Chinese Oil Refiners Spend Heavily to Tap Clean Energy Boom

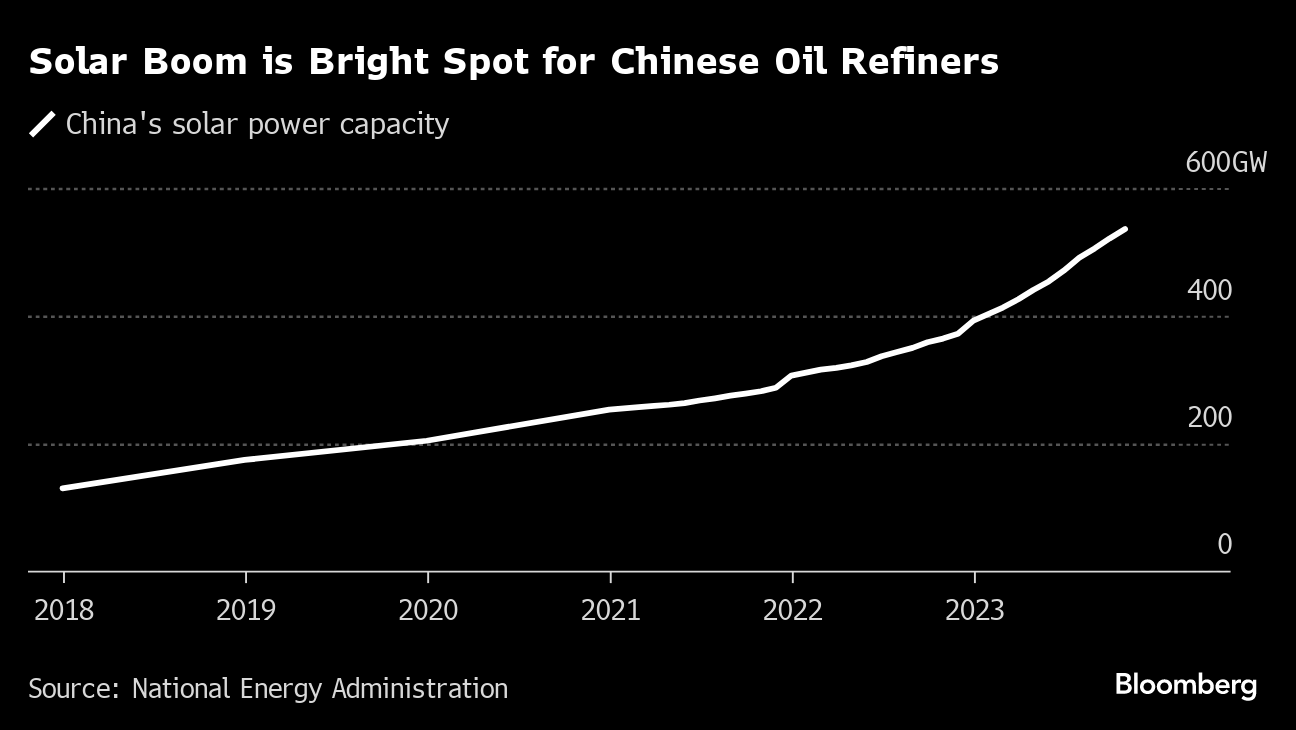

(Bloomberg) -- China’s oil refiners are spending billions of yuan to produce chemicals for the renewables sector, as the nation’s clean energy boom ripples through to even its dirtiest industries.

Beijing’s ambitious climate targets are opening up new areas of investment across the economy. For oil processors, the added challenge is how to replace revenue from traditional, carbon-intensive sectors like transport, where demand for gasoline is close to peaking as electric vehicles take an ever-increasing share of the market.

Protective coatings like ethylene-vinyl acetate or EVA, and polyolefin elastomer or POE, are finding new applications in solar cells. China’s EVA capacity is expected to more than double by 2025 to 5 million tons a year, according to one industry forecast, with nearly half of national consumption now linked to the solar industry.

“Chinese companies have been investing heavily in EVA capacity and POE technology to reduce dependence on imported materials and improve supply chain security,” said Shaohua Feng, chemicals analyst at S&P Global Commodity Insights. New materials for wind, solar and battery production provide “huge growth opportunities” for petrochemical firms, he said.

State-owned oil major Sinopec Group, the nation’s biggest refiner, is at the forefront. It broke ground last week on a massive 1.5 million-ton-a-year ethylene project at one of its largest plants in Zhenhai. China leads the world in terms of ethylene production, the base chemical from which EVA is derived.

Zhenhai Investment

The investment at Zhenhai is worth 38 billion yuan ($5.3 billion) and involves 18 new projects, including three units with total capacity of 800,000 tons delivering EVA and POE among other compounds. Earlier in the month, Sinopec also announced 3 billion yuan in spending on a 100,000-ton EVA unit at its Guangdong plant and a 50,000 ton POE unit at its refinery in Maoming.

Sinopec’s investment is an attempt to snatch back market share from the private players that have entered the sector since 2021, according to Teng Xiaofang, an analyst at industry consultant SCI99. It’s also notable given the capacity cap of 1 billion tons a year imposed last month on China’s refining industry, another sign that Beijing is calling time on the expansion of its most polluting industries as it seeks to meet its carbon goals.

Still, the materials remain niche in the context of China’s total demand for crude. Some 12% of oil is used as a feedstock for petrochemicals. Ethylene is just one of many compounds produced, and only a fraction goes to making EVA.

But the margins are impressive. “EVA and POE are currently the most profitable products on ethylene lines,” said Teng. The EVA margin has topped 5,000 yuan a ton this year, whereas other downstream uses of ethylene are struggling to break even, she said.

The Week’s Diary

Wednesday, Nov. 29:

- CCTD’s weekly online briefing on Chinese coal, 15:00

Thursday, Nov. 30:

- China’s official PMIs for November, 09:30

Friday, Dec. 1:

- Caixin’s China factory PMI for November, 09:45

- China weekly iron ore port stockpiles

- Shanghai exchange weekly commodities inventory, ~15:30

On the Wire

Workers at MMG Ltd.’s copper mine in Peru began an indefinite strike Tuesday in the latest disruption at an operation that’s been marred by sporadic community protests in recent years.

As clean-energy manufacturing goes global, it’s creating challenges for Chinese companies and raising questions about whether more complexity will slow the green transition.

Eleven people have died after an accident at a coal mine in China’s northeastern province of Heilongjiang, the latest in a spate of fatalities across the country despite efforts to improve safety.

©2023 Bloomberg L.P.