China Utility Shares Primed for Gains on Reopening, Subsidies

(Bloomberg) -- Shares linked to Chinese utilities are primed to extend their rebound as the economy’s reopening spurs electricity consumption and tens of billions of dollars worth overdue subsidies may finally make their way, analysts say.

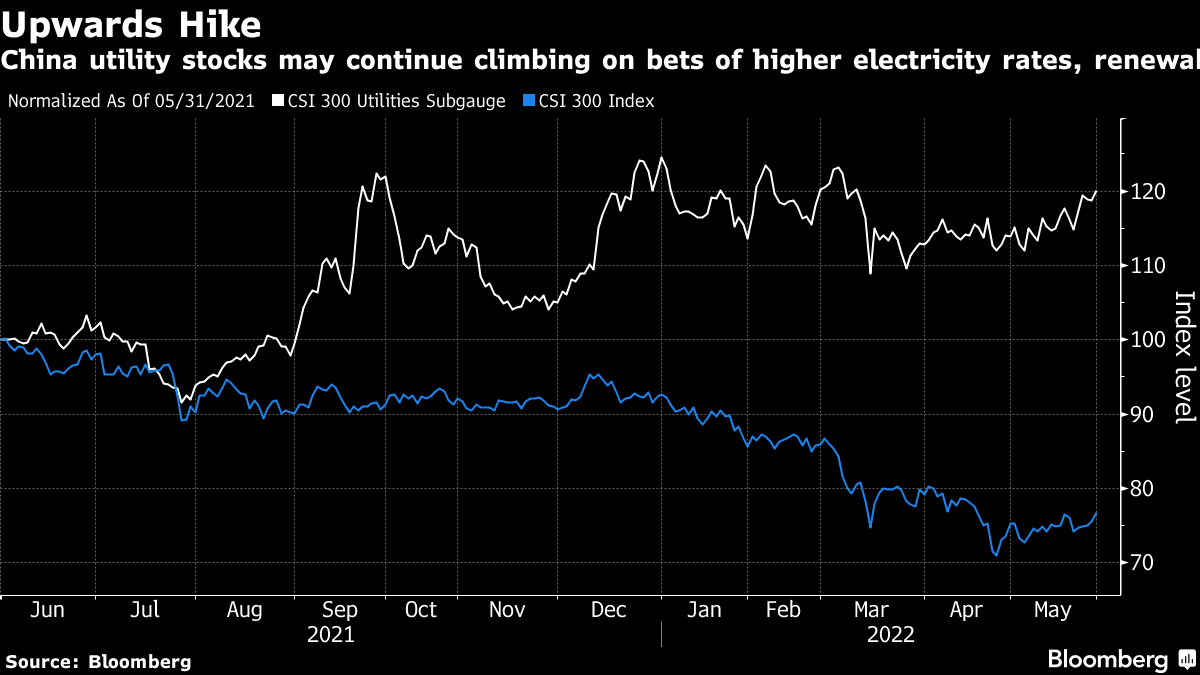

A subgauge of utility stocks on the CSI 300 Index has jumped nearly 10% since a recent mid-March low, outpacing a less than 3% rise in the benchmark index after policymakers vowed to broadly support markets. Heavyweights like Huaneng Power International Inc. and China Resources Power Holdings Co. had tumbled more than 30% to start the year.

China is home to more than half the world’s coal power plants and also has the largest fleet of solar panels and wind turbines. As key cities including Shanghai and Beijing reopen from Covid-19 restrictions, power operators may be among the top beneficiaries with electricity consumption rebounding, investors say. Expectations that delayed government subsidies will be paid out soon will also provide a further boost to those with renewable portfolios.

“We are positive on the long-term growth prospect and strong demand visibility of utility stocks, especially renewable names,” said Dennis Ip, head of power, utilities, renewable & environment research at Daiwa Capital Markets Hong Kong Ltd.

Shortage

China’s electricity sector struggled in late 2021 when a shortage of coal sent prices for the fuel skyrocketing and forced power cuts to industrial facilities. The impacts crippled coal-heavy utilities like Huadian Power International Corp. and Huaneng Power, which both posted full-year losses as input costs jumped.

Beijing responded with a series of measures to increase coal output and help thermal power generators. The incident allowed for the sector to bottom out, China International Capital Corp. analysts led by Jiani Liu wrote in a May 24 note.

Beyond low prices, utility firms that have large renewable portfolios are also set to see an uplift on expectations that a years-long delay of subsidy payments may arrive soon. Against the backdrop of China’s ambitions to achieve carbon neutrality by 2060, wind and solar firms are awaiting overdue sums. Plans are underway to pay off the arrears this year.

China Sets $63 Billion to Pay Subsidies Owed to Renewables Firms

Beneficiaries include firms like China Longyuan Power Group Corp., a utility firm that is also the country’s largest wind power operator. Morgan Stanley said in March that the amount of subsidies owed are equivalent to 22% of market cap. China Datang Corp. Renewable Power Co. has subsidies owed equivalent to 71% of its market cap.

Once the subsidy debt is settled, “cash flows and balance sheets for renewable energy utilities should significantly improve, giving ammunition for further investment (likely renewables), or improvement in dividends,” said Evan Li, head of Asia-Pacific energy transition at HSBC.

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.