BNP Paribas Exits Bond Arranging for New Oil, Gas Ventures

(Bloomberg) -- BNP Paribas SA will no longer help arrange bond deals if the issuer intends to use the proceeds to finance new fossil-fuel exploration and production.

The development means bond syndications and debt capital markets deals associated with projects for producing more oil and gas are now off-limits for the largest French bank, according to a person familiar with the guidelines who asked not to be identified because they’re not authorized to discuss the matter in public.

The decision adds detail to an announcement made last month by BNP, when the Paris-based bank laid out plans to expand restrictions around fossil-fuel financing, including the phaseout of its support for non-diversified oil exploration and production firms. BNP was criticized at the time by nonprofit ShareAction, which said the measures didn’t go far enough.

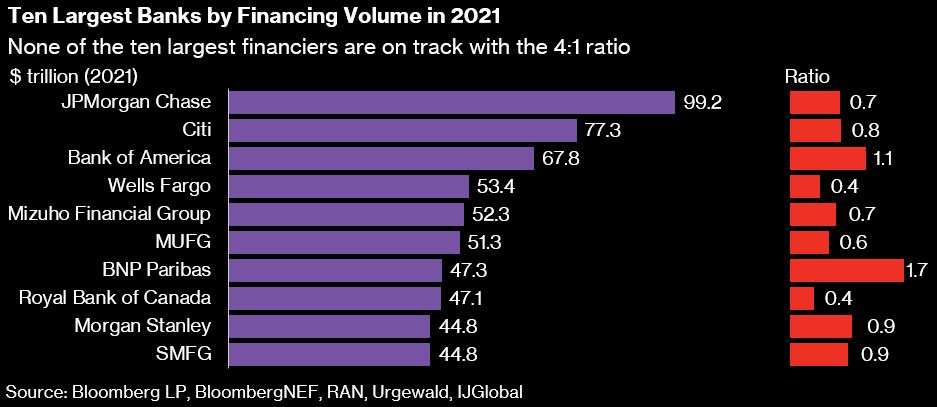

BNP remains the subject of a lawsuit by nonprofits, who say the bank isn’t living up to its environmental obligations. At the same time, BNP has overtaken its peers this year to become the biggest provider of bonds and loans for green projects, Bloomberg data show. And unlike a number of other major banks offering green finance such as JPMorgan Chase & Co., BNP isn’t among the top-10 underwriters of oil and gas deals. For that reason, its ratio of green to fossil financing is the highest among its biggest peers, according to BloombergNEF.

In an emailed comment to Bloomberg, BNP said the bank has “a core ambition to serve as a leading player in the movement towards a more sustainable economy” and has therefore “initiated a major pivot towards financing low-carbon technologies and activities,” while at the same time “progressively re-directing financing from carbon-intensive industries.”

The bank also said it still intends to “provide strong support — including capital raising and lending — to our clients with an ambitious energy transition agenda.”

And BNP will still look at syndicating bonds for oil and gas companies that are reducing or not expanding their fossil-fuel business, the person familiar said.

Financing Change

An analysis by BloombergNEF suggests the finance industry overall remains a long way from achieving the balance that’s needed to rein in global warming. The ratio of financing for clean-energy relative to fossil fuels must hit 4 to 1 by the end of the decade to live up to the Paris climate agreement, according to BNEF.

At the end of 2021, the ratio was 0.8 to 1, BNEF said in February. For BNP, the ratio was 1.7. Its decision to exclude new fossil fuels from its underwriting business “is indeed rare among peers,” said Trina White, an analyst at BNEF in New York.

BNP’s decision is “an interesting case study in engagement, as it doesn’t require the voting capability that is granted by owning equity in a firm,” said Ryan Loughead, a BNEF analyst in London. “BNP are using the implicit threat of denying a high-emitting firm credit unless it changes its behavior. How effective this will be remains to be seen, but it has the potential to become another string to the bow of financials hoping to facilitate the transition without simply enacting divestment policies.”

Banks hardly ever apply the same fossil-fuel financing restrictions to their capital markets business as they do to their lending operations. That may soon change, however, as the industry faces new guidelines. The Partnership for Carbon Accounting Financials (PCAF), which is made up of industry representatives, is currently piecing together standards intended to dramatically limit the so-called facilitated emissions of the global banking sector.

A Milestone

Any such agreement would mark a milestone in climate finance. Assigning responsibility for facilitated emissions — which refers to emissions enabled through debt and equity underwriting — has the potential to significantly reduce oil and gas companies’ access to the cash they need to grow, adding a powerful lever to efforts to rein in global warming.

Earlier this year, BNP said it was planning to scale back its funding of oil extraction and production by more than 80% through the end of the decade. It also promised to cut its financing of gas production by over 30%.

Meanwhile, there’s growing pressure from investors for banks to reduce exposure to fossil fuels. The Institutional Investors Group on Climate Change, whose members oversee $70 trillion of assets, has formulated emission-reduction standards that encompass debt underwriting amid inconsistent implementation of net zero pledges.

And some institutional investors have already stated their intention to offload banks that don’t cut emissions fast enough, including ABP, Europe’s biggest pension fund.

BNP is still waiting to see how its fossil-fuel financing restrictions will affect the legal challenges it faces from climate activists. In February, organizations including Oxfam joined forces to sue the bank in a Paris court. They alleged that BNP was failing to address its so-called duty of vigilance, a French legal obligation on companies to prevent negative effects from their businesses, including on the environment.

(Adds BNEF comment in ninth and 10th paragraphs, followed by chart.)

©2023 Bloomberg L.P.