Solar Trade Probe Threatens U.S. Projects, Developers Say

(Bloomberg) -- A potential Commerce Department probe of solar imports from Southeast Asia has the potential to freeze investment in the U.S., industry leaders warned Tuesday.

The agency is set to decide by March 25 whether to formally investigate if solar products from Malaysia, Thailand, Vietnam and Cambodia circumvent longstanding solar tariffs. A probe could expose the imports to retroactive duties, the Solar Energy Industries Association said Tuesday.

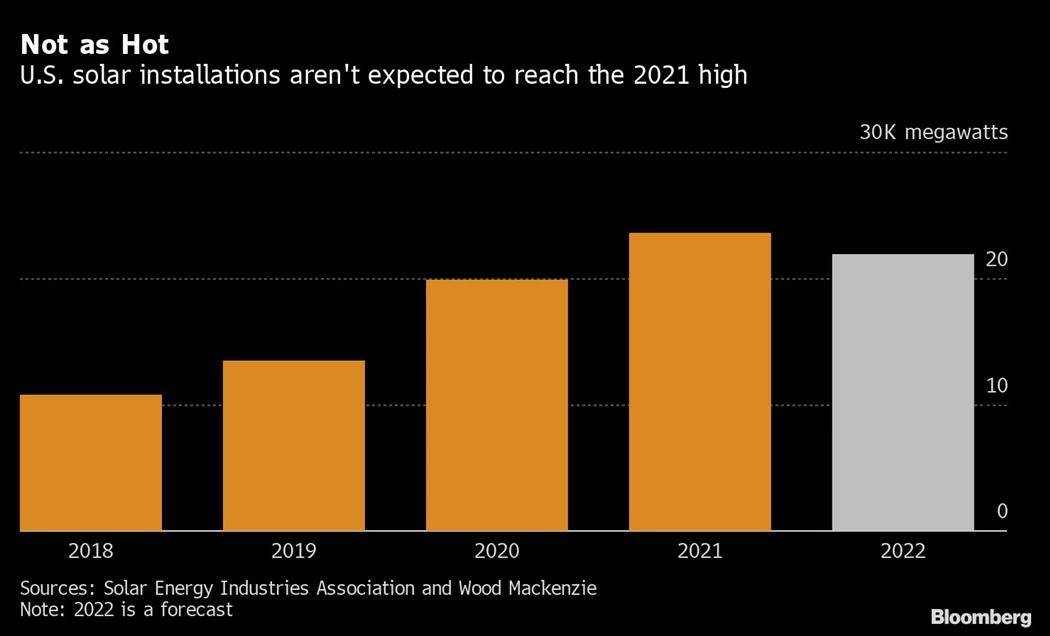

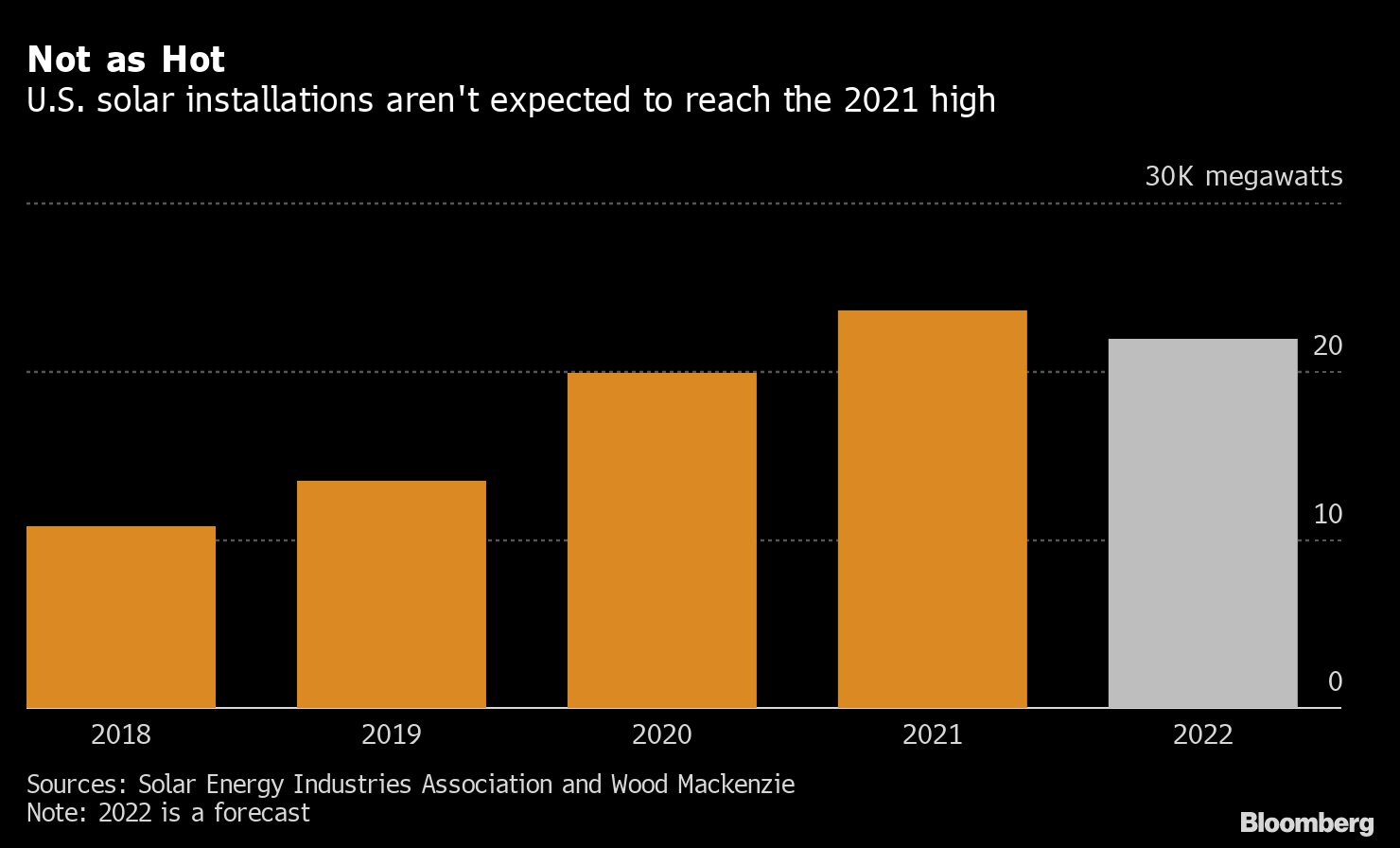

Because the four countries supply about 80% of U.S. solar imports, the dispute threatens to intensify existing headwinds for America’s solar industry, which is already seeing slower growth amid higher costs, shipping delays and supply-chain disruptions. That’s a challenge to President Joe Biden’s efforts to rapidly boost renewable power projects nationwide.

“It’s just not a rational business risk to put product on the water and send it here when you don’t know what it’s going to cost when it gets here,” said Abigail Ross Hopper, SEIA’s chief executive officer.

Commerce is responding to a petition from Auxin Solar, a small California-based manufacturer, which argues Chinese manufacturers are circumventing roughly decade-old duties by assembling their products in the four Southeast Asian nations. Supporters of a probe say the result is continued cheap imports that undermine U.S. trade laws and disadvantage American manufacturers.

“The United States can and must robustly enforce its trade laws across the board,” more than a dozen lawmakers told Commerce Secretary Gina Raimondo in a letter Tuesday. The lawmakers, led by Representatives Bill Pascrell, a Democrat from New Jersey, and Brad Wenstrup a Republican from Ohio, argued a trade investigation needn’t be a drag on domestic solar deployment.

“We fully believe that American innovators will always succeed when given a level playing field and that full and fair enforcement of our trade laws is compatible with strong industry growth,” they said.

Still, about 13% of utility-scale solar capacity scheduled for completion in 2022 has already been delayed by at least a year or outright canceled due to the higher costs, disruption and policy uncertainty in Washington, SEIA has said. Developers have warned the Biden administration that the Commerce Department decision would compound those challenges and potentially tens of thousands of American jobs hang in the balance.

“The entire solar industry is watching what the Commerce Department does,” Hopper said. “It’s hard to overstate what it would mean -- just the initiation of an investigation.”

(Updates with lawmaker letter from sixth paragraph.)

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.