Al Gore Says Fixing Grids Is Key Issue for Energy Transition

(Bloomberg) -- Modernizing the antiquated networks that deliver power to homes and companies should be considered the most-pressing issue for anyone in the US and Europe that wants to combat climate change.

That’s according to Generation Investment Management, the firm co-founded by former US Vice President Al Gore, which said on Wednesday that — in the developed world — “nothing else will matter as much” to the speed of the energy transition as upgrading the power grid.

Generation said in its annual Sustainability Trends Report that achieving this task will involve building new power lines and installing digital controls to improve efficiency. It also will mean grappling with cumbersome bureaucratic procedures and navigating fierce debates over who should pay for the improvements.

“To facilitate the faster and wider deployment of renewable electricity, it has to have an avenue from the places where the electricity is generated to the places where it’s used, and that means grids,” Gore said in an interview. “The need for higher-capacity transmission infrastructure to make use of this incredibly cheap and clean renewable energy” is a serious challenge, he said.

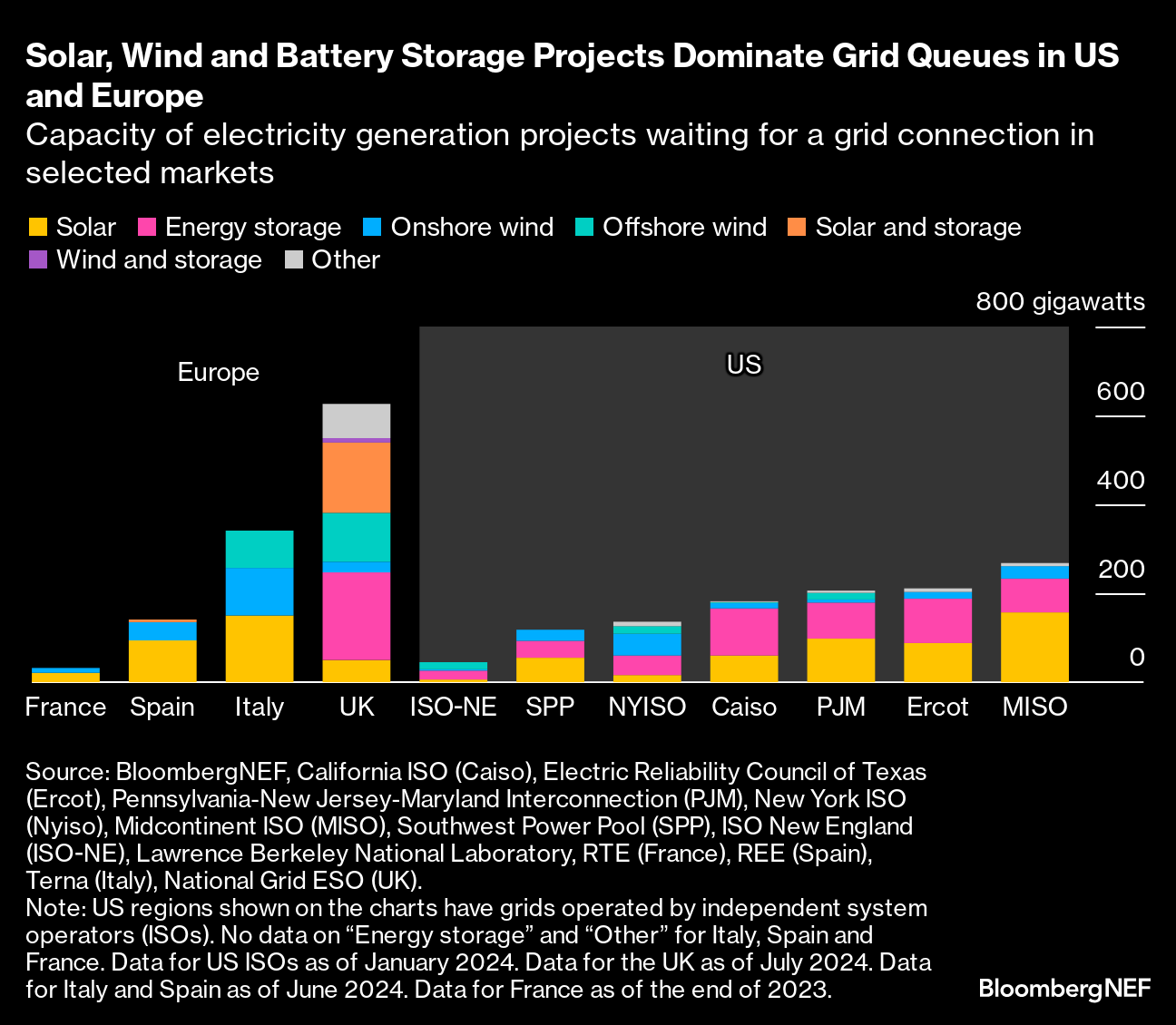

The rapid growth of renewable sources of energy, combined with the sharp fall in costs to produce the power, has caught grid operators, utilities and their regulators “flat-footed,” Generation said. Most have failed to build the necessary transmission grids capable of handling the new, more distributed flows of electrical power, Generation said. The result has been growing waiting times as renewable-energy developers request grid connections.

New power generation projects have to wait years to get a connection to the electricity grid in Europe and the US, threatening to slow the rollout of renewable energy. And there’s no sign of this gridlock clearing anytime soon, with the amount of capacity in the queue increasing by 10% over the past two years, according to data tracked by BloombergNEF.

To reach net zero carbon emissions by 2050, the world will need to triple its 2023 level of spending on power grids by the middle of the next decade, BNEF estimates.

Still, this is just one of many problems impacting global progress on attaining climate goals, Gore said.

The ambition of the Paris agreement to limit global warming to well below 2C, and ideally to 1.5C, is “hanging by a thread” as global temperatures continue to increase and emissions continue to rise, Generation said.

In emerging economies, where most of the emissions reductions for net zero will be needed, there are bigger issues than securing grid connections. A persistent problem is the cost of capital for clean-energy projects in the developing world is several multiples higher than for a similar project in the US, a reality that means it’s easier to get fossil-fuel projects off the ground than solar or wind.

“The global system for allocating private capital is one of the principle challenges,” Gore said. “One-hundred percent of the predicted increase in emissions in the years ahead will come from developing countries, and yet access to private capital in most developing countries is far less than it is in the developed world.”

The comments were made as Generation, which oversees about $34 billion of assets, released its annual report on sustainability trends. Like previous years, Gore reserved harsh criticism for Big Oil and Wall Street.

“We’re especially disappointed by some of our colleagues in the financial-services industry who took bold stands a few years ago, but are now, within this past year, attempting to wriggle out of their promises,” Gore said. “Many of the largest banks continue to shovel tens of billions of dollars into the development of yet more new fossil fuels, despite their pledges to align their lending with the climate transition.”

Still, there are some positive signs when it comes to financing the energy transition, Generation said. For every $1 invested in fossil fuels, about $2 is now being invested in clean-energy technologies, which compares with a 1-to-1 ratio just five years ago, the fund manager said, citing data from the International Energy Agency.

“We are moving in the right direction on energy investment,” Generation said. “But, as with every other aspect of the transition, we aren’t moving fast enough.”

(Updates with energy investment data in 13th paragraph.)

©2024 Bloomberg L.P.