EU Seeks to Ease Crisis But Battles Lie Ahead: Energy Update

(Bloomberg) -- European Union ministers on Friday asked the Commission to come up with emergency liquidity measures to help strained energy markets, as well as severing the link between expensive gas and power prices.

The bloc, suffering from an unprecedented energy crisis, is increasingly desperate to prevent price surges from hammering the economy. After meeting in Brussels, ministers called for steps to skim off energy companies’ profits, while there were no concrete measures to force a reduction in demand -- the crucial factor.

Officials had discussed a proposal to cap imported gas prices, with an idea floated to limit the prices of all imports -- not just those from Russia. In the end, they agreed that needed more work.

Why Europe Wants to Change the Way Power Gets Priced: QuickTake

Key Developments:

- EU ministers call for urgent push to intervene in energy market

- EU energy-crisis warnings worsen with need for immediate fix

- Trading in the euro is all about the energy crisis

- Liz Truss’s target to make the UK a net energy exporter means big reversal

(All timestamps London.)

German Gas Rationing Partially Needed: Deutsche Bank (5:02 p.m.)

“At least partial” gas rationing is needed in Germany this winter, according to Deutsche Bank AG Chief Economist Stefan Schneider. The bank’s models now suggest storage levels will fall below 10% in early March next year, but Schneider expects the Federal Network Agency to react with individual or overall rationing measures before then. Gas auctioning could be one option to help avoid such rationing, he wrote in a research note.

Bloc Does Little to Curb Demand, Says Aurora (4:40 p.m.)

The EU on Friday did little to push reduction in gas demand beyond a previously agreed voluntary cut of a 15%. “They still wanted the incentives to reduce gas and electricity consumption, and that’s already happening,” said Anise Ganbold, head of research for global energy markets at Aurora. “Wherever we can reduce gas consumption, it’s already been reduced.”

From May to August, gas demand in northwest Europe dropped by 18% compared to the same period in 2021, according to the firm’s data. That would have been even lower had it not been for the power sector, which burned more gas this summer with French nuclear plants shut for maintenance, the wind not blowing and hydro output reduced because of droughts.

EU Energy Demand Must Come Down: Yergin (4:10 p.m.)

Europe’s energy demand “has to come down” for the region to get through the current crisis, according to Daniel Yergin, vice chairman of S&P Global. A 15% reduction, through steps like voluntary responses to prices could help significantly, he said in an interview on Bloomberg TV. While Europe’s has already reduced much of its reliance on Russian energy, much depends on the winter, Yergin said. “Once they get the storage filled in Europe, I think that takes some of the pressure off the market.”

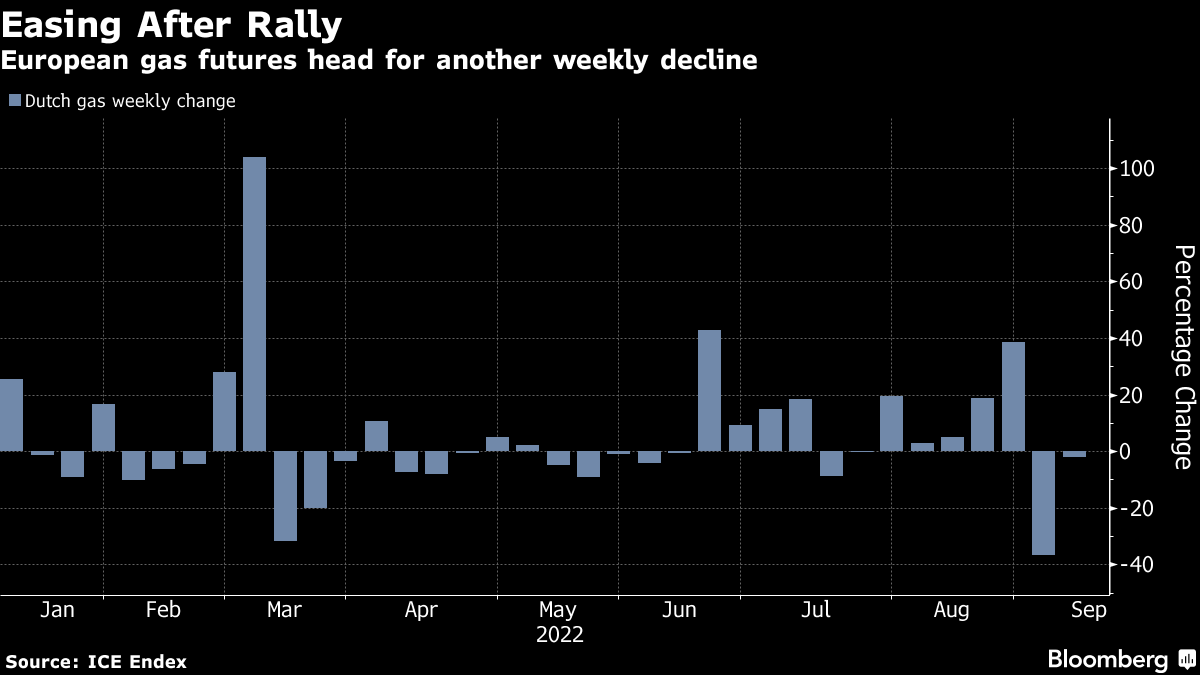

Gas Futures Slump on EU Push for Action (3:50 p.m.)

Benchmark Dutch gas futures dropped as much as 9.7% to 199.09 euros per megawatt-hour after EU ministers agreed the bloc’s executive arm should take steps to intervene to ease the crisis. Prices have been extremely volatile recently, posting the biggest weekly drop on record just seven days ago. Still, they’re about eight times higher than normal for this time of year.

Nord Stream Not Needed With Enough Gas-Demand Curbs (3:38 p.m.)

A 13% overall reduction in the EU’s gas demand -- compared with the five-year average -- is enough to get through this winter without the Nord Stream pipeline or flows through Ukraine, said James Huckstepp, head of EMEA gas analytics at S&P Global Commodity Insights. Voluntary targets to curb consumption aren’t necessary, he said. “Prices are doing the work.”

US Gas Exporters Oppose Price Caps (3:29 p.m.)

The US natural gas export industry added its voice to the opposition over proposals for the EU to cap prices on imports of the fuel.

“Measures to impose price caps inevitably distort and undermine energy markets, creating unintended consequences,” Charlie Riedl, executive director of the Washington-based Center for Liquefied Natural Gas, said in a statement Friday. The US is the largest exporter of LNG to the bloc.

Europe Seeks ‘Grand Bargain’ on Energy (3 p.m.)

While EU energy ministers have agreed the bloc needs a comprehensive plan to solve its energy crisis, how that plan will be designed remains to be seen, according to Simone Tagliapietra, a senior fellow at the Bruegel think tank in Brussels.

“From windfall measures to gas price caps, from electricity demand reduction to emergency liquidity to utilities, all options remain at the table,” he said. “As all these measures are extraordinarily complex to be engineered, it will take a great political commitment by member states to quickly adopt them in the coming weeks. Europe is off for a grand bargain on energy.”

Habeck Says Price Cap Second-Best Option (2:47 p.m.)

German Economic Affairs Minister Robert Habeck said a price cap could be an option to help ease the crisis, but it’s only the second best option. “The right option would be to not even let prices get so high and then to bring them down, but that we and all European citizens would not even be confronted with such high prices,” he said in Brussels.

Commission to Propose Energy Measures Next Week: Simson (2:46 p.m.)

EU Energy Commissioner Kadri Simson said the bloc will proposed “unprecedented” measures next week as countries face daunting challenges. She added that her team is working on a broader plan to adjust the structure of Europe’s electricity market, which she hopes will be “ready early next year.” Europe will need a high level of liquefied natural gas imports to safely make it through winter, according to Simson.

EU Commission on the Right Path, Says Habeck (2:31 p.m.)

The European Commission’s path to redefine the energy market is the right one, German Economic Affairs Minister Robert Habeck said in Brussels. He added that the EU has agreed to reduce energy prices and the burden on consumers. Habeck also said Germany will quickly decide on gas importer VNG’s request for a state bailout.

Ministers Demand Action Amid Price Cap Talk (2:19 p.m.)

European Union energy ministers asked the bloc’s executive arm to come up with urgent steps to provide liquidity to energy traders clobbered by massive margin calls and to skim off energy companies’ windfall profits so the funds can be redirected to struggling consumers.

“I hope we will be able to conclude the discussions by the end of September,” Czech Industry Minister Jozef Sikela told reporters.

Ministers Seek Fossil Fuel ‘Solidarity Contribution’ (2:15 p.m.)

The ministers called on the Commission to enact measures so that producers of power that don’t use gas -- the most expensive source -- will be subjected to a cap on their revenues. Fossil fuel companies should also be subject to a “solidarity contribution.”

The Commission should come up with the measures by mid-September. They also called for an “emergency and temporary intervention,” including a gas price cap. Exactly how that would work is not clear.

Ukraine Offers Poland Electricity (2:08 p.m)

Ukraine has agreed to sell Poland electricity from the Khmelnitskiy nuclear power plant “soon,” Prime Minister Mateusz Morawiecki said at a joint news conference in Kyiv with Ukrainian President Volodymyr Zelenskiy.

Italy Says ‘Silver Bullet’ Hard to Find (2:08 p.m.)

Italian Minister for Ecological Transition Roberto Cingolani explained why consensus is so hard to find, despite the entire region getting hit by the energy crisis.

“There are 27 states with completely different energy mixes, with completely different geographical positions, meaning heavier or less heavy summers and winters, with completely different interconnections,” he said in Brussels. “You need to accept that with such a heterogeneous mix of situations, unfortunately it is very difficult to find the silver bullet, the solution that pleases everyone, quickly.”

Price Caps Need More Work (2:07 p.m.)

After some states objected to imposing a cap on just Russian gas -- partly out of fear Moscow would retaliate -- there was some discussion of trying to limit the price of all imported gas, diplomats said. In the end, ministers said “further work is needed” on the possible introduction of such a measure.

Dutch Groningen Field Only for Emergencies (1:34 p.m.)

The Groningen gas field in the Netherlands will only be used in the event of a clearly defined emergency, not just to boost production and ease prices, according to Hans Vijlbrief, the country’s state secretary for extractive industries. Dutch authorities -- wary of earthquakes triggered by drilling -- have previously said they plan to wind down output at the field and would only increase output as a last resort. However, the crisis in Europe has intensified since Russia halted Nord Stream flows last week.

EU Should Assess Price Cap Effects: Norway (1:32 p.m.)

Norway wants the EU to take into consideration the broad effects of a price cap on gas supplies. “We fully understand that the energy crisis in Europe demands political action, both on national and EU-level,” State Secretary Andreas Bjelland Eriksen said.

“Concerning the concrete proposals from the Commission, it is important to assess the effects of a price-cap on the future energy supply,” he added. “It is equally important to assess how the proposal affects the power market, both in the short and the long term.”

German Energy Lobby Questions Price Caps (12:10 p.m.)

Kerstin Andreae, the head of Germany’s largest energy lobby group BDEW, opposed price caps as they would “only cause further uncertainty” about investments in renewable energies. “Interventions in the energy market are highly risky and should only be done after careful considerations of the partly serious side or long-term effects,” she said. To support affected consumers, the lobby group recommends direct state supports.

She also warned that “acute market intervention in the current situation would be counter-productive and impede the return of power utilities.” Instead, she called for more production capacity and less use of fossil fuels.

ECB Can Offer Liquidity to Banks, Not Energy Firms: Lagarde (12:04 p.m.)

European Central Bank President Christine Lagarde ruled out providing short-term financing lines to struggling energy firms -- saying that’s the job of European Union governments.

“In this current, very volatile environment, it’s important that fiscal measures be put in place to provide liquidity to solvent energy-market participants, in particular utility firms,” Lagarde told a news conference Friday in Prague.

German Power Network Costs Rise Sixfold (11:58 a.m.)

Amprion GmbH, Germany’s largest power grid operator, said its cost for redispatching -- the day-to-day management of electricity flows and shortages -- have jumped sixfold. Chief Executive Officer Hans-Juergen Brick also warned of a possible threefold rise in network fees that companies have to pay.

The transmission network fees also push up the costs of using local distribution networks, increasing the financial burden for smaller utilities and businesses. Large industry tends to be directly connected to the transmission network.

The four German transmission system operators will announce the new preliminary usage fees on 1. October.

Ministers Oppose Capping Only Russian Gas (11:44 a.m.)

EU ministers oppose taking measures to cap only the price of Russian gas, according to diplomats familiar with the talks.

Ministers also want steps on excess energy profits; and they all support measures to bring extra liquidity to energy markets straining under massive margin calls, the diplomats said.

Hungary Against Energy Price Cap (11:04 a.m.)

Hungary and the Czech Republic opposed a European Commission proposal to cap energy prices. “The price cap is a cloaked energy sanction,” Foreign Minister Peter Szijjarto said in a Facebook post, while attending a meeting of energy ministers in Brussels. “We’ve made it clear, we won’t even talk about energy sanctions.”

The Czech Republic, which holds the EU’s rotating presidency, said before the meeting that it wants to exclude the debate about an energy price cap from the agenda of the meeting altogether.

EU Scrutinizes Banks’ Readiness for Crisis (10:43 a.m.)

The European Central Bank is intensifying discussions with bank executives over their readiness for a potential surge in company defaults and a drying-up of energy-market liquidity.

The Frankfurt-based bank watchdog wrote to lenders last month, telling them to analyze the impact of a gas stoppage on their businesses, according to people familiar with the matter. Responses are due in mid-September, and follow-up conversations are to come by the end of this month, said the people.

No German Backing for Russia Gas-Price Cap (9:45 a.m.)

Germany doesn’t support a price cap on Russia gas because some countries are still dependent on those supplies, Economy Minister Robert Habeck told reporters in Brussels. “These countries still have dependencies which force them to use this gas,” he said. “So it would be inappropriate to say that Germany always calls for understanding, but other states don’t get any.”

Austria, which is still reliant on gas supplies from Moscow even though the dependence has eased, also doesn’t back a price limit, Energy Minister Leonore Gewessler said.

Germany is also against a general cap on gas prices as it would send the wrong signal to the market, he said. Habeck supports a “price cap on basic energy needs,” but consumers would need to pay more when their use rises above a certain amount.

Poland Cold on Gas Solidarity Deal with Germany (9:15 a.m.)

Poland doesn’t see the need for a bilateral gas solidarity agreement with Germany, according to Climate Minister Anna Moskwa. Germany’s economy minister said earlier this week that neighboring Belgium, Luxembourg, the Netherlands and Poland refuse to engage in “constructive negotiations” about such deals, a move that could exacerbate the gas crunch in Germany.

“Solutions that we have on the table for now are sufficient,” Moskwa said, referring to existing cooperation between Polish and German gas system operators. It’s obvious that if we have surpluses on our gas or power market we share them but based on our own national security and our national interest and not based on some forced mechanisms.”

Poland Calls for Quick Action (8:50 a.m.)

Current energy prices are not acceptable for all EU states and members need to react quickly to protect households and businesses, Poland’s Climate Minister Anna Moskwa said. Friday’s meeting of ministers will have no votes, but the discussions will be key for future decisions on what solutions to approve.

Ireland Says Energy Proposal Needed in Weeks (8:30 a.m.)

Irish Environment Minister Eamon Ryan said the EU needs to deliver concrete ideas on how to deal with the energy crisis as soon as possible.

“The commission proposals have to be delivered within weeks not months,” Ryan told reporters in Brussels. “Doing nothing is not an option.”

He said the key, deliverable measures energy ministers will focus on will be capping revenue for low-cost electricity producers, a solidarity contribution from fossil fuel companies and reducing demand. He added that ministers will meet again to discuss other measures.

Also see: Europe’s Challenge to Survive Without Russian Gas in Five Charts

Energy Needs Extraordinary Intervention: Simson (8:22 a.m.)

EU Energy Commissioner Kadri Simson said she will will present ministers with five proposals. She said the European Commission needs to offer governments tools for addressing the current emergency. “This is not only about prices. Also about security of supply,” she said, adding the market needs extraordinary intervention. The EU is also planning to revive dialogue with Algeria on gas supply, she said.

More Than Half German Voters Want Nuclear Extension (8:00 a.m.)

More than half of German voters want Economy Minister Robert Habeck to keep the country’s three remaining nuclear power plants in operation beyond April to help secure energy supply, according to a poll published Friday.

Habeck, a member of the Greens party, announced this week that two of the plants would be kept in reserve until mid-April and the third would be shut down at the end of this year as planned, prompting widespread criticism. Less than a third of voters back the minister’s plan, the Sept. 6-8 poll of 1,299 voters for public broadcaster ZDF showed.

Also read: Germany’s Habeck Defends Move to Keep Nuclear Units in Reserve

Czech Minister Says No Time to Waste (7:57 a.m.)

Czech Industry Minister Jozef Sikela said “there’s no time to lose” in reaching an agreement on EU-wide measures to tackle the bloc’s energy crisis. Sikela said he expects EU member states to agree on a direction on Friday, which they’ll pass onto the European Commission with a legislative proposal coming shortly thereafter.

“I expect the proposal in a few days and I want to have clarity at the end of the month,” he said. “I already see points where I’m pretty sure we will align”

He also said he’s “pretty sure” EU ministers meeting on Friday will align on liquidity measures to help ease the burden on the market. He also said he’s confident the group can reduce household energy prices.

Newest European Nuclear Reactor Boosts Output (7:55 a.m.)

Power output at Europe’s newest reactor exceeded a landmark 1,000 megawatts on Friday just as the power market needs all the supply it can get. Finland’s Olkiluoto-3 nuclear unit will provide much-needed supplies to the Nordic nation’s taut power system when it reaches the full 1,600 megawatt capacity later this autumn, after imports from Russia were cut completely in May. The Finnish grid has warned of rolling power cuts this winter as Europe faces its worst energy crisis in decades.

Germany’s Lindner Calls for Russia Oil-Price Cap (7:51 a.m.)

Germany’s Finance Minister Christian Lindner says he’ll be “inviting all members of the EU to support the idea of an oil price cap.”

Speaking before an informal meeting of European Union finance chiefs in Prague, he said, “we want to avoid higher revenues for Russia” via that price limit. The Group of Seven last week announced plans to implement a price cap for global purchases of Russian oil -- a measure it hopes will ease energy market pressures and slash Moscow’s overall revenues.

VNG Asks Germany for Help (7:50 a.m)

VNG AG, a subsidiary of EnBW, will submit an application for stabilization measures to the German Ministry for Economic Affairs and Climate Action Friday, according to a statement. Measures are directed at absorbing the currently accumulating significant losses to replace natural gas and at enabling business operations to continue.

Effective Energy Action Can Prevent Recession (7:20 a.m.)

Europe can avoid recession if officials in charge of monetary and fiscal policy can agree on effective measures to tackle soaring energy costs, according to EU Economy Commissioner Paolo Gentiloni.

“We have the chance, if we work together, monetary policy and fiscal policy, and with the right package on energy now, to avoid recession,” Gentiloni said before a meeting of EU finance ministers in Prague on Friday. “It’s a challenge, but it’s possible.”

Gas Prices Edge Lower (7:27 a.m.)

European gas futures slid, erasing the benchmark’s weekly gain. Prices have been volatile this week after Russia halted supplies on the Nord Stream pipeline indefinitely and markets weigh how effective EU measures to tackle price rises will be.

India May Keep Importing Coal (5:43 a.m.)

Utilities in India may need to continue coal imports to avoid any new squeeze on the nation’s energy sector, according to Power and Renewable Energy Minister Raj Kumar Singh.

With stockpiles falling in recent weeks, power plants must act to maintain adequate inventories and import supply if needed -- even though the nation’s longer-term policy is to limit purchases from overseas, he said in an interview. Coal accounts for about 70% of electricity generation in India.

Buying by India’s power firms could add to global competition for seaborne coal that’s already pushed benchmark prices to records.

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.