Dutch Farm Finance Giant Is Pushing for a Green Energy Shift

(Bloomberg) -- Rabobank is making the energy transition a core part of its strategy as the Dutch lender -- better known for its hard-to-decarbonize food and agriculture business -- seeks ways to reduce emissions.

The plan includes boosting financing for renewable energy by as much as 30% a year to 2025 as the energy transition offers “a real opportunity,” said Wiebe Draijer, chair of the managing board. The bank, which also has 190 billion euro ($217 billion) mortgage business, is also increasing the share of energy-efficient homes it lends to and lowering the energy intensity of its managed funds.

Lenders are under pressure to account for the environmental impact of their loans. Rabobank has about a 100-billion euro exposure to farming, a sector producing about a quarter of greenhouse gases. From methane burped out by cows to deforestation caused by cattle and soy farming, agriculture is a big driver of climate change and hard to cut emissions from.

“Our advisers need to engage their clients on what they are doing and ensure we can justify that a client is moving with the intent to reach” Paris climate goals, Draijer said. “If we believe that, then we want to help them on the path. If they are not committing and there is no progress, then ultimately that could lead to us deciding it’s not a client we can be in a relationship with.”

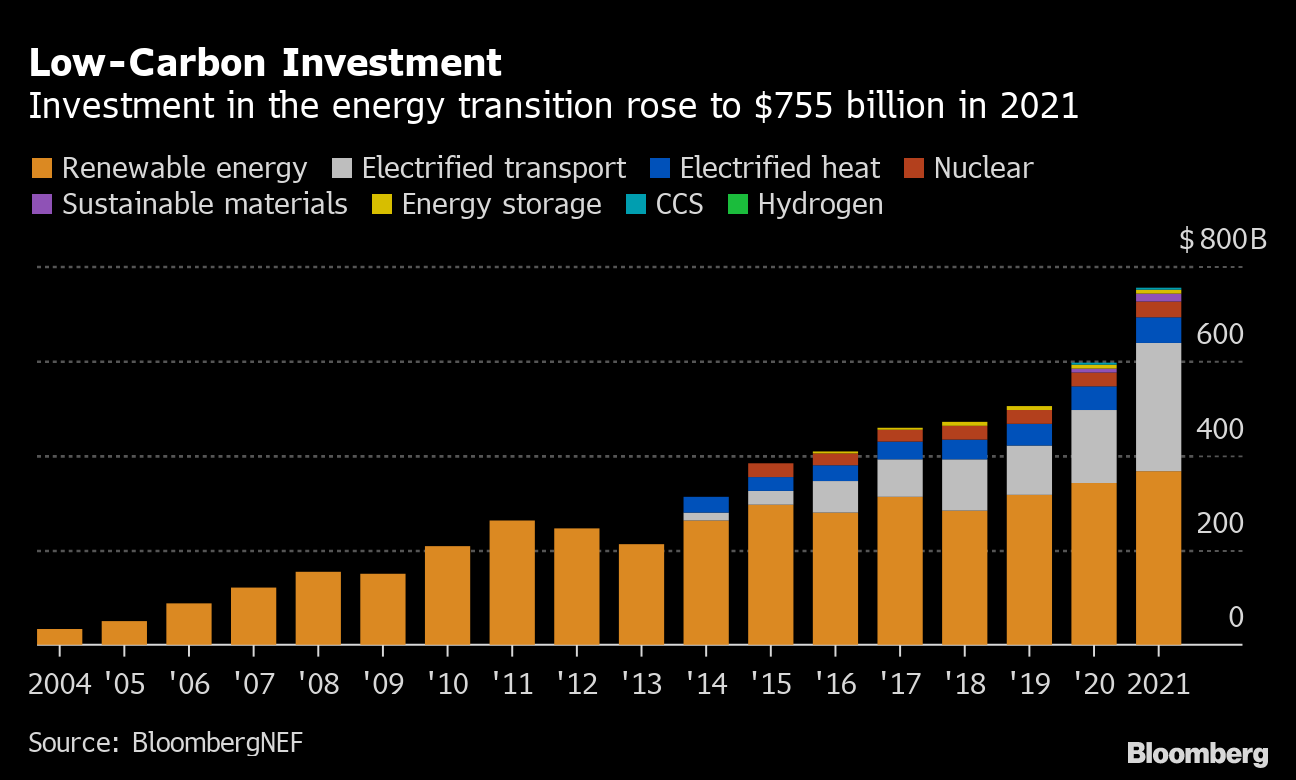

Financing the energy transition also provides opportunities for banks. Governments and companies need to invest at least $92 trillion by 2050 to cut emissions fast enough to avoid the worst effects of climate change, BloombergNEF estimates.

Renewables already account for 88% of Rabobank’s energy portfolio and it wants to eventually make the business exclusively green, said Draijer, who’s due to step down later this year. The lender also wants the average energy label of its mortgages portfolio to be B by 2024, compared with a C rating in 2020.

“There’s such massive investment required in creating a more sustainable energy supply to the world, whether it’s large-scale investments, infrastructure investments or collaborative initiatives by individuals,” he said. “All of these provide an opportunity for a bank.”

Gas Needs

Rabobank still sees natural gas as a transition fuel to a greener world. The European Union controversially just labeled some gas projects as a green investment, a move aimed at aiding the shift away from coal. The bank expects the share of gas in its trade and commodity finance loans to energy firms to grow to 25% by 2025.

“We don’t finance the production part of energy,” Draijer said. “But it’s not that we exclude companies that do anything with CO2 emissions, we want to engage our clients in this journey.”

Agriculture has lagged sectors like energy and mining in developing more accurate ways to measure pollution along the supply chain. Rabobank is studying its loan portfolio to identify the biggest emitters and understand plans clients have to move in line with the Paris climate agreement.

It also wants to lead financing of new technologies such as hydrogen and carbon capture. “We need to help clients on the journey to Paris,” Draijer said.

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.