China’s New Solar Test Is Finding Enough Grid Space for Rooftop Panels

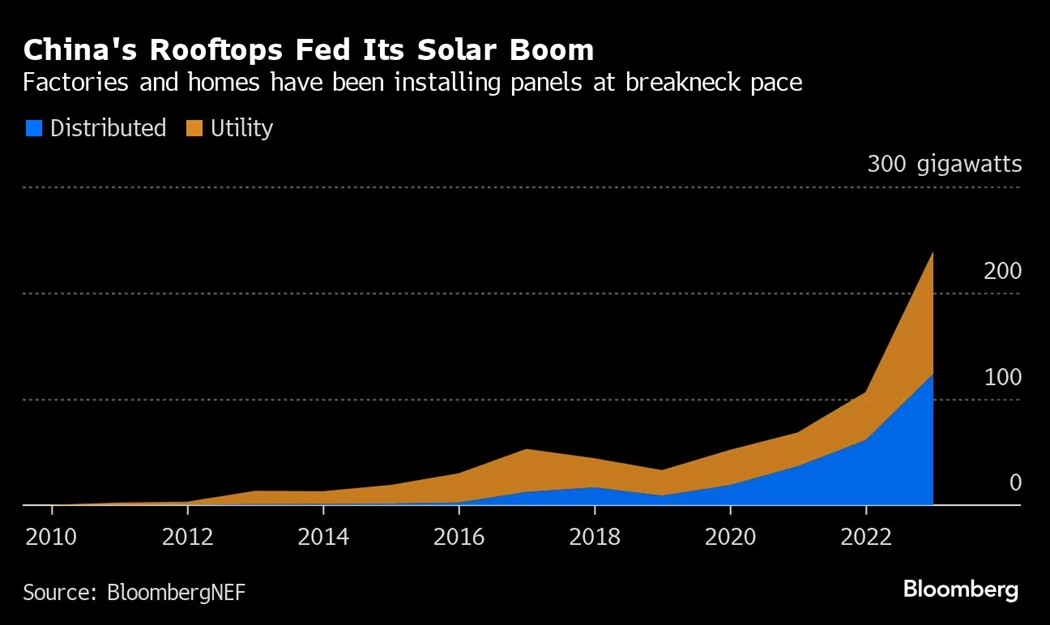

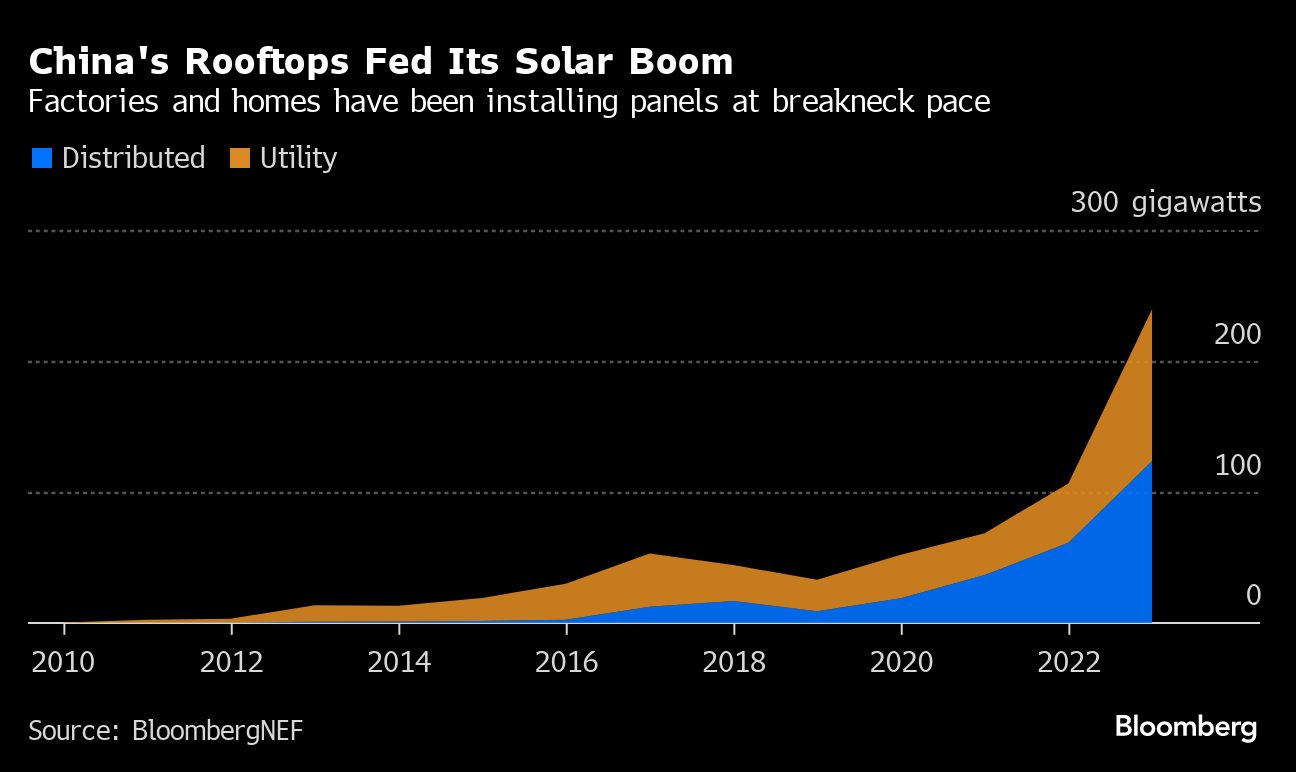

(Bloomberg) -- A rooftop solar boom that’s powered China’s world-leading pace of renewable energy installations is hitting new challenges as multiple regions run out of grid capacity for additional projects.

Three cities and counties in Hubei and Fujian provinces announced in recent days that local power infrastructure can’t currently absorb more distributed solar generation — typically small-scale arrays of panels atop homes or industrial premises. That adds to about 150 locations nationwide that have also reached their limit, according to industry publication Photovoltaic Energy Circle.

The hurdles highlight the tasks facing China’s officials to sustain the breakneck pace of the country’s green transition. After years of rapid growth in renewable generation, particularly in solar, the nation faces a need to strengthen regional grids and build out more energy storage, according to Tianyi Zhao, a solar analyst with BloombergNEF in Beijing.

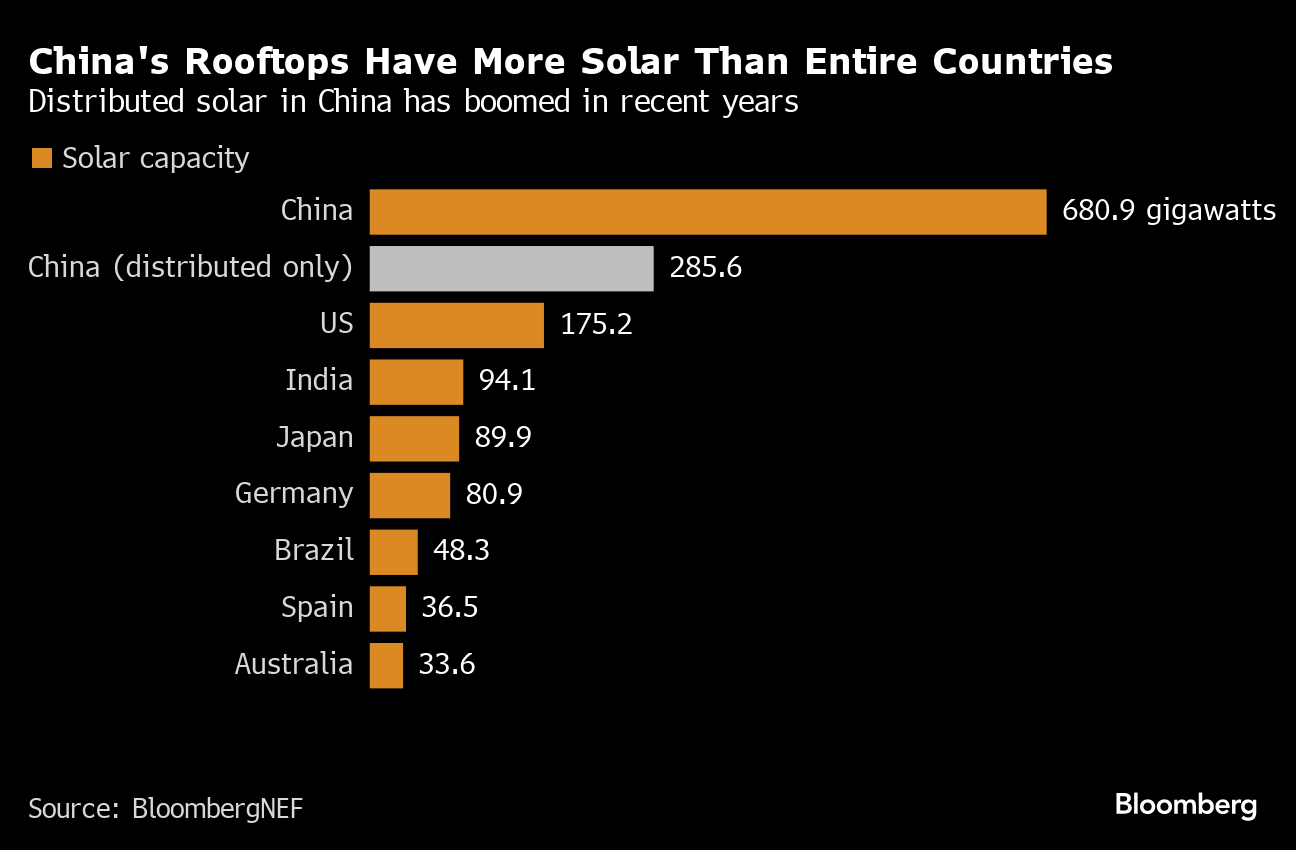

China’s network of distributed solar assets is larger than the entire solar fleet — including all types of projects — in the US. The acceleration in installations has fueled some forecasts that the world’s top polluter could touch a peak in emissions this year, though many major industrial hubs are now experiencing difficulties in handling the deluge of clean energy.

Shandong, which has the most small-scale solar capacity, last year allowed power prices to turn negative during periods of excessive generation from rooftop panels. More than 70% of the region’s cities and counties face some degree of constraints in connecting new projects, according to a statement last month by the provincial government.

Some regions have begun implementing stricter regulations on rooftop solar in recent months, according to SolarZoom. Connection issues won’t have an impact on plans for rooftop installations already filed with local grid companies for 2024, according to BNEF. But it will be extremely difficult for developers to launch new projects in affected regions, it said.

China established pilot projects last year aimed at testing technologies that can increase the grid’s capacity to absorb more power from rooftop solar projects.

Solar industry executives have also urged changes to power market policies, which they claim are slowing the development of energy storage projects, like giant battery farms.

Most power consumers in China still pay the same cost no matter what time of day it is, compared to dynamic markets in places like California or Australia where prices change by the minute. That allows battery operators to buy cheaper electricity during the day — when panels are generating most — and then sell at a higher price after the sun sets.

Falling battery prices mean that systems which pair renewable generation assets with energy storage will reach cost parity with coal-fired power by 2025, Macquarie analysts including Albert Miao said in a research note last week.

©2024 Bloomberg L.P.