Carney’s Bid to Grow Carbon Market Rejigged Amid Controversy

(Bloomberg) -- Former Bank of England Governor Mark Carney’s initiative to boost the market for carbon offsets is being scaled back, in the wake of fierce debate around whether the traded assets really help avert global warming.

In September 2020, Carney and Standard Chartered Plc Chief Executive Bill Winters launched a bold project to expand the controversial market for the financial instruments, which allow buyers to claim reduced greenhouse gas emissions often without making any changes to their own activity. Some 18 months later, the body is re-purposing its mission to tackle the criticism that offsets don’t represent real carbon reductions.

As more corporations pledge to make their emissions “net-zero,” carbon offset prices could grow more than fifty-fold by 2050, according to BloombergNEF. And while Carney initially predicted the total market could reach $100 billion by the end of this decade, the sector remains mired in confusion over the integrity of carbon removal projects and a lack of clarity over how global trading of them should function.

Read More: Math Behind ‘Carbon Neutral’ Trading Doesn’t Actually Work

The slimmer version, with about 90 members, is dubbed the Integrity Council for the Voluntary Carbon Market, and will instead focus on assuring the quality of offsets sold, according to Annette Nazareth, co-chair of the governance body and a former head of the U.S. Securities and Exchange Commission. Targets to increase the size of the market have been ditched, and Carney’s promise of a pilot market early this year has also been scrapped, she said in an interview.

Carney and Winters are members of the body’s “Distinguished Advisory Group,” and aren’t involved in the day to day running of the project, a spokeswoman said.

The 400-members of the Taskforce on Scaling Voluntary Carbon Markets, as it was known, included academics, traders and environmental groups, and they soon squabbled over the path through the maze of exchanges and standards. At COP26 in Glasgow last year, countries agreed on a package of rules to govern the international carbon market, but it remains unclear how they will be implemented and how this will impact the so-called voluntary market.

Read More: COP26 Finally Set Rules on Carbon Markets. What Does It Mean?

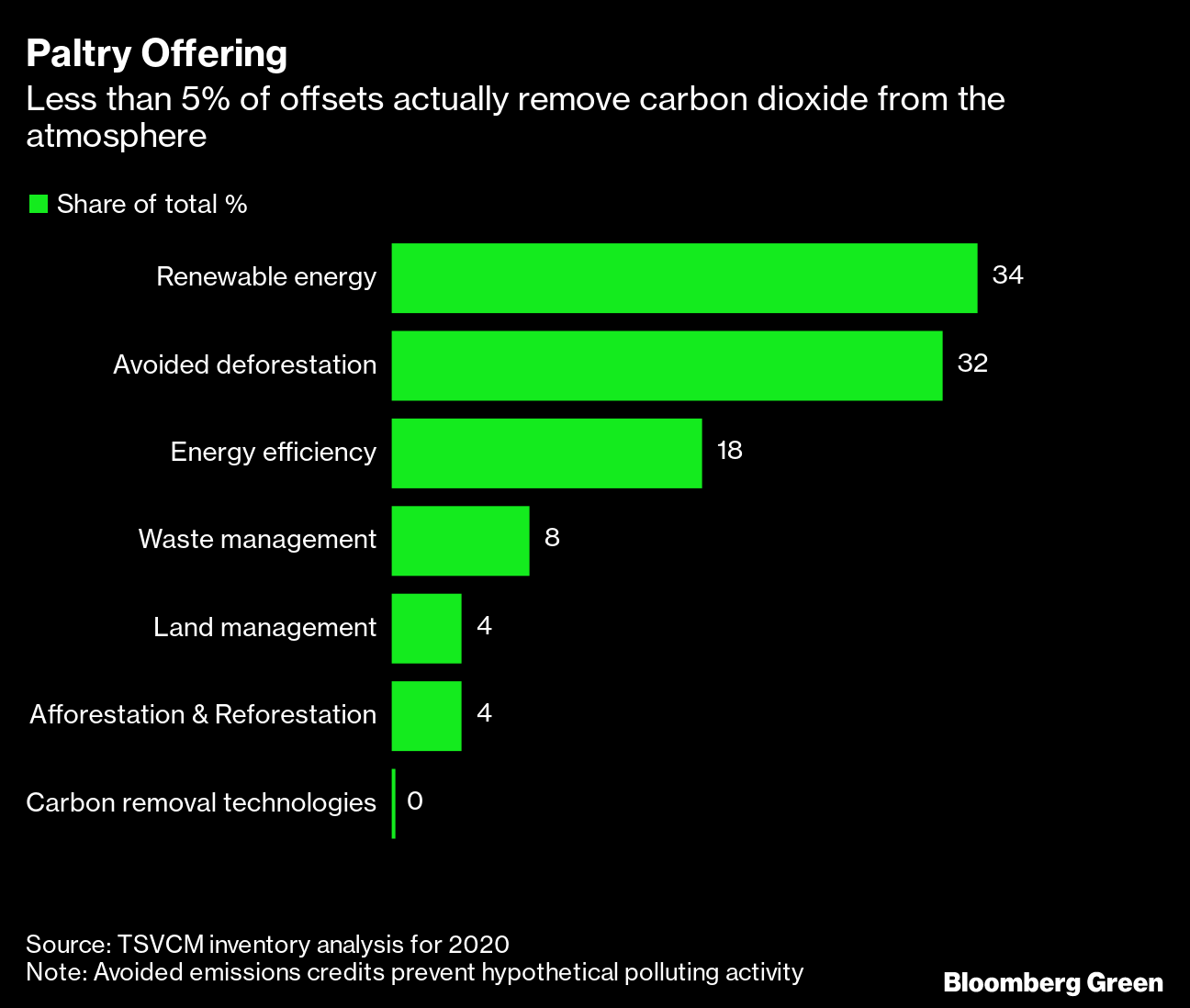

Voluntary carbon offsets represent a metric ton of reduced, removed or avoided greenhouse gas emissions, and are bought by companies and individuals to subtract emissions from their own accounts to declare improved environmental performance.

Projects generating carbon offsets span from planting trees and protecting forest to building wind farms and cleaner-energy cooking stoves. Renewables and nature-based projects in particular have been criticized for carbon accounting issues, their longevity and for negative impacts on local communities.

The group has also delayed delivering on its key objective: to come up with a “core carbon principle,” or CCP, label that could be used to mark offsets that meet its standards. Members spent months arguing over the criteria for inclusion, with sharp divides over how high to set the bar.

“Some people wanted to start early but, frankly, that would have been guessing what the CCPs would say,” Nazareth said. “You want to encourage voluntary carbon trading, but only the high integrity, CCP aligned trading.”

The council intends to consult on a set of CCPs in May, with a decision expected around September, Nazareth said. But in the meantime, offset trading is taking off. She admits that even when those CCPs are confirmed, the group will be toothless to enforce them.

“I’d love to have regulatory authority and be able to do all those wonderful things I got to do with the SEC,” Nazareth said. “Unfortunately, nobody gave us that power. But we do have the power to name and shame. We have the power to be very public and noisy about what’s going on in this area.”

Read More: Carbon Offset Trading Is Taking Off Before Any Rules Are Set

The council’s mission could be more important than ever as demand for offsets continues to grow. Nazareth says the current war in Ukraine should boost countries’ plans to cut their dependence on fossil fuels, and pursue climate goals.

“It is the momentum behind decarbonizing the economy that supports the voluntary carbon market, and war in Ukraine won’t stop that,” she said.

The International Energy Agency said earlier this month that global greenhouse-gas emissions rebounded in 2021 to their highest-ever level, following a temporary slowdown due to the pandemic.

Colonial Issues

The group, which includes representatives from the fossil-fuel industry and finance, has struggled to recruit indigenous peoples and local communities to its board, despite a pledge to do so.

“The fact that there’s been a time delay is by no means indicative of a sincere lack of interest,” said Nazareth. “We remain very committed, and it’s essential that we get those viewpoints on our board.” One representative has been accepted and two are in the pipeline, she said.

Offset projects are often located on land occupied by these groups and have been criticized for driving colonial-style land grabs, water stress and human rights violations. Carbon market rules agreed at COP26 include certain new safeguards, but critics say they still fall short.

(Updates with spokesperson comment in fifth paragraph)

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.