Battery Bonanza Is Being Sparked by Coal’s Exit in Australia

(Bloomberg) -- Australia’s rapid shift from coal-fired power to cleaner alternatives is underwriting a boom in battery projects able to store solar and wind energy.

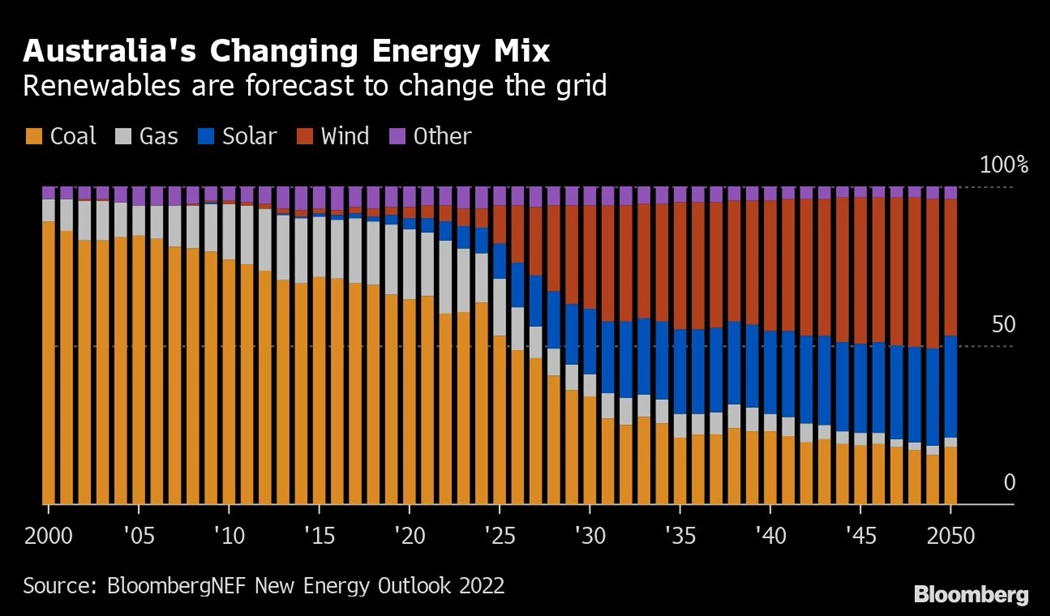

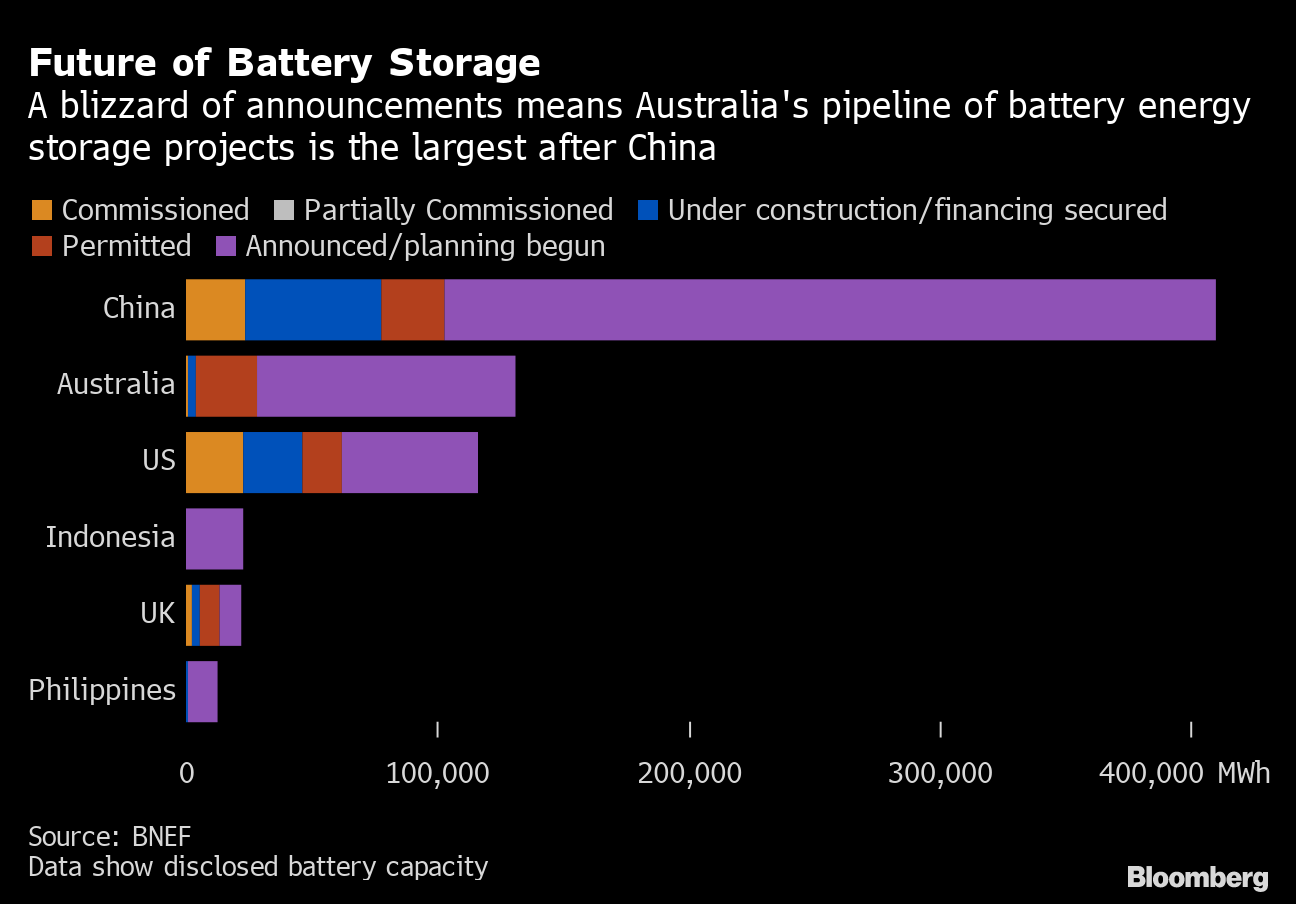

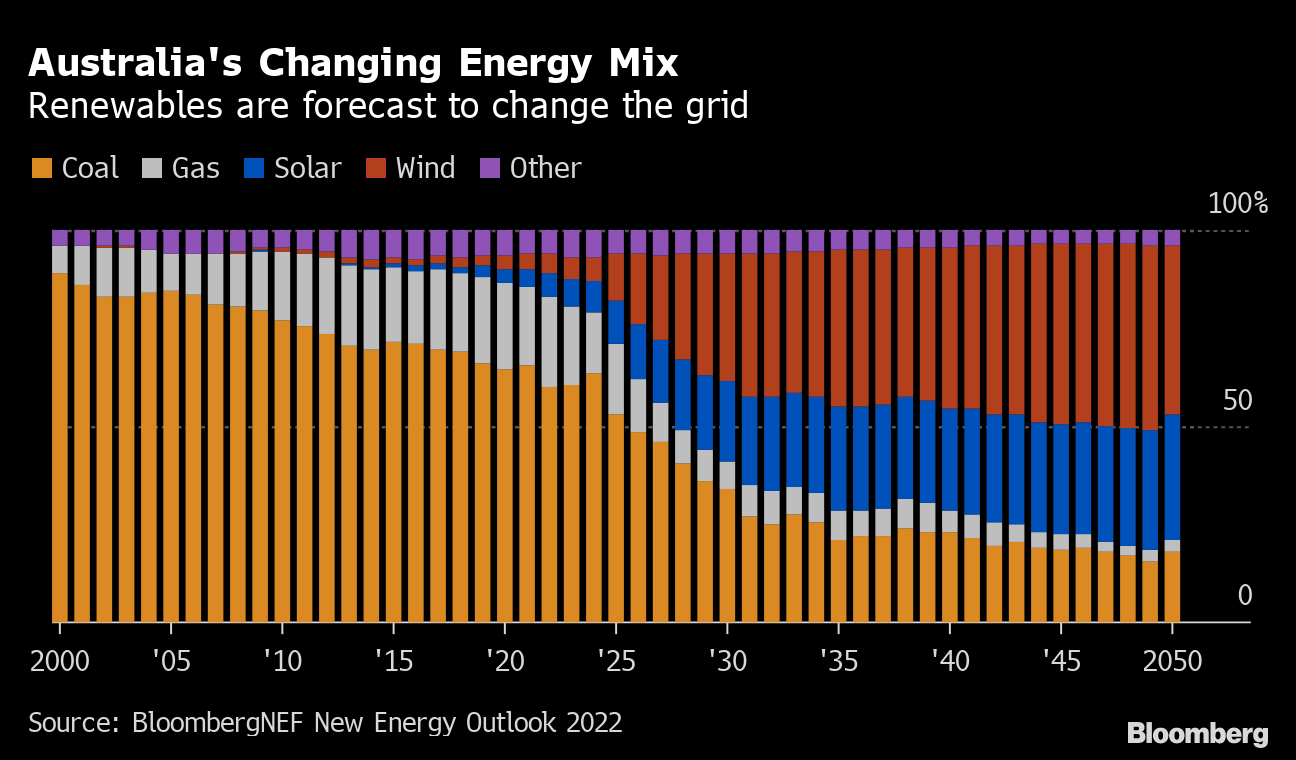

The country has at least 250 planned battery developments with a potential capacity of almost 130,000 megawatt-hours, a pipeline that’s second only to China, data compiled by BloombergNEF show. While Australia still relies on coal for more than half of its electricity generation, many major plants are set to close in the next decade.

“Operating a reliable low-carbon power system means that energy storage is imperative,” and investments are becoming “more urgent” as proposals to shutter coal assets accelerate, said Tim Jordan, commissioner of the Australian Energy Market Commission, the government’s adviser on energy policy.

The nation needs to deploy about A$64 billion ($43 billion) to build out sufficient battery storage plants through 2050, he said at a conference in Sydney on Tuesday. That’s part of an expansion of clean energy that could cost as much as A$242 billion and also include major additions of solar, wind and thousands of miles of new power lines, he said.

Utilities are racing to shutter aging coal stations to meet decarbonization targets, and as cheaper renewables make them unprofitable. Origin Energy Ltd. aims to retire the Eraring Power Station in New South Wales as soon as 2025, while AGL Energy Ltd. has brought forward closure plans by a decade. All capacity could be offline as early as about 2040, according to the main market operator.

Read more: How Australia Is Transforming Grids Away From Coal Power

“There’s really strong interest, the market over the last 12 months has become very hot,” James Harding, chief executive officer of Genex Power Ltd., a developer of projects including a battery facility in Queensland, said Wednesday in an interview. Mining companies, IT services providers and other major industries are among prospective customers exploring potential energy storage contracts, he said.

Tesla Inc. invigorated Australia’s energy storage sector — and arguably the global industry — with the 2017 installation of what was then the world’s biggest grid-scale battery at Hornsdale in South Australia. Tesla, which saw storage deployments jump 64% in 2022, is now focused on ramping up sales of its grid-scale Megapack batteries.

“This is the product that retires the fossil fuels one power plant at a time,” Drew Baglino, the company’s senior vice president of powertrain and energy engineering, said at an investor seminar last week. An entirely fossil-fuel free global energy system will require about 240 terawatt-hours of battery storage, Tesla CEO Elon Musk said at the same event.

While a large number of projects in Australia’s battery pipeline are at an early planning stage and may not complete either financing or permitting, the country is forecast to lift installations this year and in 2024, according to BNEF.

Australia’s government offered as much as A$176 million in December to help accelerate development of eight major projects with a combined cost of about A$3 billion. The funding is also to ensure the operations can replicate grid stability functions that have typically been provided by gas or coal plants.

Battery sites are also generating more revenue in Australia, and benefited from increased volatility in the nation’s power market in 2022, BNEF said in a report this month. Storage sites connected to the main National Electricity Market generated A$85 million by delivering supply to the energy market, up from A$12 million in the previous year. A further A$80 million was earned through frequency control and ancillary services.

(Updates to add comment in sixth paragraph.)

More stories like this are available on bloomberg.com

©2023 Bloomberg L.P.