Wall Street's New ESG Money-Maker Promises Nature Conservation — With a Catch

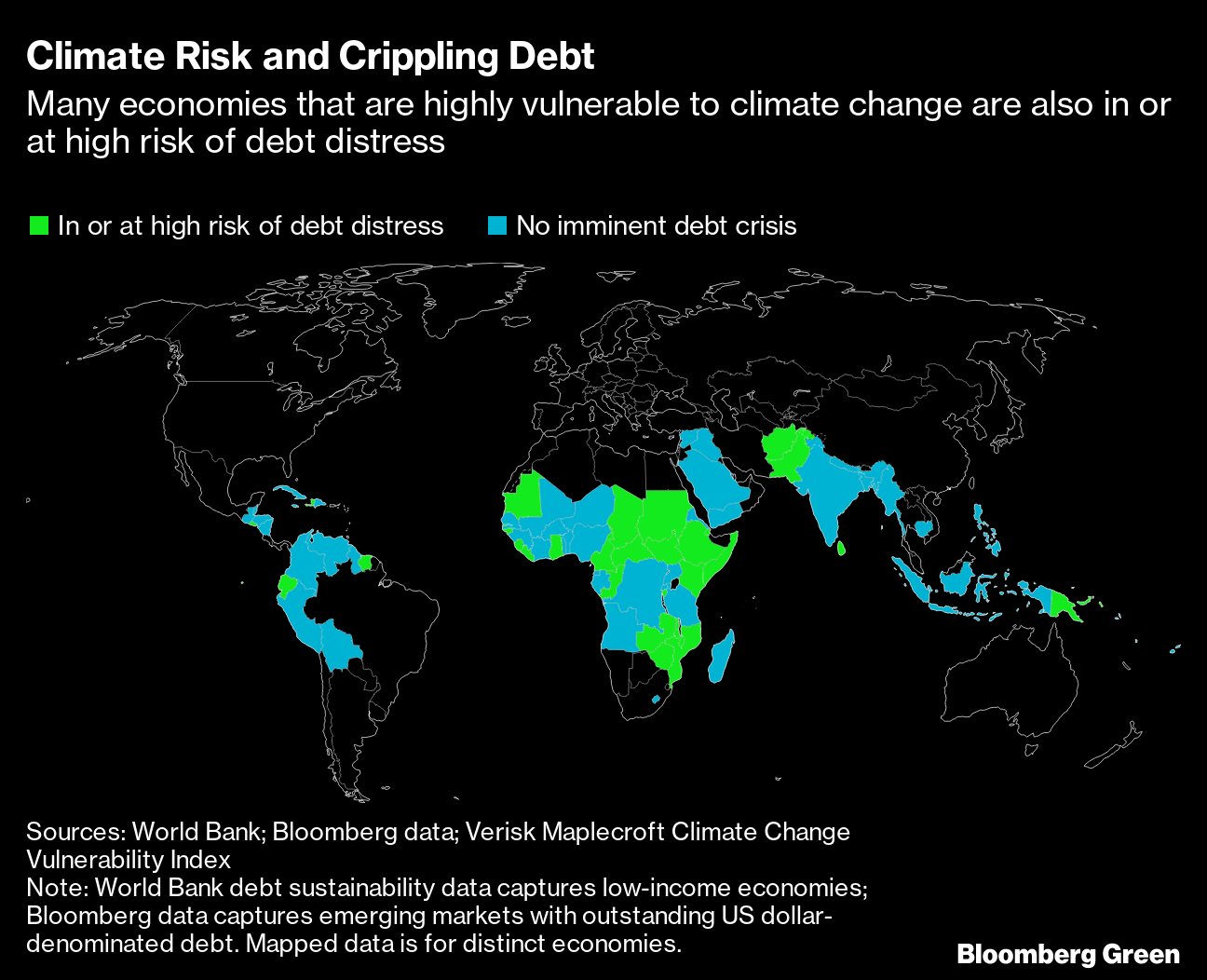

(Bloomberg) -- Big global banks are eying some of the world’s most fragile countries for a new experiment in financial engineering: debt relief in exchange for environmental protections.

Called “debt-for-nature swaps,” they present a tempting solution for the rising number of nations in distress, particularly those with ecosystems to protect. A country gets to avoid default and lower its debt burden, as long as it’s willing to earmark some of the savings to salvage a coral reef, preserve a forest or build a wind farm, for example. Global investors get better returns and enhanced green credentials. Wall Street takes a cut.

As much as $2 trillion of developing country debt may be eligible for this kind of restructuring, according to a rough estimate by the Nature Conservancy, a US nonprofit that’s taking a lead role in these deals. Belize inked a $364 million nature swap in 2021; Gabon signaled plans for a $700 million restructuring in October; Ecuador is said to be working on a $800 million transaction, and Sri Lanka is considering a $1 billion deal.

Buoyed by the finance industry’s newfound enthusiasm for biodiversity, backers of this latest flavor of swap are finding eager partners in investment banks and institutional investors. These are “turbocharged swaps,” said Daniel Munevar, economic affairs officer at the United Nations Conference on Trade and Development and former adviser to finance ministries in Greece and Colombia. “The limit in these operations isn’t the money to fund the swaps, it’s how much debt can be swapped.”

Behind the feel-good headlines, it’s unclear whether these kinds of swaps will deliver the promised benefits. The terms can be murky. Transaction costs are high. Experts question whether the complex and costly deals will achieve long-term financial stability. In December, as negotiators gathered at the United Nations’ COP15 biodiversity conference in Montreal, Greenpeace and dozens of other non-profits called for debt-nature swaps to be rejected.

“Debt-for-nature swaps have been popular for the wrong reasons. And the main wrong reason is that they generate the impression that you can kill two birds with one stone, that you can address a debt problem and you can improve nature conservation,” said Jeromin Zettelmeyer, director of Belgian think tank Bruegel and a former sovereign debt expert at the International Monetary Fund.

The first debt-for-nature swaps debuted in the 1980s, small deals limited by what governments and nonprofits could bring to the table. But with emerging market debt rising and the costs of climate change bearing down disproportionately on some of the most-indebted countries, there’s new interest in a supersized version. “There’s tons of demand,” said Ramzi Issa, managing director for credit structuring at Credit Suisse Group AG, who helped arrange Belize’s $364 million deal. “Investors haven’t really seen this before.”

The tiny Caribbean country is the biggest test to date. Better known for Mayan ruins and a nearly 200-mile barrier reef, Belize is also a serial debt defaulter, and by late 2020, it was again on its knees. The pandemic was keeping tourists away, depriving the country of its main revenue source. Its debt level approached 130% of GDP, almost double the International Monetary Fund’s sustainable threshold for the nation.

Read more: Debt-for-Nature Swaps Gain Traction Among Developing Countries

“The IMF was insisting on a program,” said Mark Espat, a former Belizean politician, now a consultant, who advised the country on its debt-for-nature swap. The IMF acts as a lender of last resort to debt-stricken countries, but its strict conditions make many governments balk. For Belize, that would have meant higher taxes, job losses and lower spending on social and conservation projects, Espat added.

The Nature Conservancy offered an alternative. It had arranged a debt-for-nature swap with Seychelles a few years earlier and was looking for a bigger deal. Together with Credit Suisse, it proposed to finance the buyout of Belize’s $553 million “superbond,” if the government agreed to spend some of the savings to protect its fragile mangroves and coral reefs. After almost a year of negotiations, around 85% of bondholders agreed to take 55 cents on the dollar, in cash, and staked their claims to a role in Belize’s ocean conservation.

The second part of the deal required TNC and Credit Suisse to re-sell the new debt — repackaged as “blue bonds,” a maritime twist on “green bonds” — to investors. That was harder: Belize had defaulted, changed terms on or restructured its dollar bonds at least five times in 14 years. Investors like Swedish pensions manager Alecta only bought in after the US International Development Finance Corporation agreed to provide insurance.

Here’s how it worked:

-

The Nature Conservancy set up a Delaware-based subsidiary, Belize Blue Investment Company, and raised $364 million from Credit Suisse

-

BBIC loaned those funds to Belize so it could buy back $553 million in debt, at a 45% discount from bond holders

-

Credit Suisse, via a special purpose vehicle in the Cayman Islands, issued $364 million in blue bonds to finance the deal

-

Belize will pay back the new, smaller loan from BBIC over 19 years with an interest rate starting at 3% and rising to 6% in 2026. It must set up a $24 million conservation endowment, and commit to spending $84 million on conservation and to protecting 30% of its oceans

-

The US International Development Finance Corporation insured the BBIC loan, essentially putting the US government on the hook if Belize can’t pay

Read more: Belize Cures $553 Million Default With a Plan to Save Its Ocean

At the time, the deal was hailed as an all-around success. It cut the country’s debt by 12% of GDP, reopened its access to financial markets, and redirected money once destined for foreign creditors into the local economy. Belize promised to funnel almost $180 million over two decades to protect its oceans. Investors were glad to have backed a worthy cause.

It was a textbook case of blended finance: Public funds are used to de-risk private investment and the two money streams combine to finance the otherwise unfinanceable. The strategy is widely viewed as a way to plug the multi-trillion-dollar gap in finance for decarbonization, climate adaptation and nature protection in developing countries.

‘The nirvana we’re trying to reach.’

Debt swaps like this one are “the nirvana we're trying to reach,” said Oliver Withers, head of biodiversity at Credit Suisse. “Products that are scalable and that can be replicated. That’s the really exciting thing with debt swaps — it ticks both of those boxes.”

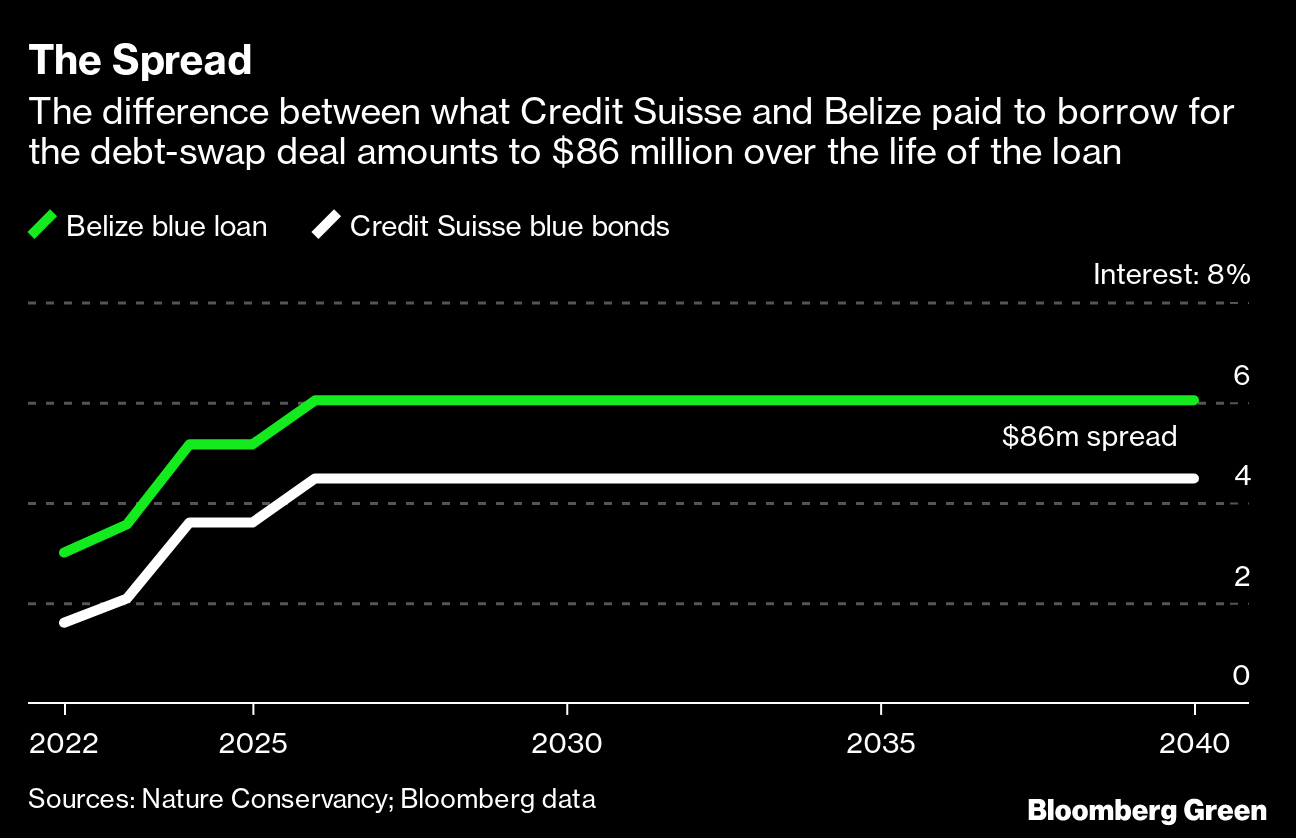

Not everyone is so sanguine. A closer look reveals that Belize’s costs were far higher than the initial $10 million price tag, said UNCTAD’s Munevar, who has studied the transaction. Millions more are hidden in Belize’s interest payments. Munevar compared what Belize pays with what Credit Suisse returns to investors in the new blue bonds. Over the life of the deal, the difference adds up to $84 million, Munevar estimated.

That spread, which TNC says is in fact $86 million, covers insurance premiums for DFC and private-sector reinsurers, along with $14 million to repay a $10.5 million loan from TNC to Belize at 3% interest and “standard financing costs (such as audit, accounting, rating agency expenses),” according to an organization spokesperson. TNC will be reimbursed at cost for staff time spent on conservation work.

Still, that’s a much higher cost than the $10 million initially disclosed, and it speaks to how murky and complicated these deals are, Munevar said. “I find this profoundly concerning — first, because it leads to a misleading assessment of the cost-and-benefits of the arrangement and second, because this is an arrangement based on taxpayer money from both Belize and the US.”

These costs make the swap “one of, if not the most, expensive debt restructurings in recent history relative to the size of the transaction,” said Munevar. Sean Newman, chief investment officer at Sagicor Group, a financial services conglomerate in the Caribbean, and emerging markets debt expert, agreed that the deal is “outrageously expensive.”

For Bruegel’s Zettelmeyer, the cost comes as no surprise. These operations are “small, they are complicated to arrange and so you end up in effect paying a lot to arrange this to someone for a very small gain,” he said. “It’s an inefficient type of operation and ultimately then the country pays for it.”

Credit Suisse said any lower borrowing costs were passed on to Belize; the difference was “provisioned to cover ongoing transaction costs,” including insurance premiums and third-party maintenance expenses. The Zurich-based bank declined to specify how much it earned on the deal.

Christopher Coye, minister of state in the Belize finance ministry, said the country’s transaction costs totaled $14 million, including financial and legal expenses related to the Eurobonds buyback, the issuance of the new blue loan and blue bonds, and conservation agreements. The government was “completely transparent with this transaction,” he said. “Every single blue bond related agreement was tabled in Parliament for debate and passage.”

Greenpeace and the group of 30 advocacy groups raise other concerns. In particular, such deals lock public funds into new conservation organizations, possibly giving short shrift to other needs, such as health or education; they also jeopardize wider and lasting reforms to debt management. “The risks and pitfalls of turning to financial markets to fund marine conservation are being ignored,” the organizations said in their December letter.

Belize stands by its transaction, costs and all. “Whatever spread there is in there for Credit Suisse or for any other entity, Belize is far better off than it would have been otherwise,” said Espat, the domestic financial consultant. To the growing number of countries interested in this kind of restructuring, he had the following advice: “Negotiate as hard as possible.”

--With assistance from and .

More stories like this are available on bloomberg.com

©2023 Bloomberg L.P.