Fraud Probe Sends Energy Absolute Shares to Lowest in Decade

(Bloomberg) -- Energy Absolute Pcl shares plunged by the 30% daily limit after the founder and chief executive quit over a fraud probe and its credit rating was slashed to junk.

Energy Absolute fell to a 10-year low of 9.2 baht when it resumed trading Tuesday, after revealing it has 19.5 billion baht ($539 million) of debt due in 2024 and is seeking one or more strategic partners. Its disclosure followed a one-day share suspension ordered by the Stock Exchange of Thailand, which demanded the renewables company explain its financials and the impact of a fraud probe.

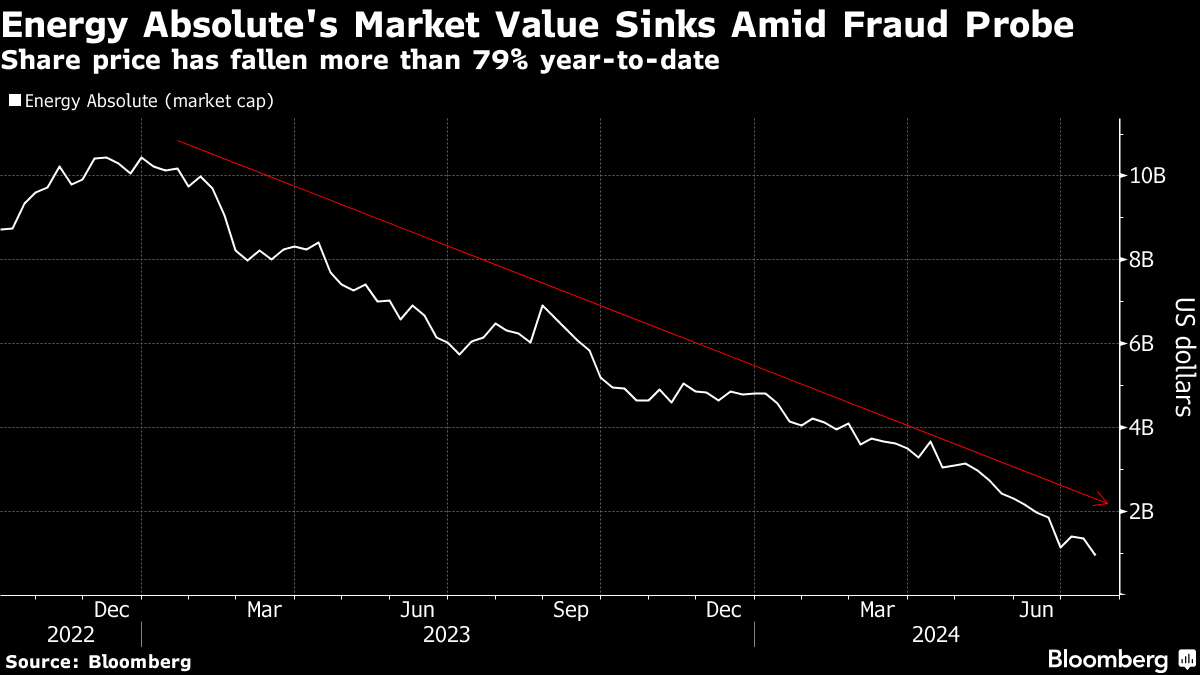

Energy Absolute has lost more than 79% this year, partly on concern at its aggressive expansion into everything from power generation and batteries to autos and the assembly of trains, ferries and buses. Founder Somphote Ahunai, who has now lost his billionaire status, resigned as CEO at the weekend after the Securities and Exchange Commission said it was investigating him and other executives for possible fraud. He denies wrongdoing.

The company is “in the process of negotiating and considering the selection of strategic partner(s)” to boost its strength, repay debt and develop a sustainable business. It also intends to roll over short-term loans and said it still has about 1 billion baht of revenue each month from power plants, according to its filing on late Monday.

But TRIS Rating, a strategic partner of S&P Global, said in a separate statement that the downgrade to “BB+” from “BBB+” reflects “heightened liquidity risk” for the company in the near term.

“TRIS Rating views that the corporate governance issue is likely to severely impact creditors’ and investors’ appetite on EA credit risk, leading to heightened refinancing risk of its near-maturing debenture obligations,” it said.

Thai authorities are now considering new and stricter measures to supervise listed companies and to prevent fraud and corruption by executives, Lavaron Sangsnit, permanent secretary at the finance ministry who is also a member of SEC board, told reporters Tuesday. The SEC needs to clean up problems “that have been under the rug” for some time, he said.

Wider Implication

While the probe into Energy Absolute is still ongoing, some analysts are already raising concerns. Banks, for instance, may have to set extra provisions against the company’s debt, according to Citi.

“Although EA may still be able to repay its debt, the weakness of its EV-related business and the loss of management credibility might cause banks to classify EA as stage 2 or 3 and set extra provisions,” analyst Rawisara Suwanumphai wrote in a note.

Thanachart Securities Pcl now recommends investors sell the stock, and UOB Kay Hian ended coverage, warning Energy Absolute’s ongoing and future projects could face delays, while the fraud allegations will likely have “severe repercussions for the company’s ability to issue bonds and manage debt repayment.”

“EA’s new bond sales scheduled this month will probably be delayed indefinitely,” Saravut Tachochavalit, an analyst at RHB Securities (Thailand) Pcl, said in a report Monday.

Still, Energy Absolute said in a press briefing Monday that it will proceed with plans to sell as much as 5.5 billion baht of green bonds on July 23-25.

New Management

The company’s existing debt appears to be little traded, and while yields on the company’s debt appear to have climbed, it’s difficult to ascertain an exact price, Ariya Tiranaprakij, executive vice president of the Thai Bond Market Association, said by phone on Tuesday.

But Ariya said Energy Absolute represented a totally different case from Stark Corp, the Thai cable wire maker whose former chairman and several other executives are being prosecuted over an accounting scandal. “Energy Absolute’s assets and operations still exist and continue to generate cash flows,” she said. “The urgent task for the company is to bring back confidence from investors, creditors and other stake holders.”

Following Somphote’s resignation, the company appointed Somchainuk Engtrakul, former permanent secretary at the finance ministry, as acting CEO and the chairman of the board effective Sunday. It also named Vasu Klomkliang as acting chief financial officer and Chachawan Jiaravanon and Chatrapol Sripratum as directors.

The charges against Somphote, Amorn Sapthaweekul, who resigned as deputy CEO, and a third individual relate to Energy Absolute’s procurement of equipment from overseas and software for a solar power plant between 2013 and 2015, the SEC said last week. Amorn also denied any wrongdoing.

(Updates throughout)

©2024 Bloomberg L.P.