Carbon Credit Developer Soars 80% in Rare Debut Despite Woes

(Bloomberg) -- Ecoeye Co. surged after becoming one of only a handful of carbon-credit developers worldwide to go public even as the $2 billion sector grapples with challenges to its credibility.

The South Korean company’s shares closed at 62,300 won, up 80% on the Kosdaq Index of small-cap stocks. Ecoeye debuted on Tuesday after raising 72 billion won ($56 million) to develop further emissions-reduction projects, including distributing cooking stoves that reduce the burning of firewood in developing nations.

The carbon offsets market has been hurt by a lack of regulation and doubts over whether many projects actually deliver climate benefits. The chief executive officer of South Pole — the world’s top seller of offsets — stepped down this month over allegations the company overstated the impact of the products it sold, while Shell Plc recently ended the world’s biggest corporate plan to develop the credits.

“Crises come and go, but the market will only grow in the long term,” Ecoeye CEO Rhee Soobok said in an interview before the debut. Additional scrutiny as a listed company will help the company increase transparency in the offsets market, he said.

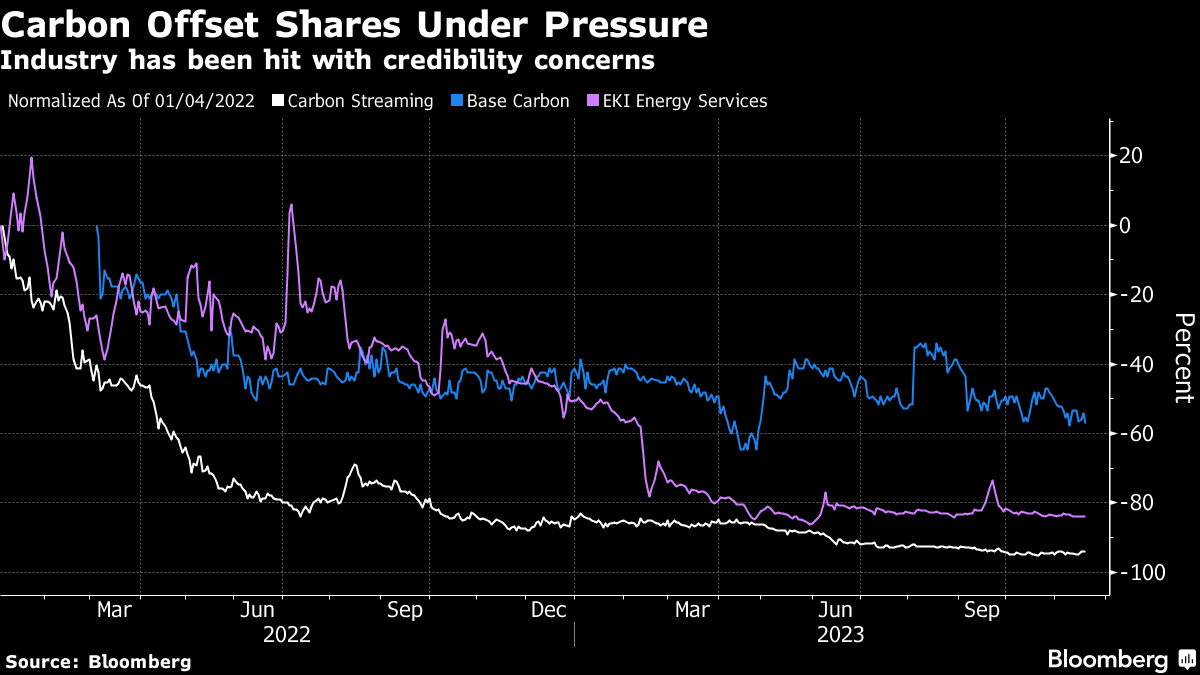

The South Korean firm joins a small cohort of carbon developers that have gone public, including Carbon Streaming Corp. and Base Carbon Inc. in Canada and India’s EKI Energy Services Ltd. Most companies that develop and trade credits remain privately owned as the market is still nascent and highly fragmented.

Ecoeye, set up in 2005, aims to generate about 10 million tons of credits per year, Rhee said. The company sold about 2.1 million shares at 34,700 won each, at the top of its marketed range.

(Updates with share gains in the second paragraph.)

©2023 Bloomberg L.P.