Germany Revives Coal as Energy Security Trumps Climate Goals

(Bloomberg) -- Germany is set to boost its reliance on coal as it battles an unprecedented energy crisis — even at the expense of its ambitious climate goals.

Europe’s largest economy is burning the fossil fuel for electricity at the fastest pace in at least six years, data compiled by Bloomberg show. It’s also poised to be one of the few nations to increase coal imports next year.

On Thursday, utility Uniper SE said it would extend commercial operations of two of its coal-fired plants in Germany until March 2024 at the latest, in an effort to conserve natural gas in the coming winters.

Across the globe, highly polluting — and relatively cheap — coal is making a comeback as countries seek to prevent soaring energy costs from triggering an economic meltdown. In Europe, the crisis is acute, after Russia curbed gas supplies in the fallout of its war in Ukraine. Germany is now trying to balance the short-term priority of bolstering energy security with the longer-term goal of net-zero emissions by 2045.

“Everyone is keeping their climate targets, but it’s true that when you face the dilemma to keep the lights on or decrease carbon emissions, the choice is to keep the lights on,” said Carlos Fernandez Alvarez, the acting head of gas, coal and power at the International Energy Agency.

Germany plans to phase out coal use by 2038, but the ruling coalition is pushing for an even earlier target of 2030. To weather the current crisis, the country has temporarily brought back some plants that were offline.

In most countries, a limited amount of capacity is returning to service. “Only in Germany, with 10 gigawatts, is the reversal at a significant scale,” the IEA said in a report. That’s enough to power about 5 million homes, according to Bloomberg estimates.

Germany now generates more than a third of its electricity from coal-fired power plants, according to Destatis, the federal statistical office. In the third quarter, its electricity from the fuel was 13.3% higher than the same period a year earlier, the agency said.

“The coal phase-out ideally by 2030 is not in question,” a spokeswoman for the German Economy Ministry said in a statement. “Against the backdrop of the crisis situation, the most important thing is that we have apparently succeeded in consuming significantly less energy in 2022, especially natural gas.”

Germany’s power-market interventions that have led to an increase in emissions are limited in time, and the country has accelerated the development of renewable energy, she said.

Revival’s Origins

The German coal revival has two main causes: fuel switching away from expensive natural gas, and rising power demand from France, where electricity generation has been hobbled by nuclear-reactor outages.

European gas prices spiked to record levels over the summer and remain about twice the five-year average for the time of year. Earlier this year, companies including power generator Steag GmbH brought back coal capacity due to soaring gas prices. Automaker Volkswagen AG also shelved a plan to switch away from coal at its Wolfsburg facility in Germany.

While both gas and coal prices have declined recently, it’s still more profitable to burn the dirtier fuel to produce electricity.

“Coal is coming back as a baseload generator,” said Guillaume Perret, who leads energy consultancy Perret Associates Ltd. “We think it will be less seasonal than it has been – with more coal-burning in summer, spring and autumn, as long as coal remains so much in the money versus gas and there remains a gas shortage.”

It’s possible that Germany’s emergency coal stations could be kept online as far into the future as December 2024, nine months after the government’s planned closure date, Perret added. He noted that the European Union and Turkey are the only major energy users worldwide expected to increase coal imports in 2023 compared to 2022.

This year Germany will also likely be a net exporter of electricity to France, the first time that has happened in record-keeping since at least 1990, according to Destatis.

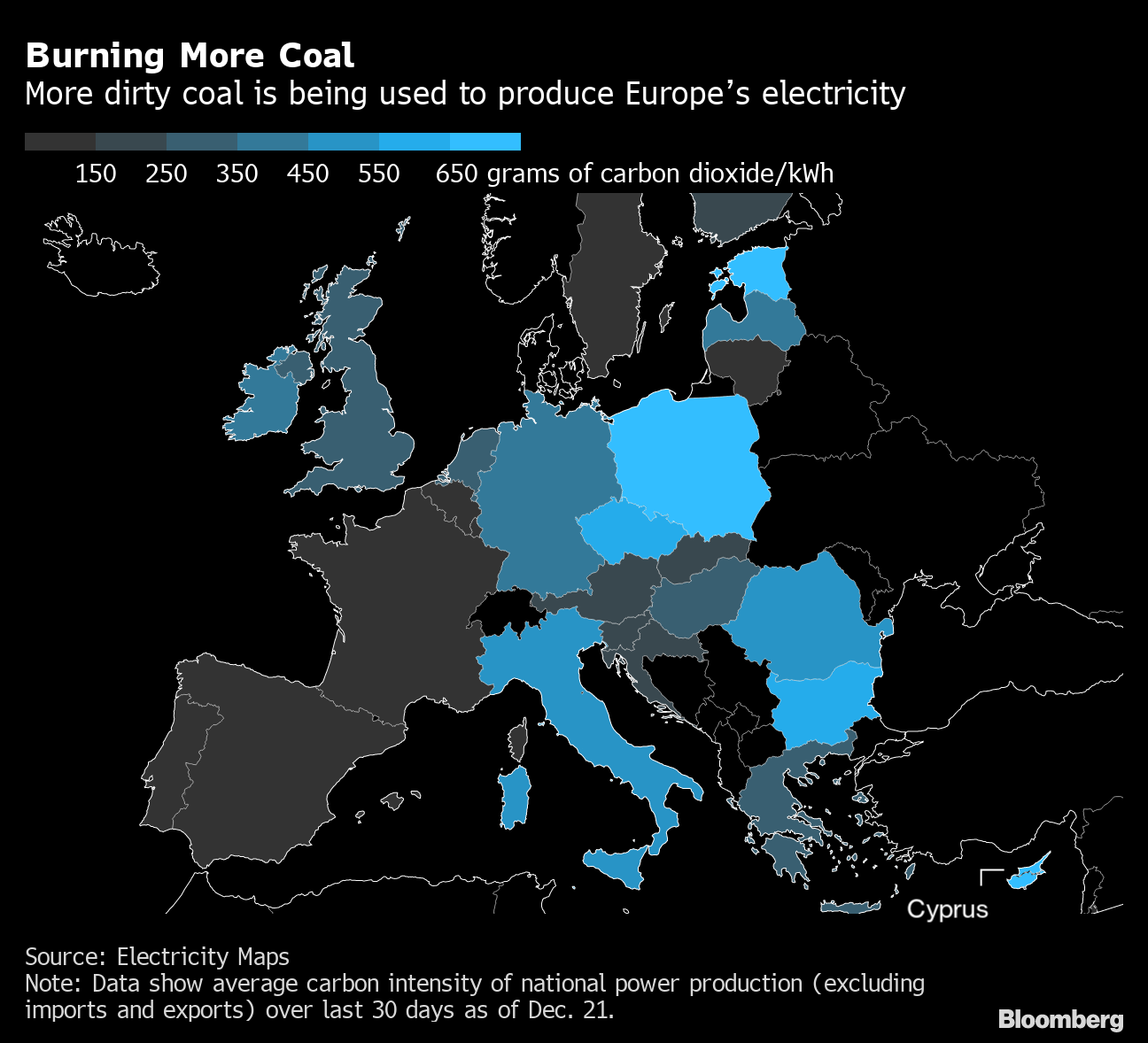

At times this month, German electricity became as polluting as power produced in South Africa and India, after lower wind speeds curbed renewable generation and coal consumption spiked, according to Electricity Maps, an app that aggregates grid data.

Path Forward

There are some bright spots for Europe that may help it avoid burning coal. Gas prices have slumped as previously mild weather pushed back the start of the heating season, and the region has seen record levels of liquefied natural gas imports recently. Gas inventories also remain above the seasonal average.

In addition, nuclear power in France has started to return. While some delays continue, reactor availability is now at about 68%, grid data show. That compares with about 50% in early November. Germany also plans to keep its three remaining nuclear plants online until at latest mid-April, beyond their original retirement date.

While Europe’s imports of coal are likely to rise, exactly how much of it is actually burned for power production is unpredictable, especially if hydropower increases in the region. Germany also increased its renewable energy generation by 2.9% on an annual basis in the third quarter of this year, according to Destatis.

“The acceleration of renewables deployment is the linchpin for both achieving energy sovereignty in the middle of this decade and our 2030 climate targets,” said Fabian Hein, project manager for EU policy at think tank Agora Energiewende.

--With assistance from , , , and .

(Updates with Uniper’s plans in third paragraph.)

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.