Billionaire Maersk Family Forms Green Methanol Firm for Shipping

(Bloomberg) -- The billionaire family behind A.P. Moller-Maersk A/S is forming a new company that will produce green methanol in a bid to help cut emissions from the shipping industry, one of the world’s biggest polluters.

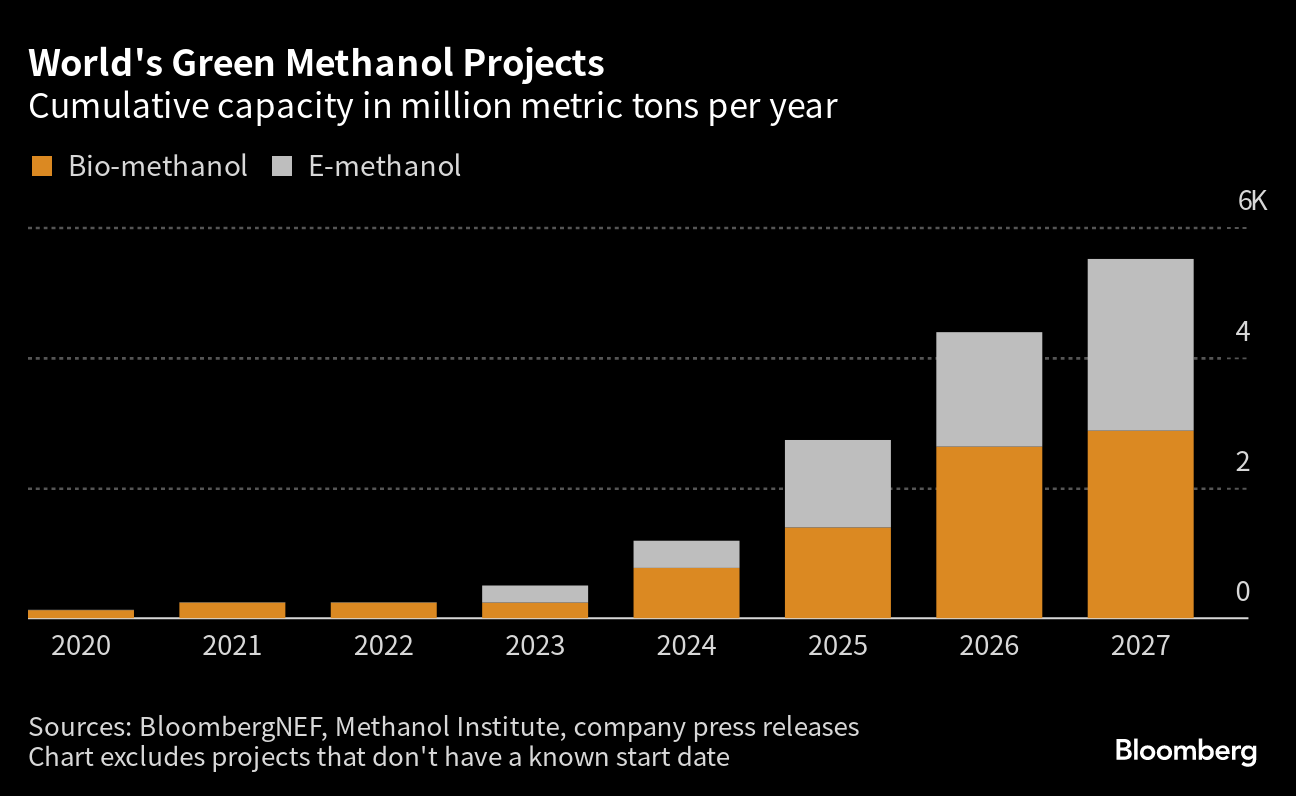

The company, called C2X, will build and operate “large-scale” production facilities and expects an annual capacity of more than three million tons green methanol by 2030, according to a statement from family fund A.P. Moller Holding A/S, or APMH, on Thursday. That’s a significant addition to an industry facing a massive shortage of carbon neutral fuel.

There’s currently about 153,000 tons of green methanol production capacity in operation around the world, including demonstration plants that might not be selling volumes commercially as well as those producing synthetic methanol, according to estimates by BloombergNEF. APMH estimates global demand for methanol could triple to about 300 million tons a year by 2050, with most being for the green kind.

Weaning the shipping industry off oil is a key component in the fight against global warming.

Maersk, which operates a fleet of about 700 container ships, is alone responsible for about 0.1% of all human-made CO2 emissions. The Copenhagen-based company has identified green methanol as the best technology to achieve its goal of becoming carbon neutral in 2040.

C2X will sell to the shipping industry as well as to chemical companies. Its main owner will be APMH, which has assets of about $110 billion and is run by Robert Maersk Uggla, the great-grandson of the shipping firm’s founder. Maersk will own a 20% stake, the companies said, without providing financial details.

The new company will be led by Brian Davis, an ex-Shell Plc oil-industry veteran, while the finance chief will be Alastair Maxwell, formerly of Morgan Stanley and Goldman Sachs Group Inc. It will start with 60 employees and is currently pursuing projects located near the Suez Canal in Egypt and in Spain.

Maersk has said the biggest threat to its green transition is the lack of fuel which presents a “chicken-and-egg” problem: few energy companies produce green methanol because there’s presently little demand, while ship owners are reluctant to build green vessels because the fuel market is so small.

But there are signs green methanol is now gaining traction. This year, container lines have requisitioned more than three times as many ships that can sail on the fuel compared with on liquefied natural gas, which doesn’t reduce emissions as much, according to BloombergNEF.

Maersk has ordered 25 green methanol ships, with the first due to be named by European Commission President Ursula von der Leyen in a ceremony later on Thursday in Copenhagen.

©2023 Bloomberg L.P.