The Propeller Is Making a Comeback in The Pursuit of Greener Air Travel

(Bloomberg) -- The propeller — a relic from the dawn of powered flight more than a century ago — is making a comeback as an emblem of aviation’s greener future.

Rotors are proliferating on futuristic air taxis and plane prototypes powered by hydrogen and electricity. The old-school feature is also central to a radical new engine that could one day replace the turbofans on today’s jetliners as climate change pushes the industry to innovate its way out of fossil-fuel dependence.

That design, developed by General Electric Co. and France’s Safran SA, could burn 20% to 30% less fuel with similar or less noise than their latest offering for single-aisle jets, executives say. They’re angling to put the engine, with its giant whirling propellers, on workhorse planes by the mid-2030s.

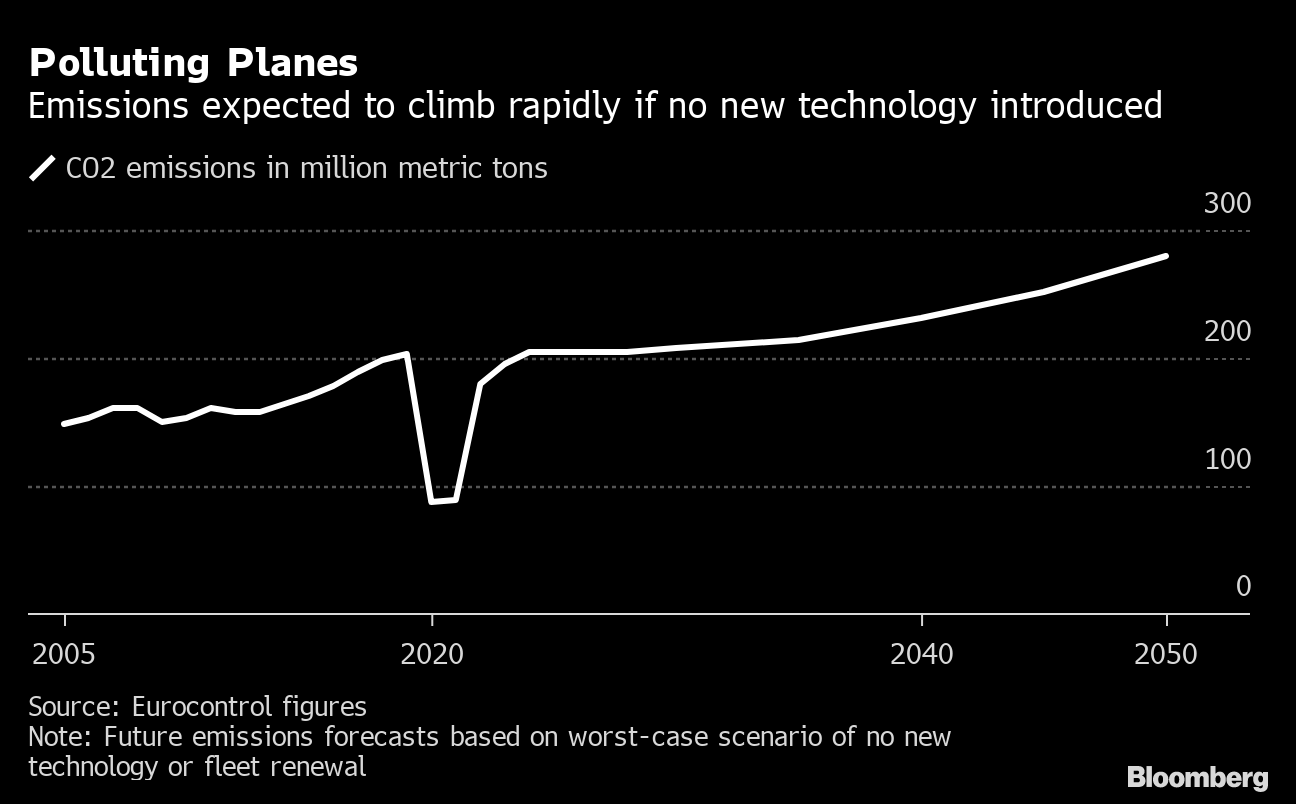

The invention push makes for some dizzyingly expensive and consequential wagers for some of the sector’s most prominent companies. Boeing Co., Airbus SE and enginemakers such as Rolls-Royce Holdings Plc need to plow billions of dollars into producing more environmentally friendly planes that will fly well past the 2040s.

But it’s not clear yet which technologies will provide the best path forward, or when airlines will be ready to embrace them. The financial toll of a misstep could linger for decades — or even wipe out a company — while engineering hurdles and regulatory scrutiny loom as potential roadblocks.

“I wouldn’t want to be a president of Boeing or Airbus,” said Steve Udvar-Hazy, the pioneer of aircraft leasing who’s been one of both companies’ biggest buyers for decades. The challenges they face in trying to make the right call about what will replace today’s technology “are probably the most difficult they’ve faced in my career,” he told a conference on Sept. 7.

Futuristic Concept

The futuristic concept from GE and Safran’s partnership, CFM International, features scimitar-like blades that spin exposed outside the turbine. It eliminates the casing that is seen on turbofan engines that currently power most commercial aircraft.

That so-called open-fan design means engineers can install much bigger blades, which improves fuel efficiency by accelerating more air through the fan section for thrust instead of through the fuel-burning center. And unlike piston-driven propeller planes of yore, those huge blades are driven by a high-tech turbine made with advanced materials that CFM says can run on biofuels or hydrogen.

While they unveiled the concept last year, executives of the partnership offered new details in interviews about how they’ve worked to overcome key technical hurdles that bedeviled earlier open-fan designs.

Using supercomputers housed in research labs at the US Department of Energy, GE Aerospace’s Vice President of Engineering Mohamed Ali says company engineers have unlocked how to resolve trade-offs between cruise speed, fuel efficiency and noise. The government machines allowed GE to model turbulence and airflow around the engine on an almost molecular level, revealing how to precisely sculpt blades to make them quieter, he said.

Initial flight tests are planned for mid-decade before CFM and Airbus rig the engine to an A380 superjumbo jet for additional demonstration flights prior to 2030.

If those trials are successful, analysts say CFM’s open-fan design will be a serious contender to power the aircraft that will eventually replace Boeing’s 737 Max and Airbus A320neo jetliners — the duopoly’s most important cash cows.

“Up until now, each new engine family has been evolutionary,” said analyst Robert Spingarn of Melius Research. “These are revolutionary.”

As Ali sees it, climate change leaves little choice but to pursue such dramatic reinvention.

“Can we really afford to leave that fuel-burn advantage on the table?” he said.

Engineering Advances

Of course, propeller planes have never completely vanished from the market, even after the modern jet ushered in faster travel decades ago. Such aircraft have been a mainstay of short, regional hops, though never coming close to matching the sales and speed of the turbofan-powered jets that routinely fly hundreds of people across continents and oceans.

But the massive, exposed propellers like those in CFM’s open-fan concept would be something of a different species — a throwback, in some ways, to the 1980s. Back then, GE and rival enginemaker Pratt & Whitney each developed and flight-tested similar engines as a solution for airlines looking to blunt sky-high fuel costs with a jump in efficiency. Boeing even marketed a plane powered by twin open-fan engines. But the concepts never made it to production, as technical challenges abounded and oil prices plunged.

Now, though, the harsh reality of climate change is likely to make for a more enduring impetus for invention than fickle energy prices did last century.

Engineering barriers, too, are falling. GE’s 1980s model had two sets of exposed blades that spun in opposite directions, making it heavy, complex and raising reliability concerns.

That is one of the problems GE’s Ali says has now been solved. The second set of blades was needed to reach the necessary cruise speed of commercial airliners. But using supercomputers and wind-tunnel tests, Ali says GE discovered that a single set of blades with stationary vanes behind them can yield the same result.

Meanwhile, propellers figure prominently in other efforts to make air transport greener. Pratt & Whitney and Collins Aerospace plan to flight-test in 2024 a hybrid-electric propulsion system on a regional, propeller-driven aircraft. Funding is also gushing into startups developing new propulsion systems. Sustainable aviation garnered 23% of the $2.2 billion invested in futuristic air technologies during the first half of 2022, up from just 2% of funding a year earlier, according to McKinsey data. Battery-powered eVTOLs, which aim to whisk travelers over traffic-clogged streets, raked in the most funding.

Challenges to Adoption

While the auto industry decisively pivots to electric vehicles, Boeing and Airbus are taking more cautious steps to decarbonize, like replacing petroleum-derived kerosene with biofuels that can be burned by today’s jet engines. Hydrogen-powered airliners likely won’t be ready for decades, and in the meantime, going all-in on designs that rely on open-fan engines is risky — not least because conventional turbofans also have room for powerful improvements.

“The modern turbofan is one of the most efficient power generators that people have ever created,” said Brian Yutko, vice president and chief engineer for sustainability and future mobility at Boeing.

“If you take the duct away,” he said, referring to a jet engine’s protective covering, “you don’t absolve yourselves of integration challenges — you have different ones.”

That helps explain why Rolls-Royce and Pratt & Whitney are sticking to a more conventional engine approach. Rolls-Royce, after assessing and ground-testing open-fan technology, is moving ahead with what’s known as a geared turbofan with a model called Ultrafan that targets burning 25% less fuel. Pratt spent $10 billion to develop a geared turbofan that entered service in 2015 and offers a 15% improvement in efficiency versus its predecessors.

Geoff Hunt, Pratt’s senior vice president for engineering, said the engine could boost fuel efficiency by another 20% via technology upgrades over time — a similar gain to what CFM expects its propeller design could offer.

Such advances in turbofans could present a serious challenge to widespread adoption of open-fan formats. Airlines might be loath to switch to an unproven new engine when a familiar option — one that fits neatly into the established design of existing planes – is offering comparable improvement.

There are other obstacles, too, such as the likelihood that regulators would pay new aircraft special attention. The GE and Pratt concepts of the 1980s bellowed so loudly, they raised doubts they could comply with noise limits. Safety issues, namely how to prevent a blade failure from sending debris slicing through a plane’s frame, would also be scrutinized by authorities — and customers, too.

Airbus, for example, was skeptical of open-fan designs pitched by CFM about 15 years ago as it considered engines for what became the A320neo, people familiar with the matter said. The planemaker would’ve needed to completely rework the A320 to make the engine fit, one of the people said, and the blades would’ve been positioned high and on the rear of the aircraft, presenting challenges to winning regulatory certification due to the risk of a blade breaking off or a tail scrape.

And that’s all before considering how passengers might react.

“Looking out and seeing Cuisinart blades under the wing with double rows, dozens of blades — yeah, that’s disconcerting,” said aviation consultant Richard Aboulafia.

New Jets

Developing a new airplane can cost $15 billion — or far more if a groundbreaking technology goes awry. The potential of the CFM open-fan engine is likely to factor into planemakers’ high-stakes plans.

Boeing and Airbus are already plotting their strategies into the next decade, when they’ll need to replace their most profitable jets, which have designs that date to the 1960s and 1980s.

The US manufacturer is expected to make the first move. Badly lagging Airbus in the crucial narrowbody market, Boeing is likely working on an all-new jet to counter its rival’s A321neo, and Spingarn of Melius Research expects it to also unveil a 737 Max replacement by late decade.

Airbus’s dominance, meanwhile, gives it more breathing room to devise upgrades to its A220 and A320 families of aircraft. Still, as the company girds for the future, it’s making big bets on unproven technology, such as pledging to bring a hydrogen plane into service by 2035. Many in the industry are skeptical it can meet that timeline.

The open-fan engine should be in the running for both Boeing and Airbus — provided CFM can deliver its engine by 2035, and resolve the issues that caused the planemakers to reject propellers in the past.

The conventional jet engine has “gone as far as it can given the level of challenge that our industry has taken on,” said Francois Bastin, Safran’s vice president of commercial engines. “Now there is something bigger than all of us, which is the environmental challenge.”

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.