s new policies on distributed solar come into effect

- Holiday in China

Friday, May 2:

- Holiday in China

(Updates with comments from Longi Green’s chairman in eighth paragraph)

©2025 Bloomberg L.P.