Wind Power’s ‘Colossal Market Failure’ Threatens Climate Fight

(Bloomberg) -- Optimism abounds about the future of wind power, with a clean-energy boom powering robust growth in an industry that businesses and governments agree is key to slowing climate change. But a nagging problem could keep the sector from fulfilling that promise: Turbine makers are still struggling to translate soaring demand into profit.

Wind power heavyweights Vestas Wind Systems A/S, General Electric Co. and Siemens Gamesa Renewable Energy SA are reeling from high raw material and logistics costs, changes in key clean-power subsidies, years of pressure on turbine prices and an expensive arms race to build ever-bigger machines.

“What I’m seeing is a colossal market failure,” said Ben Backwell, chief executive officer of trade group Global Wind Energy Council, noting a mismatch between government targets for new wind power and what’s happening on the ground. “The risk is we’re not on track for net zero [emissions] -- and the other risk is the supply chain contracts, instead of expanding.”

A retreat from wind power could have devastating consequences, as it is set to play a pivotal role in global efforts to transition to green energy. To limit warming to as little as 1.5 degrees Celsius, the world would need to start adding about 390 gigawatts of wind farms a year by 2030, according to the International Energy Agency. In 2021, only about a quarter of that amount of wind capacity was added.

There could also be geopolitical implications from the U.S. and European companies’ challenges, as Chinese rivals move to expand outside their home market.

Western turbine manufacturers are now retrenching to shore up their bottom lines. The companies say they’ll compete for fewer projects in fewer markets, raise prices, streamline their product lineups and cut manufacturing costs. That comes just as surging fossil fuel prices should be making renewables more competitive.

“You absolutely need to see some of these profit pictures turn around for the decarbonization goals to be achievable,” said Aaron Barr, global head of onshore wind at consultancy Wood Mackenzie.

Profit Pressure

The pandemic roiled the wind industry, leading to supply-chain disruptions and a surge in costs for materials and shipping.

But the troubles started back in the mid-2010s, when governments started to pull back on generous subsidies and make tenders for renewable energy developers more competitive, according to Credit Suisse analyst Mark Freshney. That fueled pressure to reduce turbine prices, squeezing manufacturers’ bottom lines.

It doesn’t help that the wind market is constrained by limited permitting for new projects. The process usually involves federal planning and local approvals, and both can get gummed up by people who don’t want the giant structures dotting their view of a horizon.

Those dynamics have pressured margins just as turbine makers have invested heavily to roll out bigger turbines that can capture more wind. These more powerful machines have helped drive down the cost of electricity from wind, but they’ve been costly for manufacturers to introduce. The industry also faces an unstable pipeline for future work, which does little to incentivize greater investment.

“The risk is that we will not have suppliers ramping up,” said Martin Neubert, chief commercial officer at Orsted AS, the world’s largest developer of offshore wind farms. “We will have a shortage in terms of supply for meeting global demand.”

Chinese Rivals

A slowdown in U.S. turbine manufacturing risks further weakening the country’s energy independence. Already, it counts on Chinese manufacturers for much of its supply of solar panels -- a reliance that has contributed to trade tensions between the countries.

Now, Chinese competitors see opportunity in the wind market. Companies including Xinjiang Goldwind Science & Technology Co., Envision Group and Ming Yang Smart Energy Group Ltd. plan to invest in factories abroad to take market share.

Vestas briefly held bragging rights for the world’s biggest turbine when it announced a 15-megawatt structure, but in an example of China’s increasing muscle, it was quickly overtaken when Ming Yang introduced a 16-megawatt machine in August.

A more recent sign of trouble for players outside China came earlier this month, when Siemens Gamesa scrapped its full-year guidance and said it was tracking toward a profit margin of minus 4%. Orders in its second quarter fell to the lowest level since the company was formed through a merger in 2017.

“The performance is clearly lagging behind our and my expectations,” Chief Executive Officer Jochen Eickholt said. “There are severe doubts around the targets we’ve set as a company.”

The same factors that pressured Siemens Gamesa’s results could weigh on profitability at GE Renewable Energy, the largest supplier of wind turbines in the U.S., for the next several quarters, says Citigroup analyst Andy Kaplowitz. He expects the division to post a first quarter negative operating margin of 16%, more than double what it sustained in both the prior-year period and last year’s fourth quarter.

Wind segment troubles caused GE Renewable Energy to push back its goal of returning to break-even this year, after the division posted some $2.3 billion in operating losses since 2019. GE now expects the division to be “approaching break-even” in 2023, with the onshore wind business, the largest by revenue, reaching low single-digit profit margins.

GE’s electricity grid unit has been a big source of the division’s financial woes, but the onshore wind business has deteriorated amid inflation pressures, supply chain challenges and the expiration of a key U.S. tax credit.

Analysts expect a roughly $370 million loss at the division when the conglomerate reports first-quarter earnings on Tuesday, according to data compiled by Bloomberg.

Price Increases

The wind industry didn’t always look so bleak. After a major wind farm construction push, global installed wind capacity topped 742 megawatts in 2020 after standing at less than 100 gigawatts as of 2007, according to BloombergNEF data.

At the same time, prices for electricity generated by wind farms steadily declined. Those improvements were helped by manufacturers launching ever-larger turbines that meant projects were cheaper to develop, build and maintain.

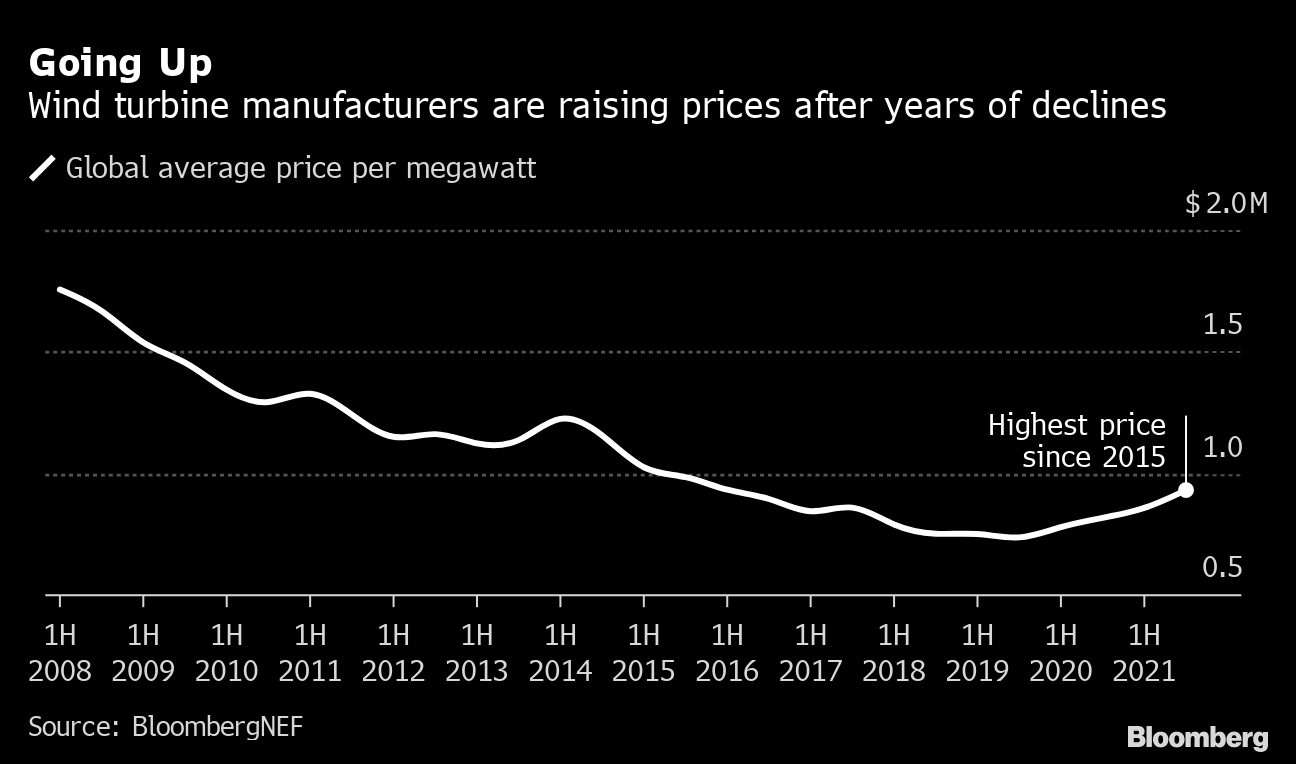

That has begun to change. Turbine manufacturers in the second half of last year raised prices the most since 2014, according to BloombergNEF. Wind farm developers expect that to reverse the decade-plus trend of falling costs for wind power, a key factor that has fueled its expansion.

Read More: Surging Renewable Power Prices in Europe Are Still a Bargain

Last year, Vestas raised prices by over 20% on average for its turbines. GE has also been boosting prices, raising them by double-digit percentages since late last year. It’s part of a new overhaul of the business being overseen by Scott Strazik, who in November was tapped to lead GE’s energy-related businesses as they prepare for a 2024 spinoff.

The 130-year-old manufacturer is shifting how it goes to market in onshore wind outside of the U.S. It plans to compete for turbine orders in fewer countries and be more selective about the projects it supplies.

Soon after stepping into the role early this year, Strazik hosted more than a dozen of GE’s largest wind suppliers for a summit to discuss ways to improve the profitability of the industry. “Each CEO came in with their recommendations for us and them to lift all boats in an industry that, frankly, has to ultimately become more profitable,” he said at the company’s March 10 outlook meeting.

The quick influx of bigger, more powerful machines has strained turbine manufacturers and the supply chain, Strazik said in an interview. He said the industry needs to slow down the turbine “arms race” and build more standardization into its product line so that manufacturers and suppliers can produce turbines more quickly and efficiently, at scale.

“There’s an element of normalization or industrialization that’s going to be required here for us to be able to achieve the growth prospects that a lot of these countries have set out,” he said.

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.