Change Can Be Good: What Markets Expect From the German Election

(Bloomberg) -- There was a time when markets would fret at the prospect of Angela Merkel -- a beacon of stability in a turbulent world -- abandoning the helm of Europe’s biggest economy. That time is gone.

As German voters head to the polls, investors are ready to embrace change, and a potential turn to the left, as long as it’s moderate.

A surge in support for the Social Democrats and the Greens has raised market expectations that the next coalition will be less committed to the draconian application of fiscal restraint rules that was the hallmark of Merkel’s conservative-led government before the pandemic. A strong showing for the two center-left parties could also mean that post-Merkel Germany will be more enthusiastic in its backing of further European unification, another welcome development for markets.

“My money is on a significant lift in German public investment in the years to come, maybe of close to 1% of GDP, even if –- most likely –- it’ll come via somewhat opaque fiscal engineering,” Erik F. Nielsen, chief economist at UniCredit SpA, wrote in a note. “The next German government will, on balance, turn more committed to Europe and further integration than in the past, mostly because of the likely substantial increase in influence by the Green party.”

While negotiations for the formation of a new coalition may drag on for weeks or months, here’s our guide on how investors might position themselves for the day after the vote:

Equities Fallout

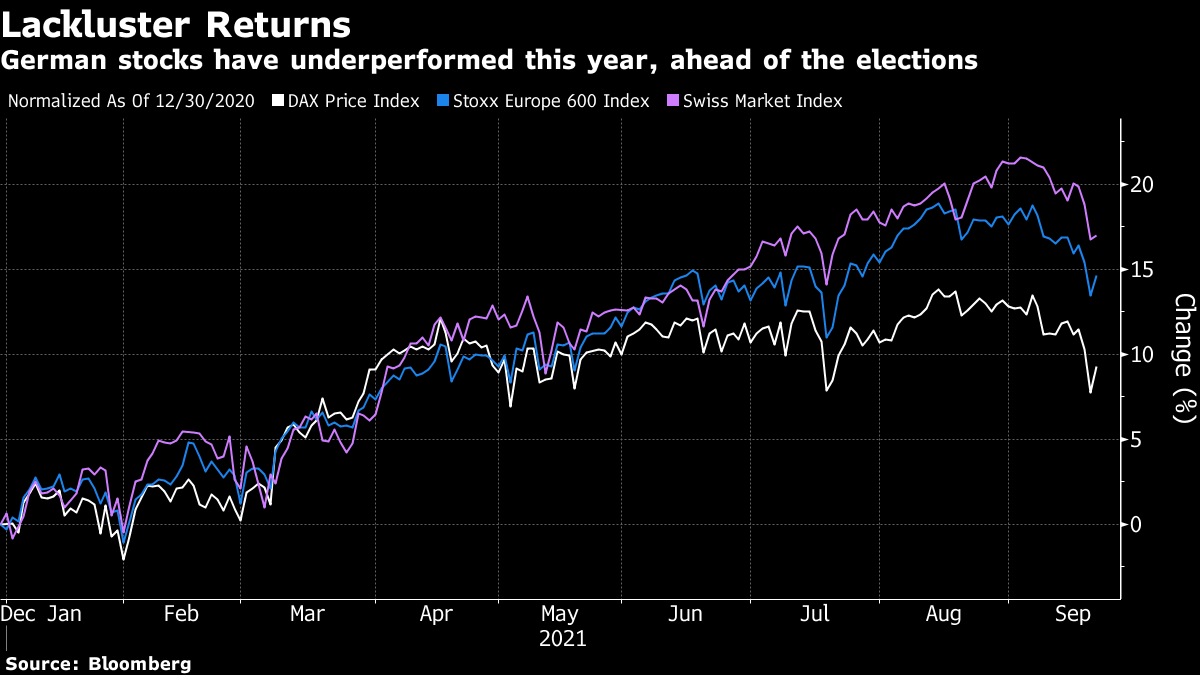

Large swaths of corporate Germany may benefit from the changing of the guard at the chancellery, though polluting industries may have a reckoning from the country’s accelerating transition to climate neutrality. An emerging consensus among all the main political parties on the need for additional investments, especially for low-carbon infrastructure, may even have spillover effects for the continent’s equities markets more broadly.

“In most scenarios, the focus on climate change is likely to increase, which could allow the utilities sector to recover some of the very weak year-to-date performance,” JPMorgan Chase & Co. strategists led by Mislav Matejka wrote in a note. “On the other hand, higher CO2 emitters, such as airlines, transport, steel, construction, could see headwinds.”

UBS Group AG analysts including Felix Huefner identified Siemens Gamesa, Vestas, Infineon, RWE, and E.ON among the companies likely to benefit from a new coalition’s focus on additional investment in green and digital technologies. A left or center-left government led by the Social Democrats of the SPD could push for tighter labor market regulation and higher wages, which could hurt apparel companies such as H&M and Zalando SE, as well as airlines and airports, including Fraport AG and Deutsche Lufthansa AG, which are also exposed to tougher climate rules, UBS said in a presentation.

“We believe that German assets could offer appealing investing opportunities to global investors, primarily in the equity market, with a focus on those industries that are transitioning towards the net-zero goal by 2045,” Amundi Asset Management’s Thomas Kruse and Tristan Perrier wrote in a note. “More generally, sectors such as green energy and automotive might be attractive, given the focus on the transition towards e-mobility.”

Currency Impact

The likelihood of Social Democrat Olaf Scholz becoming the next German chancellor still isn’t fully priced in by markets, according to Jordan Rochester, G-10 currency strategist at Nomura International Plc. Confirmation of a center-left coalition could prompt the euro to move higher by around 1%, he said.

Analysts generally see such a coalition as positive for the euro over the longer term because it would mean an increased likelihood of supportive fiscal policies. Nomura’s Rochester sees the euro strengthening to $1.22 by the end of the year. The latest poll shows Scholz’s SPD with a narrow lead over the center-right CDU/CSU bloc.

There’s also room for the euro to move lower if the results remain unclear.

“The markets are maybe a tad complacent about the prospect for a lengthy period of political uncertainty in Germany after the vote,” said Valentin Marinov, the head of G-10 currency strategy at Credit Agricole CIB. The euro could approach lows for the year against the dollar and yen in that instance, he said, pointing to the outcome of the last federal election. “The key driver of the euro weakness in 2017 was the lingering uncertainty in the immediate aftermath of the vote.”

A surprise swing to the center-right in any coalition could also mean the euro would “head lower still versus the dollar,” said Marinov, given market concern over the ensuing growth outlook.

Still, the German elections are unlikely to be the deciding factor in whether the euro pops out of its existing trading range, according to Kit Juckes, chief foreign-exchange strategist at Societe Generale SA in London. Barring a large surprise, “that’s much more likely to be concerns about rates having to go up because of inflation and more general global risk aversion stemming from China,” he said.

Bond Markets

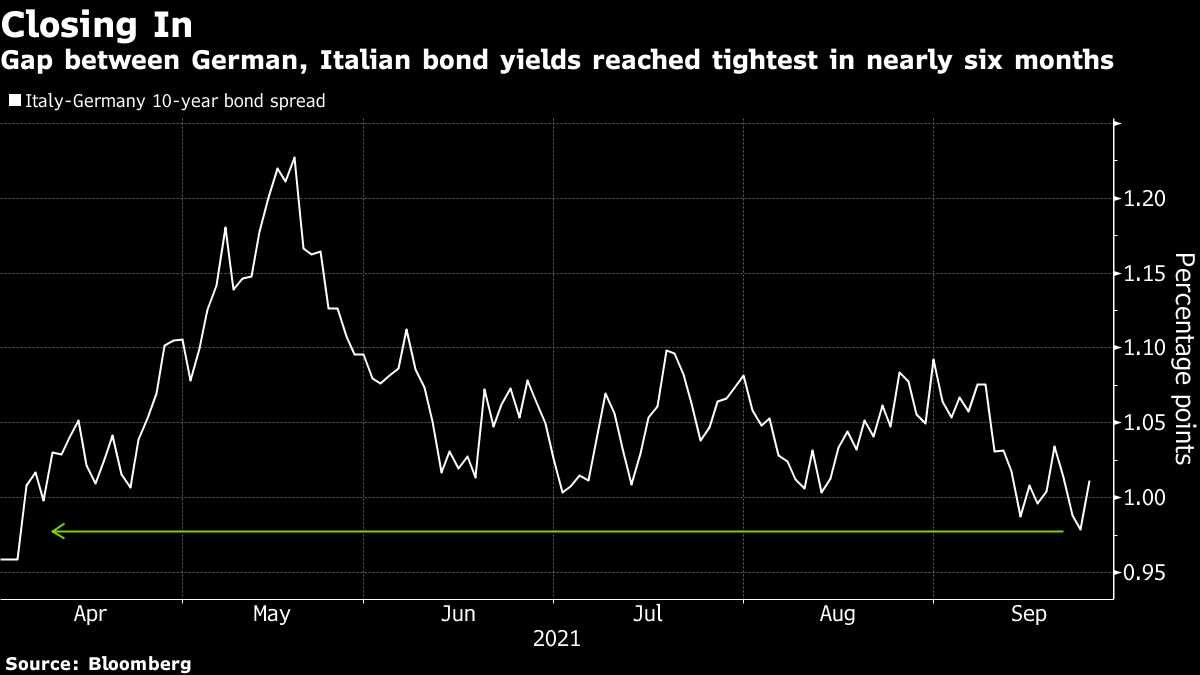

Bond investors are looking past the election, with global risk sentiment and expectations surrounding the European Central Bank’s asset purchases continuing to dominate the agenda instead.

Optimism in Rome is also more important than German politics, with Italian bonds catching up with their safer German peers. The yield spread narrowed Thursday to the tightest since April following news the Italian Treasury would skip some regular debt sales given the country’s improving economic prospects. Ten-year bund yields, meanwhile, have risen about 30 basis points since early August.

That’s not to say there won’t be any drama. If the Social Democrats and Greens combined get enough votes for a parliamentary majority, then bund yields could rise three or four basis points on Monday, while if the Left party gets less than the 5% threshold required for electing lawmakers in the next assembly, then German yields could drop as many as two basis points, said Rohan Khanna, a strategist at UBS.

A coalition including the SDP and Greens would be seen as more committed to further integration in the European Union, which would benefit Italian debt, according to Althea Spinozzi, a rates strategist at Saxo Bank A/S. That outcome would drive up yields and help further tighten their spread against German peers, potentially to as low as 75 basis points by year-end, the tightest in over a decade, she said. That forecast also takes into account Italy’s continuing political stability and improving fundamentals.

Yet those outcomes are far from certain.

“If the results come as currently suggested by opinion polls, then many different coalitions are possible -- so there should be no immediate reaction,” Khanna said. “Over the medium term, ECB policy matters a lot more for bunds than local politics.”

More stories like this are available on bloomberg.com

©2021 Bloomberg L.P.